Investing.com’s stocks of the week

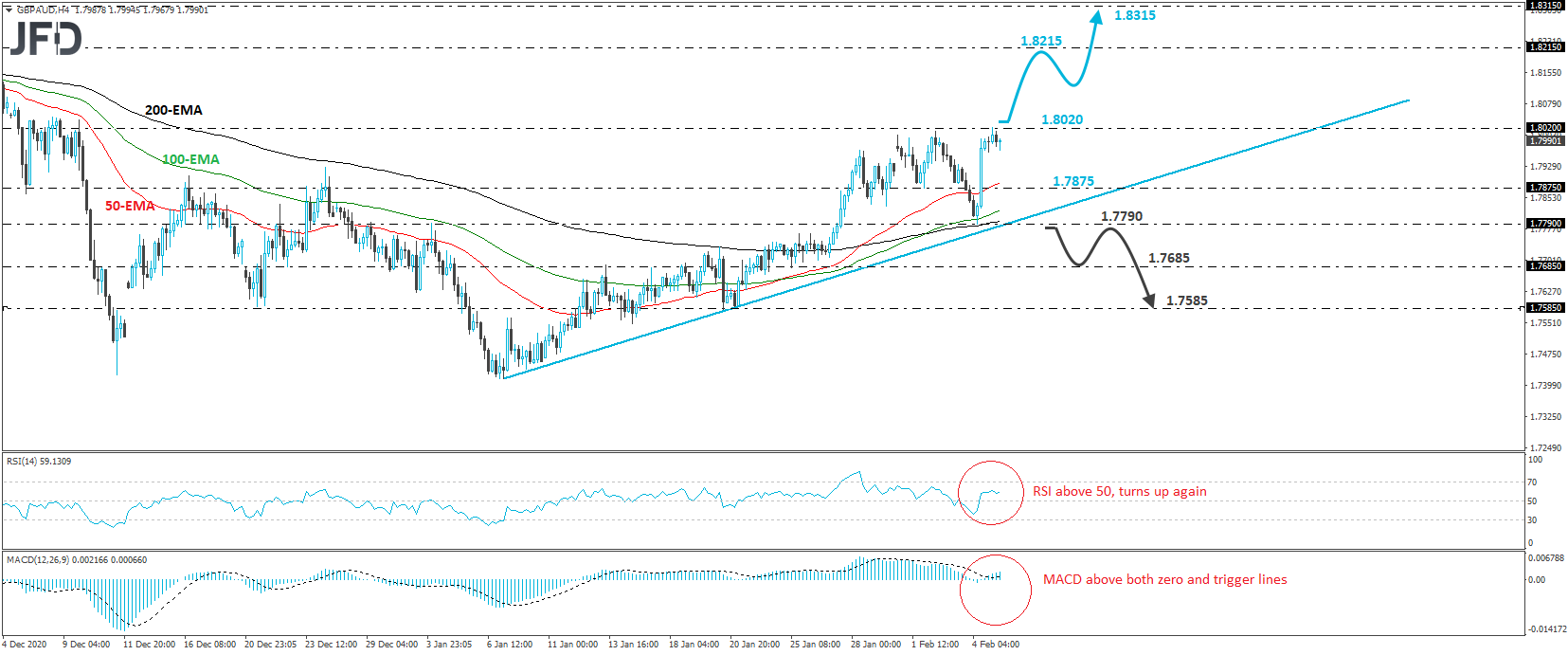

GBP/AUD shot up yesterday, after hitting support at 1.7790, slightly above the upside support line drawn from the low of Jan. 7. That said, the rally was stopped today, near the 1.8020 territory. Overall, the pair continues to trade above the pre-mentioned upside line and thus, we would consider the short-term outlook to be positive for now.

A clear and decisive break above 1.8020 would confirm a forthcoming higher high and could set the stage for advances towards the 1.8215 area, defined as a resistance by the high of Dec. 4. If the bulls are not willing to stop there, then a break higher may extend the uptrend towards the peak of Nov. 23, at 1.8315.

Taking a look at our short-term oscillators, we see that the RSI, already above 50, has turned up again, while the MACD lies slightly above both its zero and trigger lines. Both indicators suggest that the rate may start picking upside momentum soon, which supports the notion for the continuation of the short-term uptrend.

On the downside, we would like to see a strong dip below 1.7790 before we start examining whether the bears have gained the upper hand. Such a move would also take the rate below the aforementioned upside support line and may initially open the path towards the low of Jan. 25, at 1.7685. Another break, below 1.7685, could extend the fall towards the 1.7585 zone, near the lows of Jan. 20 and 21.