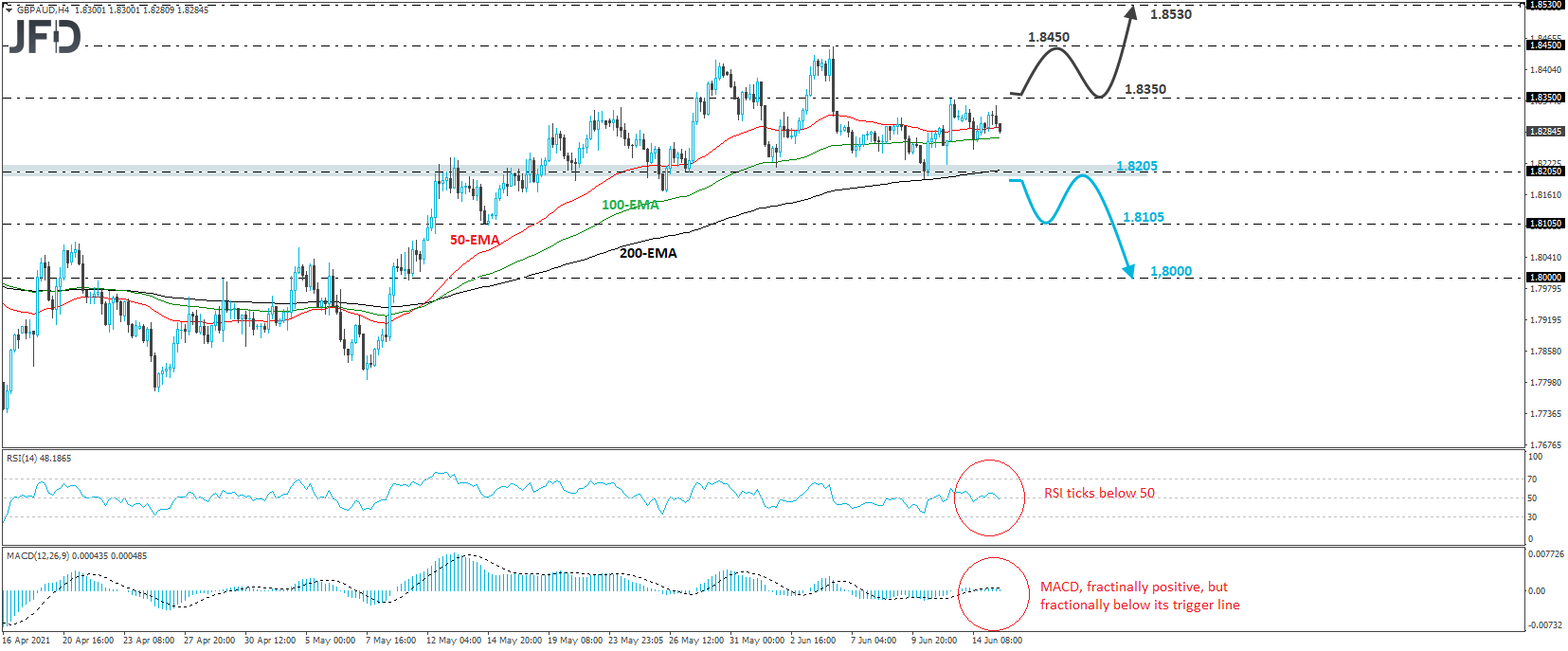

GBP/AUD traded lower today, after hitting resistance slightly below the 1.8350 obstacle, marked by Friday’s high. Overall, the pair has been trading in a trendless mode, above the key support barrier of 1.8205 since May 18, and that’s why we will adopt a neutral stance for now.

If the bears eventually find the strength to overcome that barrier, this will confirm a forthcoming lower low on the 4-hour chart and may open the path towards the low of May 14th, at 1.8105. If they are not willing to stop there, the next area to consider as a potential support may be near the psychological round figure of 1.8000, marked by the low of May 11.

Shifting attention to our short-term oscillators, we see that the RSI has ticked back below 50, while the MACD is fractionally positive, but fractionally below its trigger line. Both indicators hover near their equilibrium lines with no signs of clear directional speed, enhancing our choice to stand pat for now.

On the upside, a break above 1.8350 may encourage some buyers to jump into the action, but the move that would turn the picture into a positive one is a break above the peak of June 4, at 1.8450. Such a move would confirm a forthcoming higher high and may see scope for advances towards the 1.8530 territory, defined as a resistance by the high of Oct. 22.