Investing.com’s stocks of the week

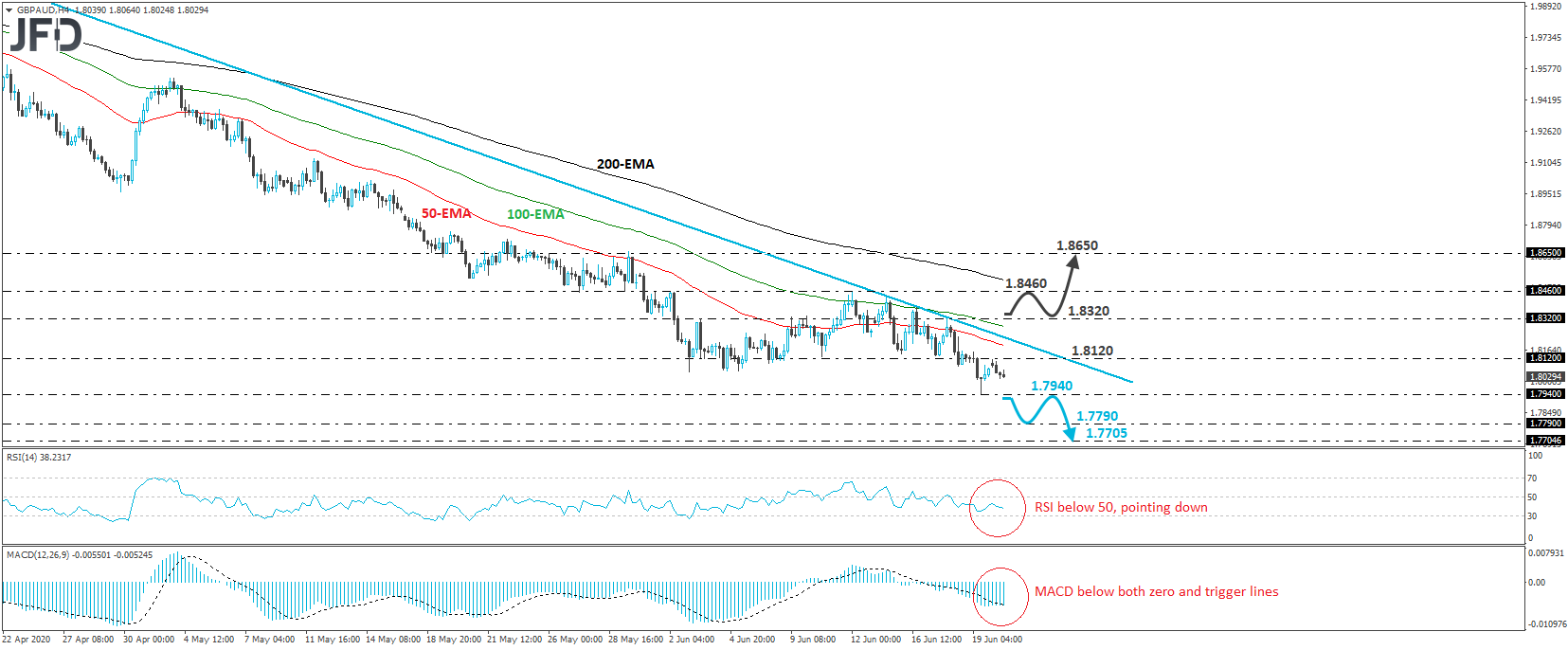

GBP/AUD traded lower on Monday, after hitting resistance near the 1.8120 level. Overall, the pair has been trading below a tentative downside resistance line drawn from the high of April 2nd, as well as below all three of our moving averages on the 4-hour chart. Thus, having all these signs in mind, we would consider the near-term outlook to still be negative.

A clear and decisive break below Friday’s low of 1.7940 would confirm a forthcoming lower low and thereby, signal the continuation of the prevailing downtrend. The bears may then get encouraged to push the battle towards the 1.7790 zone, marked as a support by the low of September 3rd. Another break, below 1.7790, may extend the decline towards the 1.7705 hurdle, which prevented the rate from drifting lower on August 9th and 13th.

Shifting attention to our short-term oscillators, we see that the RSI lies below 50 and points down, while the MACD stands below both its zero and trigger lines. Both indicators detect negative momentum and support the notion for some further near-term declines in this exchange rate.

On the upside, we would like to see a strong rebound back above 1.8320 before we start examining the case of a bullish reversal. The rate would already be above the aforementioned downside line and could sail north towards the peak of June 12th, at 1.8460. If the bulls are strong enough to overcome that barrier as well, then we may see them driving the action higher, towards the 1.8650 area, which provided strong resistance between May 25th and 29th.