Tyson Foods, Inc. (NYSE:TSN) is scheduled to report first-quarter fiscal 2019 results on Feb 7, before the opening bell. We note that earnings of this renowned meat products company surpassed estimates in three of the trailing four quarters, the average positive surprise being 11.9%. In the last reported quarter, the company delivered a positive earnings surprise of 18.8%. Let’s see what’s in store for the company this time around

How are Estimates Faring?

The Zacks Consensus Estimate for first-quarter earnings is pegged at $1.55, reflecting a 14.4% decline from $1.81 per share registered in the year-ago quarter. Notably, the consensus mark has remained stable over the past 30 days. For revenues, however, the consensus mark stands at $10.36 billion, mirroring a 1.3% growth from the year-ago quarter’s figure.

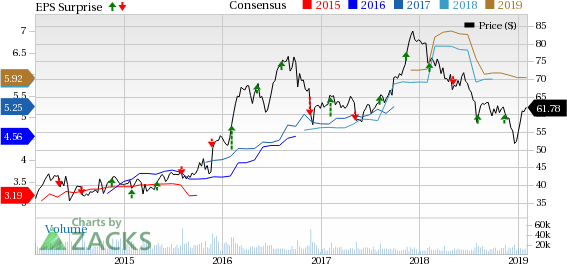

Tyson Foods, Inc. Price, Consensus and EPS Surprise

Factors Working in Tyson Foods’ Favor

Tyson Foods should keep gaining from rising demand for protein-packed food, which has been boosting sales volumes in the Chicken and Beef segments. Notably, the company divested the non-protein businesses (such as Sara Lee Frozen Bakery, Kettle and Van’s) to focus more on the growing protein-packed food arena. Moreover, for fiscal 2019, the USDA expects overall domestic protein production (chicken, beef, pork and turkey) to rise year over year which also gives us positive signals for the impending quarter.

Apart from this, the company has been steadily expanding its fresh prepared foods offering to cater to consumers’ rising demand for natural fresh meat offerings without any added hormones or antibiotics.

Also, Tyson Foods has long been focusing on acquisitions to strengthen its portfolio, which remains a tailwind to the company’s revenue. The company has completed the buyout of the Keystone Foods business, which supplies a broad array of meat and chicken products across the globe. The move is likely to bolster’ international presence, with improved sales as well as distribution network in growth markets. Earlier, Tyson Foods acquired AdvancePierre, Original Philly Holdings, Hillshire as well as Mexican food restaurant chains — Circle Foods and Don Julio Foods.

These upsides paint an impressive picture about the company’s top line in the quarter to be reported. Markedly, the Zacks Consensus Estimate for Prepared Foods, Beef, Pork and Chicken segment’s sales is pegged at $2,386 million, $3,993 million, $1,306 million and $3,019 million, reflecting a 4.1%, 2.8%, 1.8% and 0.7% increase, respectively, from the prior-year quarter’s reported sales.

Will Freight & Tariff Woes Linger?

Volatile market conditions for chicken and pork is concerning for Tyson Foods. These units have been affected by fluctuations in domestic and export prices of chicken and pork due to uncertainties in trade policies and raised tariffs. Thanks to such factors, the company is struggling to balance demand and supply conditions in the pork category.

Additionally, the company is witnessing escalated freight expenses. Notably, higher freight costs are negatively impacting operating income in the Beef, Chicken, Pork and Prepared Foods segments for a while. Notably, these headwinds along with narrowed earnings projection for fiscal 2019 remain a threat to the company’s bottom line.

Though Tyson Foods is on track to boost financial strength through the Financial Fitness Program, it is yet to be seen if savings from this program can completely offset the hurdles.

What Does the Zacks Model Say?

Our proven model does not conclusively show that Tyson Foods is likely to beat estimates in first-quarter fiscal 2019. A stock needs to have both — a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Though Tyson Foods has a Zacks Rank #1, its Earnings ESP of 0.00% reduces chances of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these have the right combination of elements to post earnings beat.

Nomad Foods Limited (NYSE:NOMD) has an Earnings ESP of +1.45% and a Zacks Rank #2.

Monster Beverage Corporation (NASDAQ:MNST) has an Earnings ESP of +0.31% and a Zacks Rank #2.

Lamb Weston Holdings, Inc. (NYSE:LW) has an Earnings ESP of +1.42% and a Zacks Rank #2.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Monster Beverage Corporation (MNST): Get Free Report

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Get Free Report

Original post

Zacks Investment Research