Investors who allocated a portion of their capital abroad have been experiencing a whole lot of performance envy lately. For instance, those who concentrated their dollars in the S&P 500 last year savored 30% price appreciation, while those who allocated some money to the MSCI EAFE Index struggled to come to terms with a disappointing 18%. Heaven forbid you believed that emerging market valuations were so cheap that you had placed a small stake in the MSCI Emerging Market Index; exchange-traded funds tracking the index actually lost value in 2013.

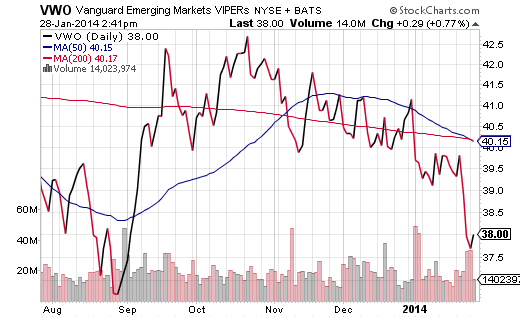

Perhaps unfortunately, U.S. Federal Reserve “tapering” is liable to increase borrowing costs and dent currencies in developing countries. Couple the reduction in electronic dollar printing with an exodus of capital from up-n-coming regions, and the prospect for a turnaround in Vanguard Emerging Markets (VWO) appears to be a crisis or two away. Worse yet, the technical deterioration associated with the dreaded “black cross” — the 50-day moving average crossing below its 200-day moving average — is likely to coincide with additional downside in price.

Not everything is as gloomy abroad as it seems at first blush, however. A flash euro-zone manufacturing indicator in January jumped to its highest level in two-and-a-half years (53.9). What’s more, whereas the U.S. central bank (i.e., Federal Reserve) feels pressure to taper (a.k.a. “tighten”) or maintain its current level of monetary accommodation, the European Central Bank (ECB) actually has room to loosen its policy to support investor sentiment as well as boost economic growth. With price-to-earnings ratios in the U.S. at lofty levels by most traditional measures, the euro-zone has been looking better.

This is not to suggest that Europe is without risk. On the contrary… the entire continent has plenty of walls of worry to climb. Nevertheless, it is worth noting the month-over-month differences between key foreign developed stock ETFs and U.S. stock ETFs. Might the percentages represent a January barometer of relative strength?

| Performance Shift Overseas? | ||||||

| 1 Month % | ||||||

| iShares MSCI Small Cap EAFE (SCZ) | 0.4% | |||||

| Vanguard Europe (VGK) | -1.0% | |||||

| iShares MSCI European Monetary Union (EZU) | -1.2% | |||||

| iShares MSCI EAFE Index (EFA) | -1.7% | |||||

| WisdomTree Hedged Europe (HEDJ) | -2.0% | |||||

| S&P 500 SPDR Trust (SPY) | -2.6% | |||||

| Dow Jones Industrials (DIA) | -3.2% | |||||

According to Russ Koesterich at Blackrock, there have been 14 calendar years since 1954 when interest rates and P/E ratios both rose in the U.S. The average return in the following year for the S&P 500? Just 2.3%. Raising some cash to buy U.S. stocks on a significant sell-off may have a greater probability of success on the domestic front than holding-n-hoping throughout 2014.

While it is unlikely that highly correlated assets like U.S. stocks and European/Pacific equities would decouple the way that the developed and undeveloped markets have, many European stock ETFs are 15%-25% cheaper than their U.S. counterparts (on a P/E basis). It follows that, hypothetically speaking, a fund like iShares MSCI European Monetary Union (EZU) might gain 18%-20% in a year where the S&P 500 SPDR Trust (SPY) collects 6% (1/3 of which came via dividends).

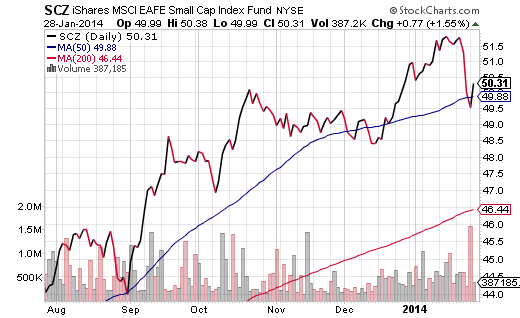

Allocating to iShares Small Cap EAFE (SCZ) may be particularly rewarding. It trades at a 40% P/E discount to the iShares Russell 2000 Small Cap Fund (IWM). And while small caps are trading at a premium to large caps stateside, the opposite is true for developed Europe/Asia/Far East (EAFE).

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.