We expect Flowserve Corporation (NYSE:FLS) to beat earnings when it reports second-quarter 2017 results on Jul 27, after the closing bell.

The company posted a positive earnings surprise of 25% in the last reported quarter. Overall, Flowserve has an average positive surprise of 3.6% for the trailing four quarters, marked by two earnings beats for as many misses.

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

According to our proven model, Flowserve has the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Earnings ESP for Flowserve is +4.55% as the Most Accurate estimate is pegged at 46 cents, higher than the Zacks Consensus Estimate of 44 cents. This is a major indicator of a likely positive earnings surprise.

Zacks Rank: Flowserve’s Zacks Rank #3, when combined with a positive ESP, makes us reasonably confident of an earnings beat.

Factors to Drive Better-than-Expected Results

Flowserve’s key strengths, including strong operational model, solid productivity, considerable aftermarket content and geographical diversity, are anticipated to drive results in the soon-to-be reported quarter. For the past few quarters, the company has been witnessing stabilization in core aftermarket activities concerning parts, services and repairs as markets return to regular maintenance schedules.

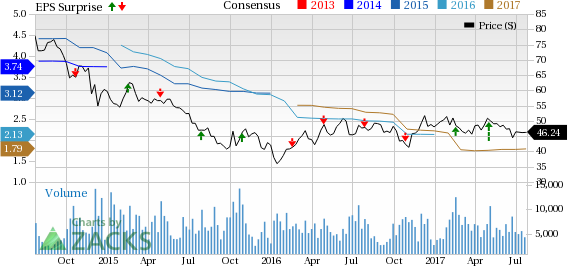

Flowserve Corporation Price, Consensus and EPS Surprise

We believe the company’s top line in the second quarter is likely to benefit from modest natural gas investments in North America and Asia. Also, increased bidding activity in the desalination space is expected to boost sales. This apart, the company’s restructuring initiatives over the past few quarters are anticipated to prove conducive to second-quarter results.

Currently, the company is pursuing a $400-million multi-year investment plan, which is expected to result in $195 million of savings in 2017. These initiatives helped the company garner savings of $28 million in first-quarter 2017. Further, Flowserve is planning to trim its workforce by 15–20% as compared to the 2015 levels, as well as shift manufacturing to lower cost regions. We believe savings from these restructuring activities will boost profits in the upcoming quarter.

Also, under the restructuring program, Flowserve completed the divestiture of the Gestra AG business unit to Spirax-Sarco Engineering plc during the quarter. The sale is part of Flowserve’s broader strategy to improve focus on core business, and optimize its product portfolio as well as manufacturing footprint. In addition, relative stability of oil at around the $45–$50 level for the past couple of quarters is encouraging. Modest recovery in client spending also looks promising.

Stocks That Warrant a Look

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Galapagos NV (NASDAQ:GLPG) , with an Earnings ESP of +33.33% and a Zacks Rank #3, is expected to release quarterly numbers around Aug 4. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Calumet Specialty Products Partners, L.P. (NASDAQ:CLMT) , with an Earnings ESP of +26.09% and a Zacks Rank #1, is slated to report results on Aug 4.

DENTSPLY SIRONA Inc. (NASDAQ:XRAY) , with an Earnings ESP of +4.55% and a Zacks Rank #3, is likely to report quarterly numbers on Aug 4.

More Stock News: Tech Opportunity worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Flowserve Corporation (FLS): Free Stock Analysis Report

Galapagos NV (GLPG): Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY): Free Stock Analysis Report

Calumet Specialty Products Partners, L.P. (CLMT): Free Stock Analysis Report

Original post