Last week, the FOMC released the minutes from its last meeting. What implications do they carry for the gold market?

FOMC Finally Acknowledges the Situation As Serious

Last week, the FOMC has published minutes of its meeting from April 28-29. They show that the Fed reassessed the coronavirus economic implications since the previous meeting at which the central banks did not yet grasp the full gravity of the situation. This time, they acknowledged that “the second quarter would likely see overall economic activity decline at an unprecedented rate.” Indeed, as we reported many times, the GDP will collapse, while the unemployment rate will soar to the levels not seen since the Great Depression.

And what’s next? The Fed’s baseline scenario is that economic growth will rise appreciably and the unemployment rate will decline considerably in the second half of the year, although a complete recovery was not expected by year-end. So, forget about the V-shaped recovery, even in the baseline scenario!

But the US central bank prepared also a more pessimistic projection which is “no less plausible than the baseline forecast.” In this scenario, there would be further economic disruptions, which could lead to a protracted period of severely reduced economic activity:

a second wave of the coronavirus outbreak, with another round of strict restrictions on social interactions and business operations, was assumed to begin around year-end, inducing a decrease in real GDP, a jump in the unemployment rate, and renewed downward pressure on inflation next year. Compared with the baseline, the disruption to economic activity was more severe and protracted in this scenario, with real GDP and inflation lower and the unemployment rate higher by the end of the medium-term projection.

The FOMC members noted several downside risks. The first is, of course, a negative evolution of the coronavirus outbreak and related uncertainty. Actually, the mere possibility of secondary outbreaks of the epidemic may cause “businesses for some time to be reluctant to engage in new projects, rehire workers, or make new capital expenditures.” This is very important as investments are the real engine of economic growth. Unfortunately, the real business fixed investment slumped in the first quarter and they are expected to drop even further in the second quarter amid social distancing restrictions, declines in crude oil prices and elevated level of uncertainty. Thus, the future pace of economic growth might be sluggish.

The second major risk is, what we also warned about, that “even after government-imposed social-distancing restrictions come to an end, consumer spending in these categories would likely not return quickly to more normal levels.” Some people even say that the behavioral changes could persist until the wide distribution of the vaccine. It doesn’t require much imagination to predict that many companies will go bankrupt. For example, even before the pandemic, many restaurants had tiny profit margins. With only half of tables occupied, such enterprises will not survive. Not to mention airlines or travel companies. So, even the central banks figured out that “even after social-distancing requirements were eased, some business models may no longer be economically viable, which could occur, for example, if consumers voluntarily continued to avoid participating in particular forms of economic activity.”

Third, some workers who lost jobs will not get it back quickly, as they may experience a loss of skills or even become discouraged and exit the labor force. As we wrote earlier, it is very easy to lose job or become broke, but it takes more time and effort to get a new job – especially if generous unemployment benefits do not encourage to take quick actions – or to set up a new business, especially when one is confronted with the sea of uncertainty.

Fourth, “higher levels of government indebtedness, which would be exacerbated by fiscal expenditures that were necessary to combat the economic effects of the pandemic, could put downward pressure on growth in aggregate potential output.” Bravo, Fed, you finally realized that debt only borrows the economic growth from the future!

Fifth, there are significant risks to financial stability. A number of the FOMC members were concerned that banks and corporations could come under greater stress, if adverse scenarios for the spread of the pandemic and economic activity were realized. The high level of corporate debt and low energy prices exacerbates these risks.

Implications for Gold

The FOMC minutes reaffirms recent Powell’s interviews, speeches and testimonies that prepare investors for an unprecedented disaster in the second quarter and subdued economic activity later this year with significant downside risks. As Powell’s remarks were generally positive for the gold prices, the minutes should continue to be supportive for the yellow metal too, although the main message has been already known by investors.

However, the minutes show also two new things. First, they indicate that the FOMC members want to be more transparent regarding the future trajectory of interest rates. So, at the upcoming meeting, we could see important changes in the Fed’s forward guidance: “While participants agreed that the current stance of monetary policy remained appropriate, they noted that the Committee could, at upcoming meetings, further clarify its intentions with respect to its future monetary policy decisions.” Given the epidemiological – we are all epidemiologist now! – and economic situation, we expect dovish moves, which should be positive for gold prices.

Second, the minutes show the increasing support for the yield-curve control:

Several participants remarked that a program of ongoing Treasury securities purchases could be used in the future to keep longer-term yields low. A few participants also noted that the balance sheet could be used to reinforce the Committee's forward guidance regarding the path of the federal funds rate through Federal Reserve purchases of Treasury securities on a scale necessary to keep Treasury yields at short- to medium-term maturities capped at specified levels for a period of time.

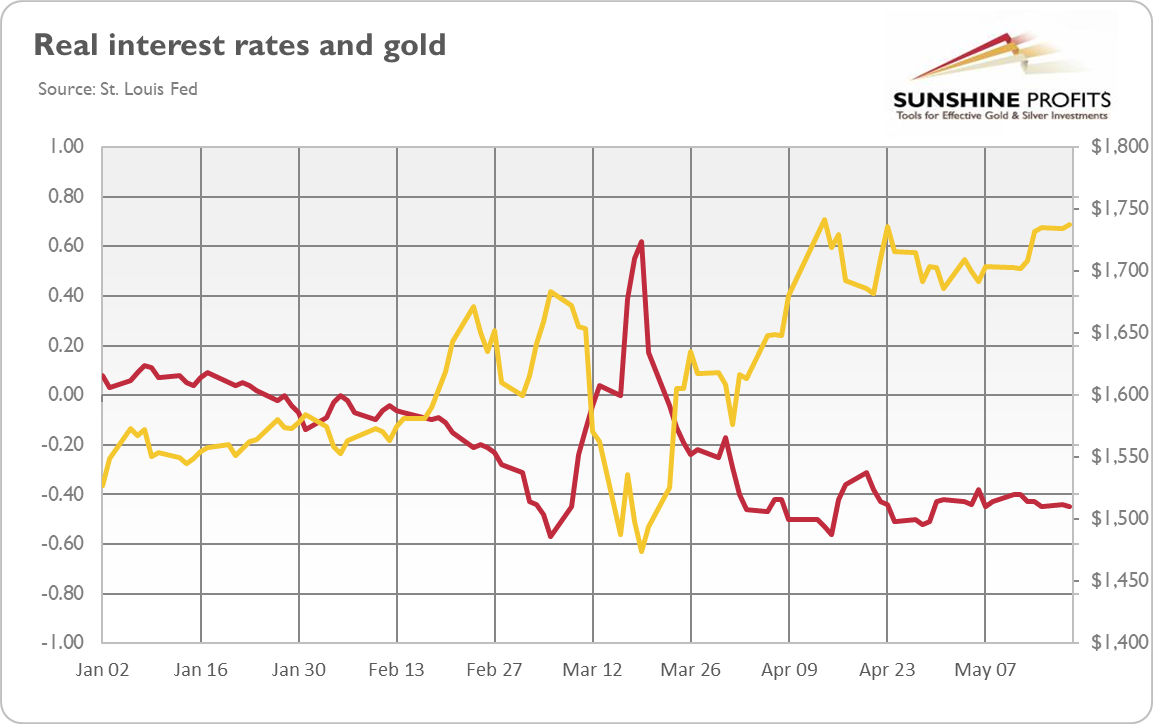

As the chart below shows, the real interest rates are already below zero. If the Fed decides to cap the bond yields, they will remain at ultra-low levels.

Chart 1: Real interest rates (red line, left axis, US 10-year inflation-indexed Treasury yields) and the price of gold (yellow line, right axis, London P.M. Fix)

The elimination of the upward pressure on the interest rates would be positive for the gold prices. Gold is a non-interest bearing assets, so it benefits from low real interest rates, in particular from negative interest rates.