Market movers ahead- We expect the Fed to make a dovish policy shift at the upcoming meeting.

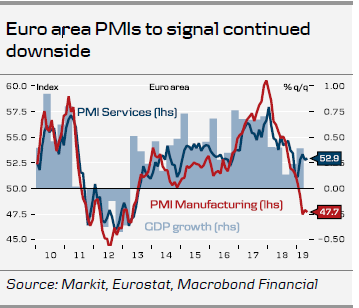

- June PMI figures on both sides of the Atlantic will give more clues on whether the cyclical downturn continues.

- In Europe, a range of important decisions loom at the EU summit and markets will keep a close watch on monetary policy hints from the ECB's Sintra Forum.

- The UK Conservative Party leadership contest continues, while the Bank of England meeting should not bring much news.

- We expect the Bank of Japan to keep its assessment of the economy at its meeting.

- We expect Norges Bank to raise its policy rate by 25bp to 1.25%.

Weekly wrap-up

- Calls for central bank easing are getting louder both in the US and Europe.

- We published our updated global view in The Big Picture (audio recording here ).

- ECB credibility continues to be challenged with euro area (market-based) inflation expectations nose-diving.

- Trade conflicts and geopolitical risks continue to weigh on risk sentiment.

Market movers

Global

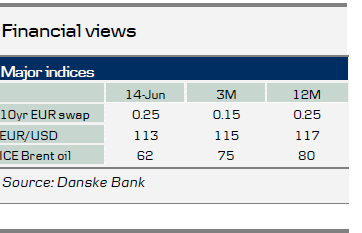

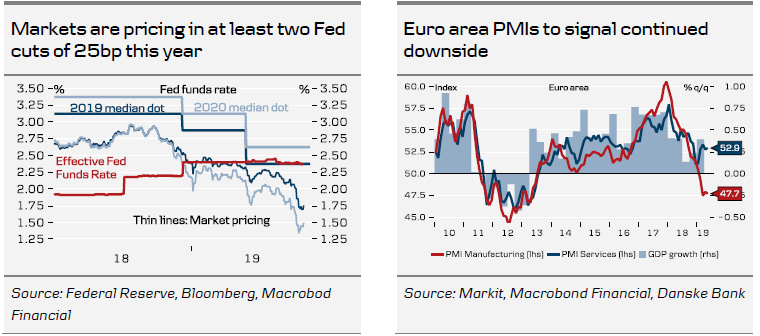

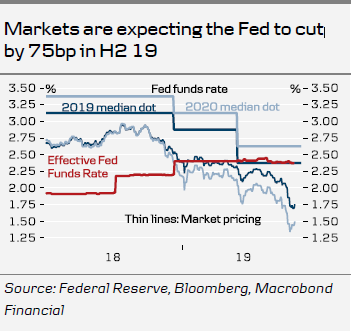

In the US, the Federal Reserve meeting concluding on Wednesday is set to be very important for markets, as the pressure for easing monetary policy is increasing. We expect the Federal Reserve to make a dovish policy shift, paving the way for a rate cut in July and a total of 75bp in cuts in H2 19 (see FOMC Preview: Cutting like it is the 90s, 11 June). While we have a constructive US macro outlook, uncertainty has risen and, from a risk management perspective, we believe it makes more sense to ease monetary policy than to do nothing.

In terms of economic data releases, we are due to get preliminary Markit PMIs for June. The very weak PMIs for May, indicating growth of just 1% annualised, caught most by surprise and the uncertainty is whether this was just a blip or whether the economy has slowed faster than we had expected.

In the euro area, we have a range of interesting events next week. On the politics front, we expect the EU summit from 20-21 June to be interesting as we might get more clarity on the front-runners for the EU Commission presidency and other EU top positions (see also Flash Comment – Let the EU ‘Game of Thrones’ begin, 27 May). In our view, markets will also monitor closely the Council’s decision with regard to formally opening an excessive deficit procedure (EDP) against Italy, after on 5 June the Commission found the country in violation of the debt reduction rules for 2018. This could mark the starting shot for a renewed budget fight with Brussels and weigh on market sentiment.

On the data front, we expect the June PMIs to be in the limelight on Friday. Driven by a further improvement in the order-inventory balance, manufacturing PMI remained broadly stable at 47.7 in May. Still, we see the improvement in new orders as temporary in light of the trade war escalation and hence look for further downside for the manufacturing PMI in June (at 47.6) and in coming months. In contrast to industry, activity in the services sector continues to hold up well overall but new incoming business and expectations still eased in May. This leaves us looking for a slight dip in the services PMI from 52.9 to 52.7 in June.

The ECB’s annual conference in Sintra takes place from 17-19 June. A significant number of policymakers are set to speak at the conference and while much of the discussion is set to be academic in nature, we will be closely watching Mario Draghi’s welcome address on Monday evening and introductory remarks on Tuesday morning. In 2017, he used the event to signal a potential upcoming change in monetary policy, which led to a sharp market sell-off.

Last but not least, the final May HICP figures due out on Tuesday should reveal which services price components dragged core inflation back down to 0.8% (from 1.3% in April) (see Flash Comment – Base effects in the driver's seat but ECB concerns, 4 June.

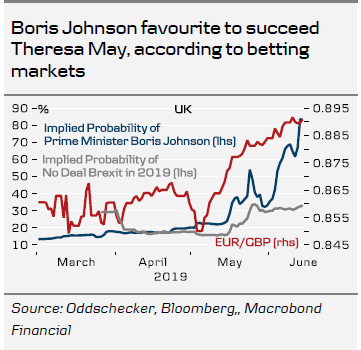

In the UK, the Conservative Party leadership contest continues, with the pool of candidates set to narrow to just two. Boris Johnson remains the favourite but the Conservative Party members have a long history of stabbing each other in the bag. While on paper Johnson is more pro-Brexit, we believe it is hard to see how he would be able to pull the UK out of the EU without a deal, as Parliament would be likely to block such an attempt.

The Bank of England meeting is probably not important. In our view, the bank is firmly on hold despite its tightening bias and it is one of the small meetings without an updated inflation report or a press conference.

To read the entire report Please click on the pdf File Below..