Last Friday, the euro moved sharply higher against the greenback, which resulted in a climb to a new 2017 high. Early Monday, EUR/USD hit a fresh peak and the question is whether or not will we see further improvement in the week ahead.

On Thursday, we wrote the following:

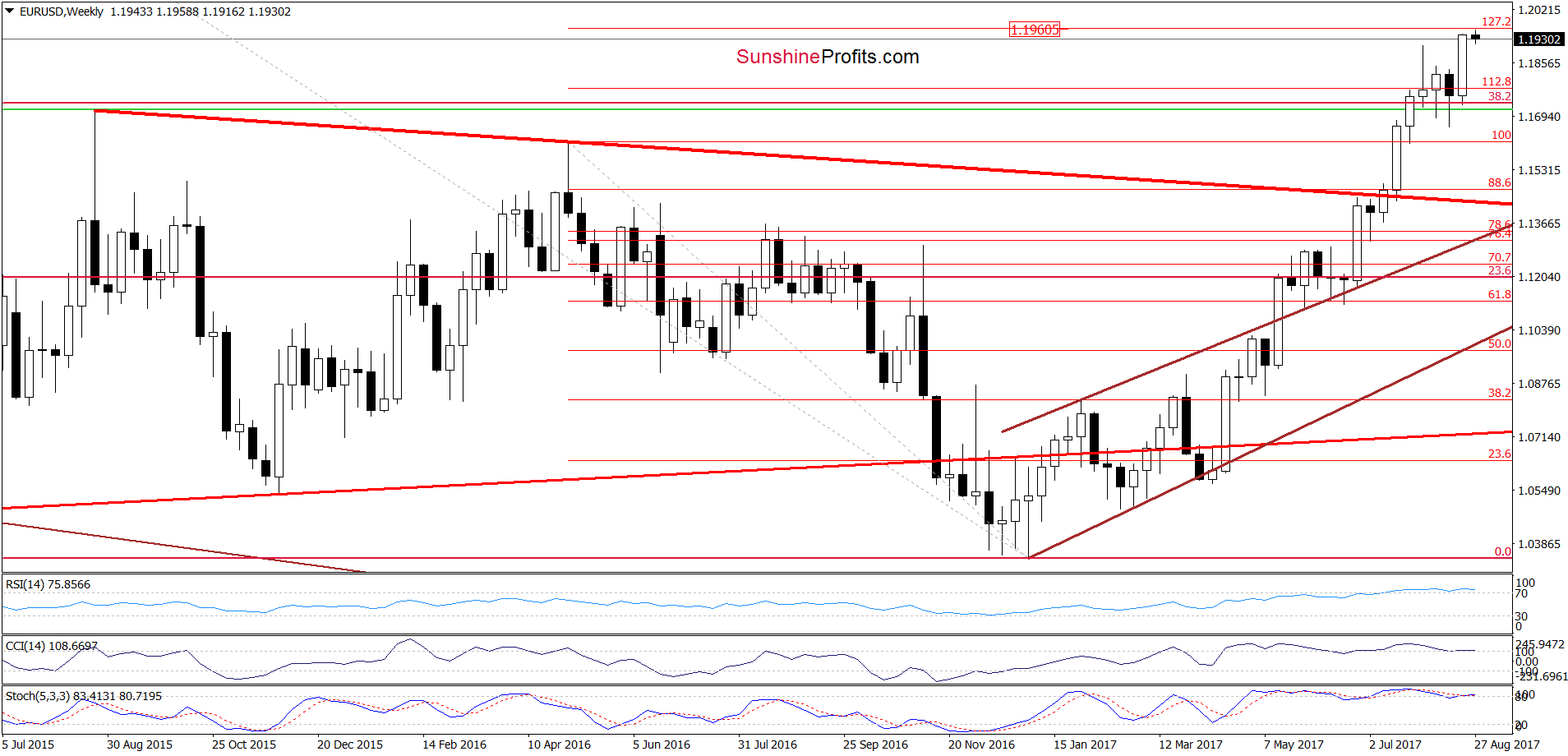

(…) EUR/USD is still trading in the blue consolidation under the upper border of the brown rising trend channel, which makes the very short-term situation unclear. Nevertheless, the pair climbed above the 38.2% Fibonacci retracement and the 112.8% Fibonacci extension (marked on the weekly chart), which suggests an invalidation of the earlier tiny breakdowns under these lines and another attempt to move higher.

From Monday’s point of view, we see that the situation developed in tune with the above scenario as EUR/USD broke above the upper border of the blue consolidation, triggering a climb above the upper line of the brown rising trend channel and the early August high. As a result, the pair hit a fresh 2017 peak. On Monday the exchange rate extended gains, but then reversed and declined.

Will we see another upswing in the coming days? Let’s examine the medium-term chart.

In our Forex Trading Alert posted August 7, we noted:

(…) currency bulls pushed EUR/USD higher in the previous week, which resulted in a breakout above the 38.2% Fibonacci retracement based on the entire May 2014-January 2017 downward move (the retracement is more visible on the long-term chart) and the 112.8% Fibonacci extension (based on the May 2016- January 2017 downward move).

(…) such price action suggests that (…) if the pair moves higher from current levels, the initial upside target will be around 1.1960, where the 127.2% Fibonacci extension is.

Looking at the weekly chart, we see that currency bulls pushed EUR/USD to 1.1958, which resulted in an increase to (almost) the 127.2% Fibonacci extension. Taking this fact into account and combining it with the current position of the weekly and daily indicators, it seems to us that we may finally see a reversal and a bigger move to the downside in the coming week. Nevertheless, this scenario will be more likely and reliable if EUR/USD invalidates the breakout above the early August peak and if the indicators generate sell signals in the following days. If we see such price action, we’ll consider opening short positions. As always, we’ll keep you informed should anything change.

- Very short-term outlook: mixed with bearish bias

- Short-term outlook: mixed

- MT outlook: mixed

- LT outlook: mixed

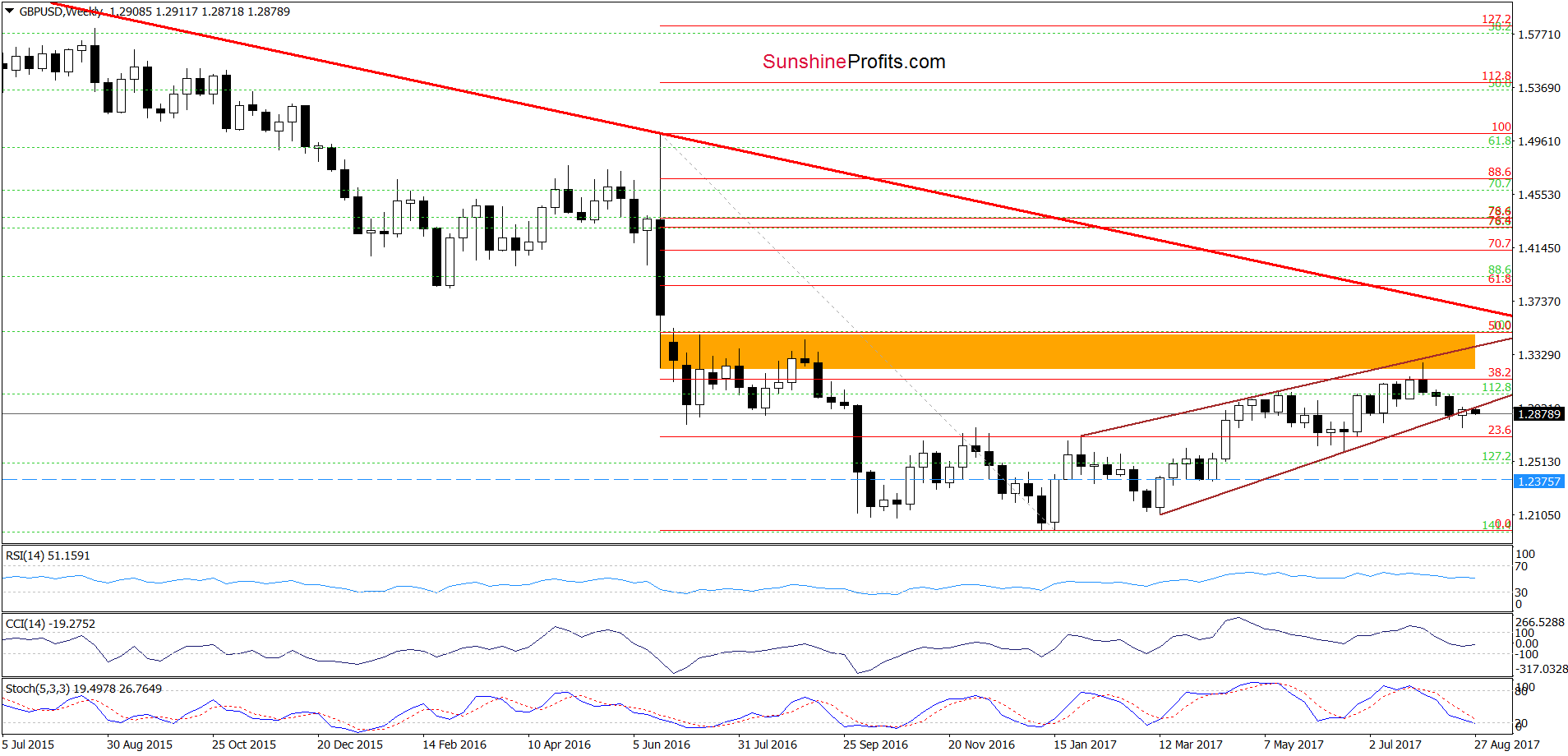

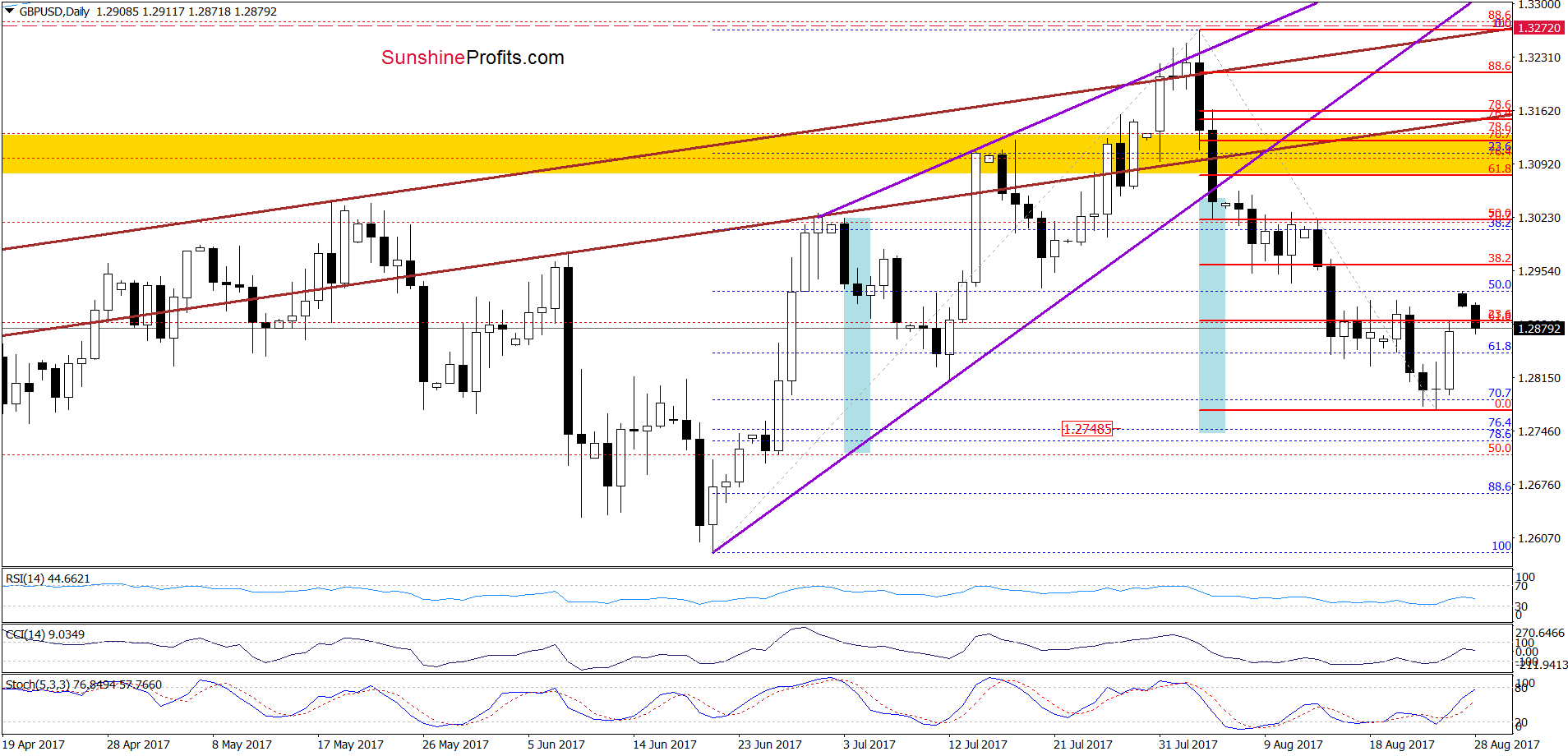

On the daily chart, we see that GBP/USD rebounded on Friday, but, in our opinion, the move didn’t change a thing. As you see on the above chart, although currency bulls pushed the exchange rate above last week’s highs, the pair didn’t reach the 38.2% Fibonacci retracement, which suggests that currency bulls are not as strong as they seem at the first look.

Additionally, the pair remains under the lower border of the brown rising wedge marked on the weekly chart, which suggests that another move to the downside and realization of the bearish scenario from our Trading Alert posted last Thursday is very likely:

(…) another downside target for currency bears will be around 1.2748, where the size of the downward move will correspond to the height of the rising wedge and where the 76.4% and 78.6% Fibonacci retracements are.

- Very short-term outlook: bearish

- Short-term outlook: bearish

- MT outlook: mixed with bearish bias

- LT outlook: mixed

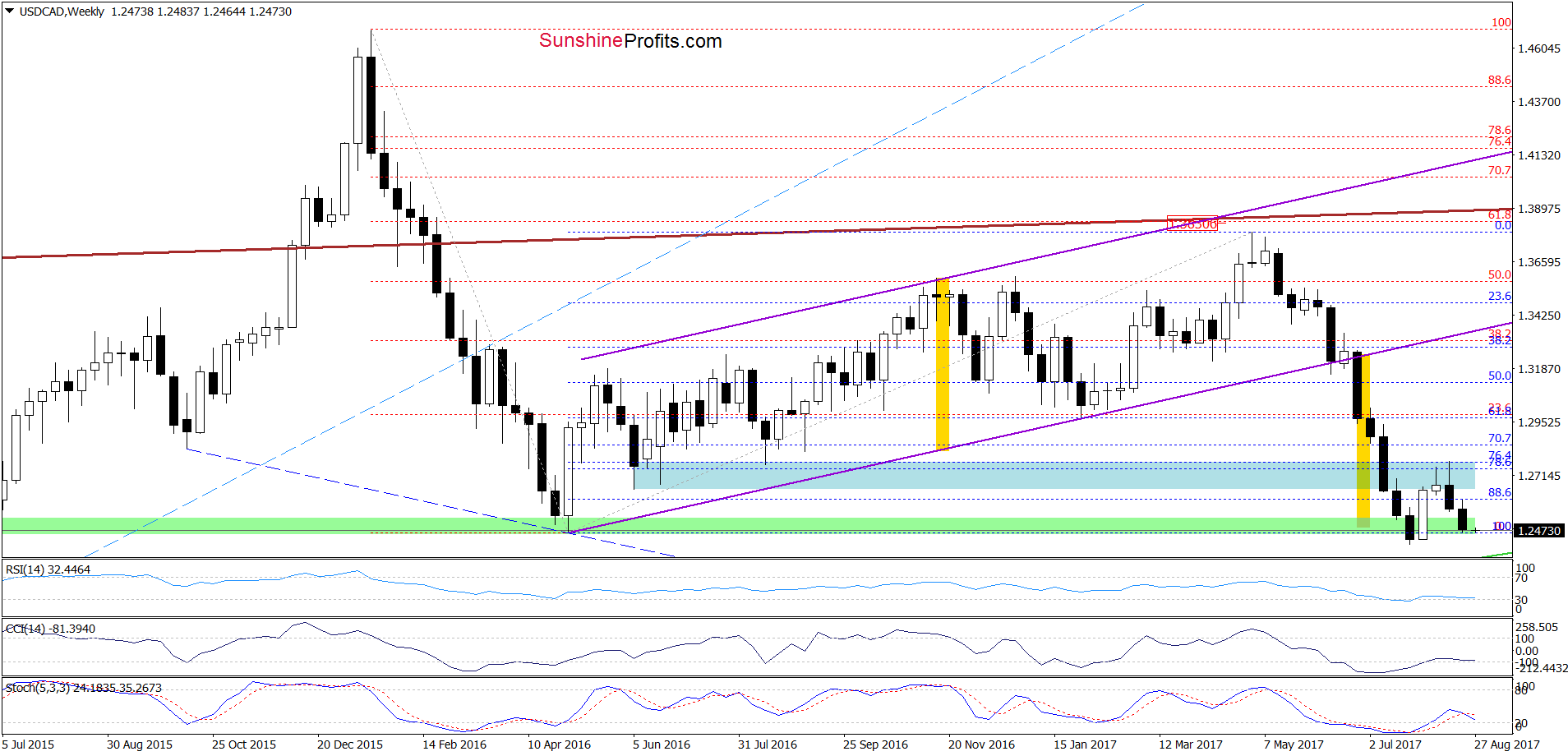

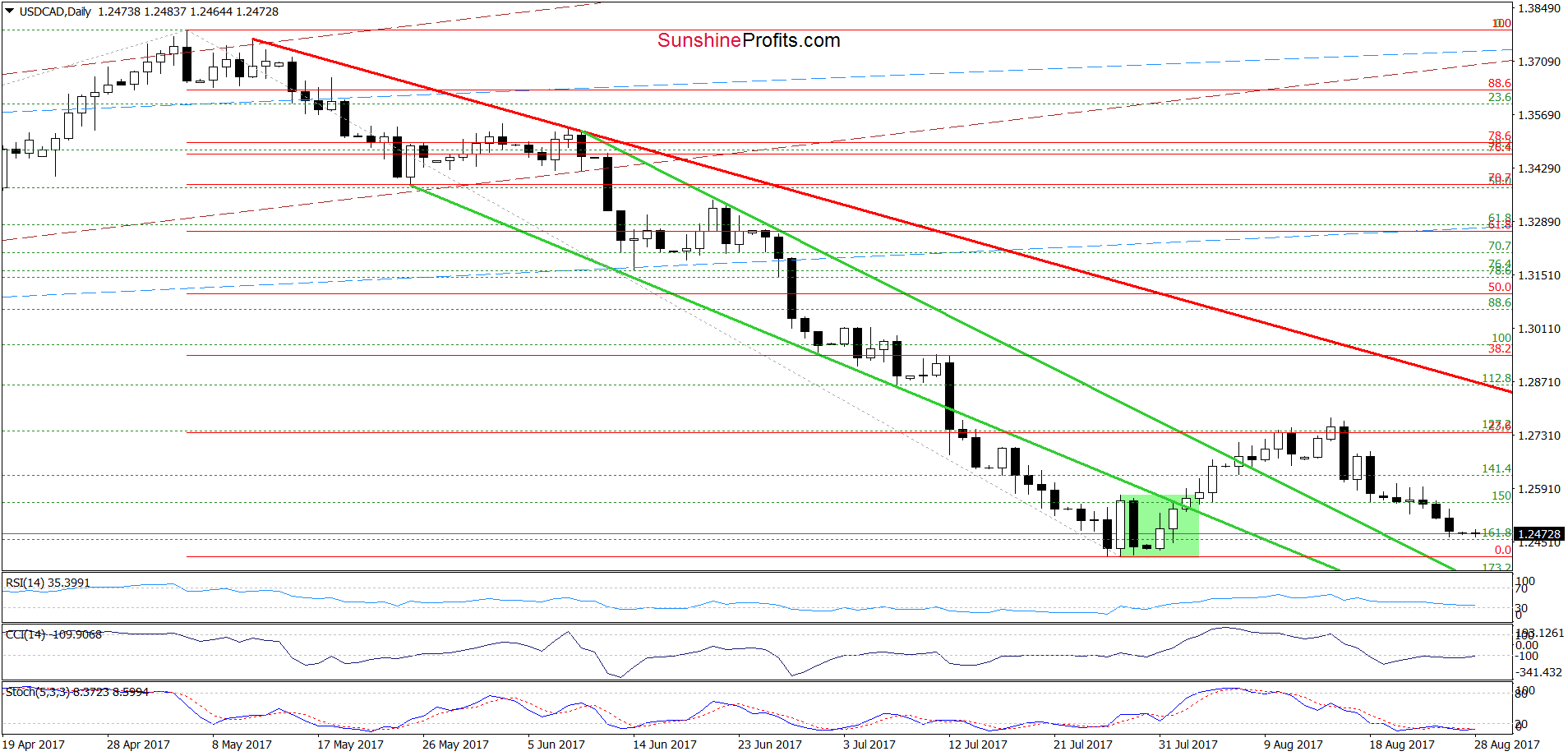

Last Friday, USD/CAD moved visibly lower once again, resulting in a drop to the lowest level since the beginning of the month. Additionally, the sell signal generated by the weekly Stochastic Oscillator continues to support currency bears, which suggests that we’ll see a test of the late July lows in the coming days.

- Very short-term outlook: mixed with bearish bias

- Short-term outlook: mixed

- MT outlook: mixed

- LT outlook: mixed

Naturally, things could change in the coming days and we’ll keep you updated, but that’s what we see based on the data right now.

Thank you.