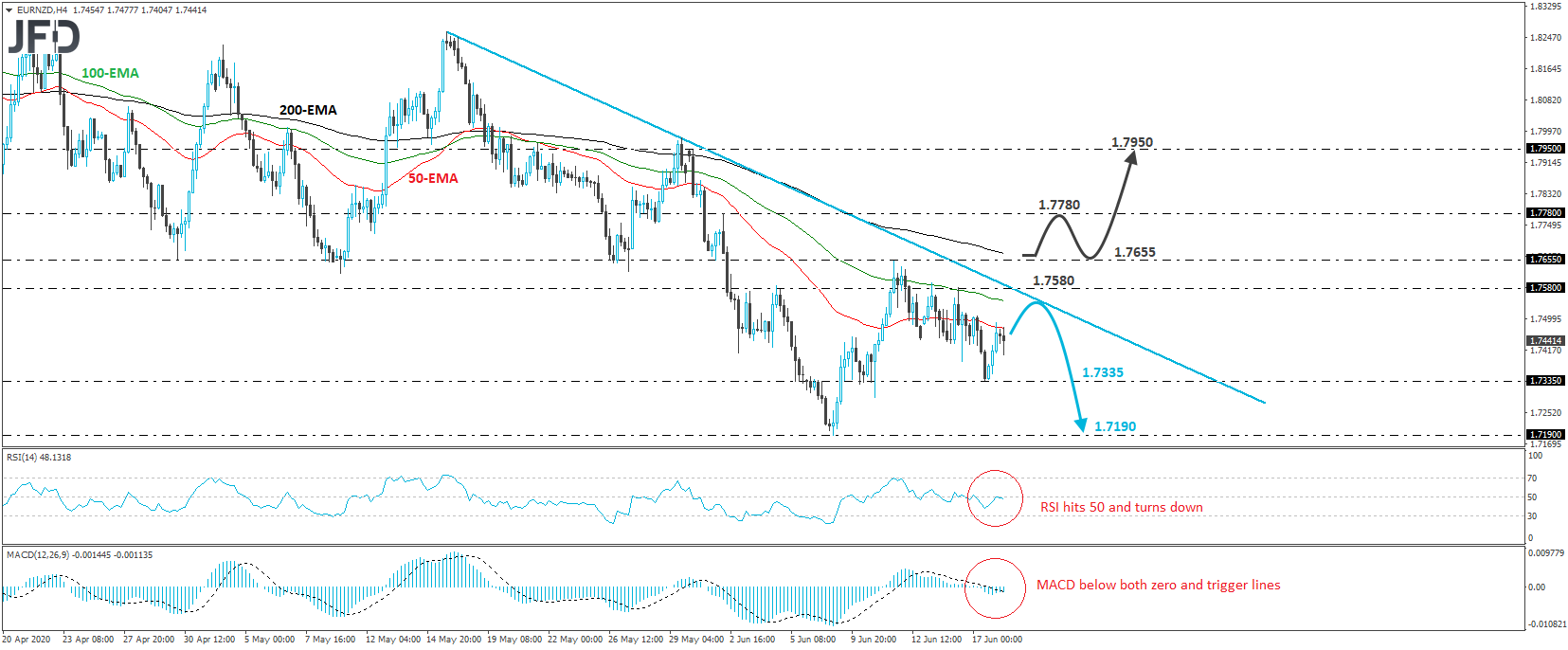

EUR/NZD traded higher yesterday after it hit support near the 1.7335 support zone. However, the price action is still below the downside resistance line drawn from the high of May 15th, and thus, even if the recovery continues for a while more, as long as that line stays intact, we would consider the near-term outlook to be cautiously negative.

If the bears are willing to take charge again soon, we may see them aiming for another test near yesterday’s low of 1.7335. If, this time, they are strong enough to overcome that hurdle, we may see them setting the stage for declines towards the low of June 9th, at 1.7190.

Turning attention to our short-term oscillators, we see that the RSI ticked down after hitting resistance at 50, while the MACD, already slightly negative, has just touched its toe below its trigger line. Both indicators suggest that EUR/NZD may start gaining downside speed again, which means it may not continue with the recovery and instead start falling from current levels.

In order to start examining the bullish case, we would like to see a strong break above 1.7655, a resistance marked by the high of June 11th. The rate would already be above the aforementioned downside resistance line and may allow the bulls to climb towards the 1.7780 obstacle, marked by the high of June 2nd. If that level is not able to halt the rise either, then the action could be driven towards the 1.7950 zone, which provided strong resistance on June 1st.