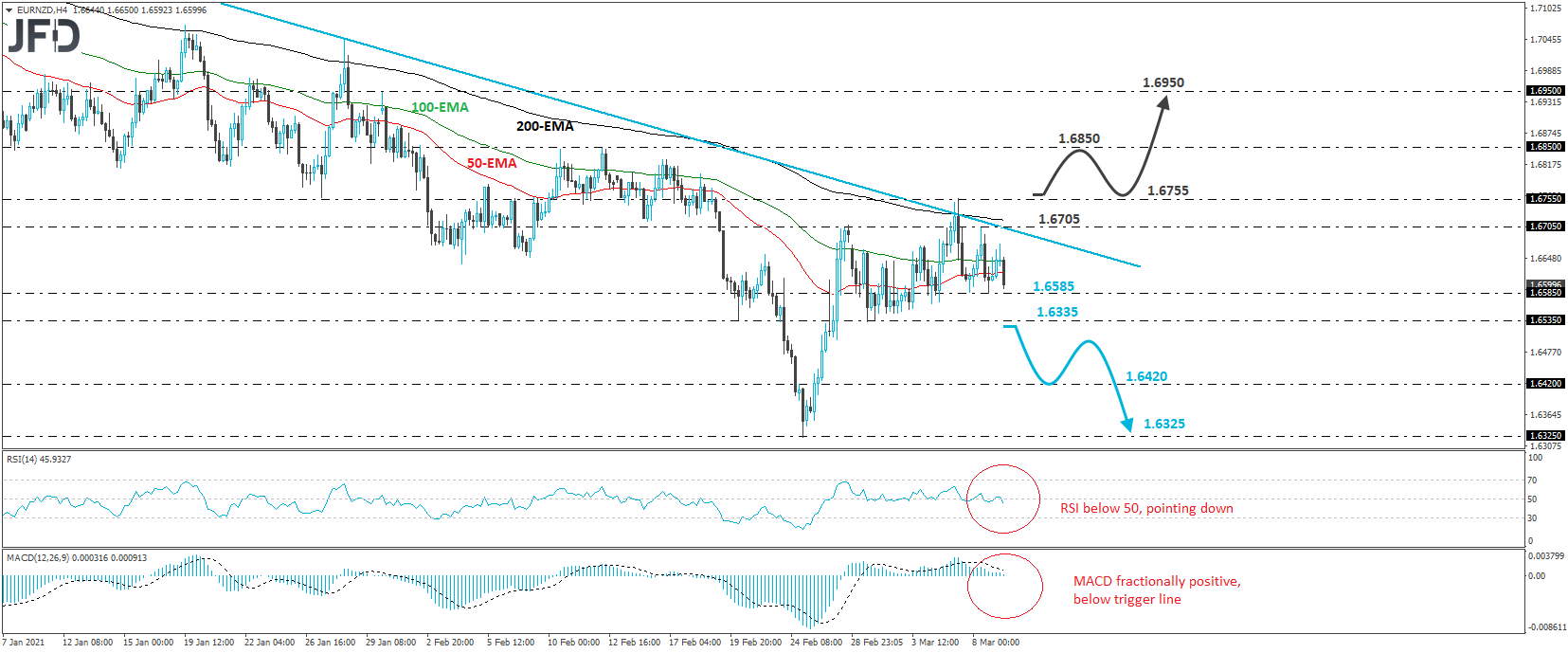

EUR/NZD traded lower on Tuesday, but stayed within the sideways range that’s been containing most of the price action since Feb. 26, between 1.6535 and 1.6705. Overall, the pair remains below the downside resistance line taken from the high of Dec. 22, and thus, we would see more chances for the rate to exit the short-term range to the downside, rather than to the upside

A clear and decisive dip below 1.6535 will add credence to that view and may allow the bears to push the battle towards the 1.6420 barrier, marked by an intraday swing high formed on Feb. 24. If that level is not able to withstand the pressure, its break may pave the way towards the low of that day, at around 1.6325.

Shifting attention to our short-term oscillators, we see that the RSI turned down and crossed back below its 50 line, while the MACD, although fractionally positive, lies below its trigger line. It could turn negative soon. Both indicators suggest that EUR/NZD may start picking up downside speed, which enhances the chances for some further declines in the short run.

Now, in order to abandon the bearish case and start examining whether the bulls have gained the upper hand, we would like to see a clear rebound above 1.6755. Such a move may also confirm the break above the aforementioned downside line and may see scope for advances towards the 1.6850 hurdle, which provided resistance on Feb. 10 and 12. Another break, above 1.6850, may carry more bullish implications, perhaps opening the path towards the 1.6950 area, marked by the high of Jan. 31.