Investing.com’s stocks of the week

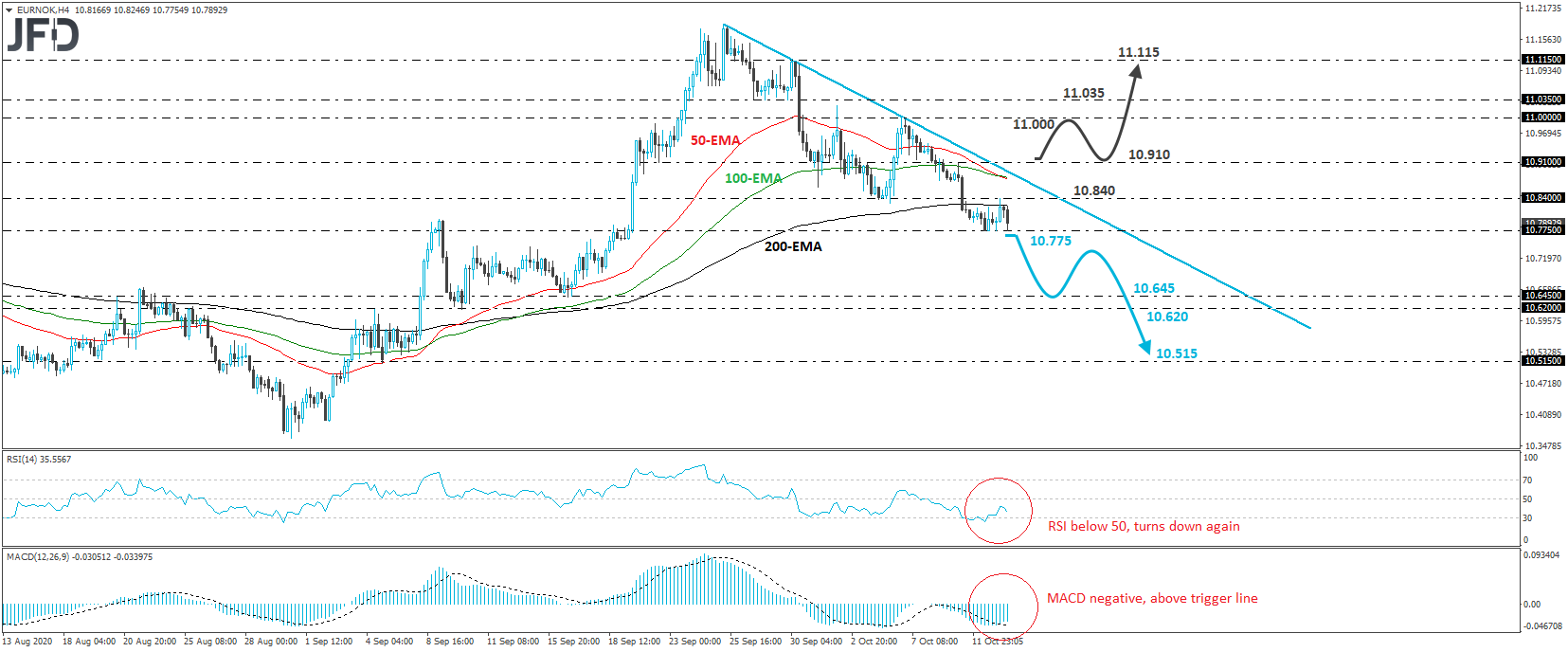

EUR/NOK has been trading in a consolidative manner since Friday, staying between the 10.775 and 10.840 levels. That said, overall, the pair continues to trade below the downside resistance line drawn from the peak of September 25th, and thus, we would consider the short-term outlook to be negative for now.

If the bears are willing to retake control and manage to break below the 10.775 obstacle, we may see them traveling towards the 10.645 or 10.620 zones, marked by the lows of September 16th and 10th respectively. Another break, below 10.620, could carry more bearish implications, perhaps paving the way towards the 10.515 barrier, near the low of September 4th.

Shifting attention to our short-term oscillators, we see that the RSI, already below 50, has turned down again, while the MACD runs within its negative territory. That said, it lies above its trigger line. Both indicators detect downside momentum, but the fact that the MACD is above its trigger line enhances our view to wait for a dip below 10.775 before getting more comfortable on further declines.

On the upside, we would like to see a strong rebound above 10.910 before we start examining the bullish case. The rate would already be above the pre-mentioned downside line, which may encourage the bulls to push towards the 11.000 hurdle, marked by the high of October 6th, or towards the 11.035 level, marked by the inside swing lows of September 28th and 29th.