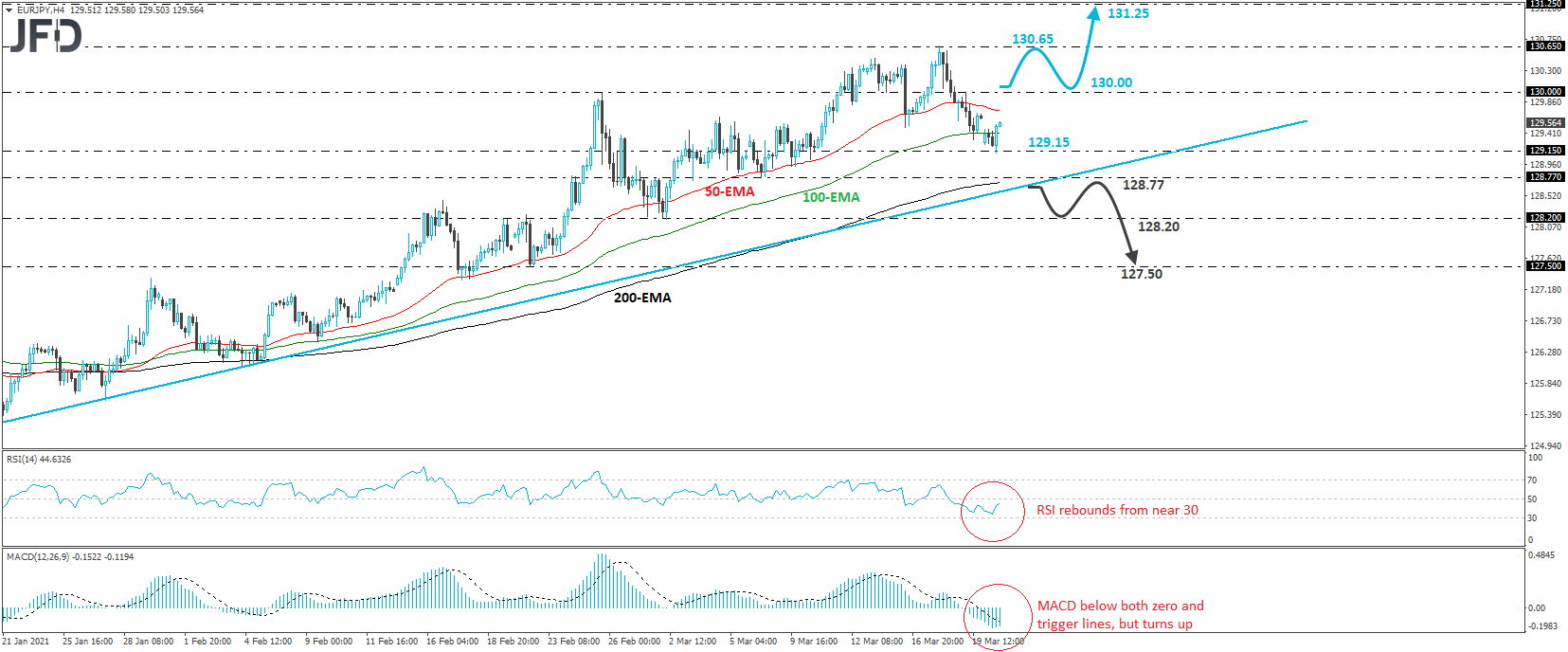

EUR/JPY has been in a sliding mode since Thursday. Today, the pair opened with a negative gap, but hit support near 129.15, and then it rebounded somewhat. Overall, the rate continues to trade above the upside support line drawn from the low of Jan. 18, but before we start considering the continuation of the prevailing uptrend, we would like to see a clear break above 130.00. For now, we will stay cautiously positive.

A clear and decisive break above 130.00 may signal that the latest retreat is over and that the next wave may be in the direction of the prevailing uptrend. The bulls may get encouraged to target Thursday’s peak at 130.65, the break of which will take the rate into territories last tested in October 2018. The next resistance may be the high of the 18th of that month, at around 131.25.

Looking at our short-term oscillators, we see that the RSI rebounded from near its 30 line and now looks to be headed towards 50, while the MACD, although below both its zero and trigger lines, has bottomed as well. Both indicators detect slowing downside speed, suggesting that the latest corrective setback may be over.

In order to start examining a bearish reversal, we would like to see a strong dip below the 128.77 zone, and the aforementioned upside support line. We could then see the pair diving towards the 128.20 hurdle, which provided support on Mar. 1 and 2, and also acted as a resistance on Feb. 19 and 22. The bears may decide to take a break after testing that zone, thereby allowing a small rebound. However, as long as the rate would stay below the upside line, we would see decent chances for another leg south and perhaps a break below 128.20. This may pave the way towards the low of Feb. 22, at 127.50.