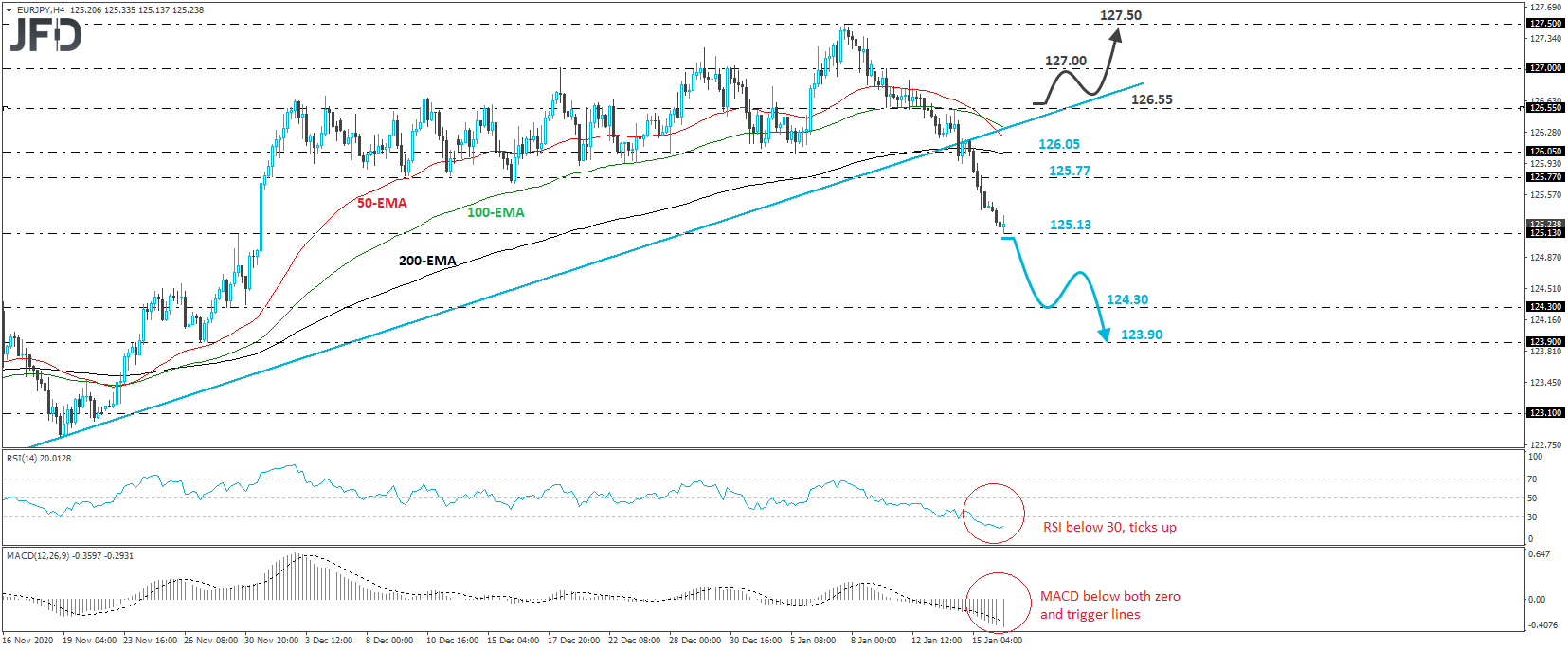

EUR/JPY has been in a tumbling mode since Jan. 8, after hitting a nearly two-year high at 127.50, the day before. Last Thursday, the pair broke below the upside support line drawn from the low of Oct. 30, and continued to slide up until today, eventually testing the support of 125.13, marked by the inside swing high of Nov. 30. In our view, the dip below the upside line may have turned the short-term outlook to the downside.

If the bears are willing to stay in the driver’s seat, then a break below 125.13 may pave the way towards the low of Nov. 30, at around 124.30. If that zone fails to stop the fall, the slide could get extended towards the 123.90 territory, marked by the low of Nov. 27.

Shifting attention to our short-term oscillators, we see that the RSI lies below 30, while the MACD runs below both its zero and trigger lines. Both indicators detect strong downside speed, but if we take a closer look, we can see that the RSI has just ticked up, which means that there is a chance for a small corrective bounce before the next negative leg.

Having said that, in order to abandon the bearish case, we would like to see a rebound back above 126.55, marked by the inside swing lows of Jan. 11 and 12. This could also take the rate back above the aforementioned upside line and may initially allow advances towards the 127.00 territory, marked by the high of Jan. 11. Another break, above 127.00, may set the stage for extensions towards the peak of Jan. 7, at 127.50.