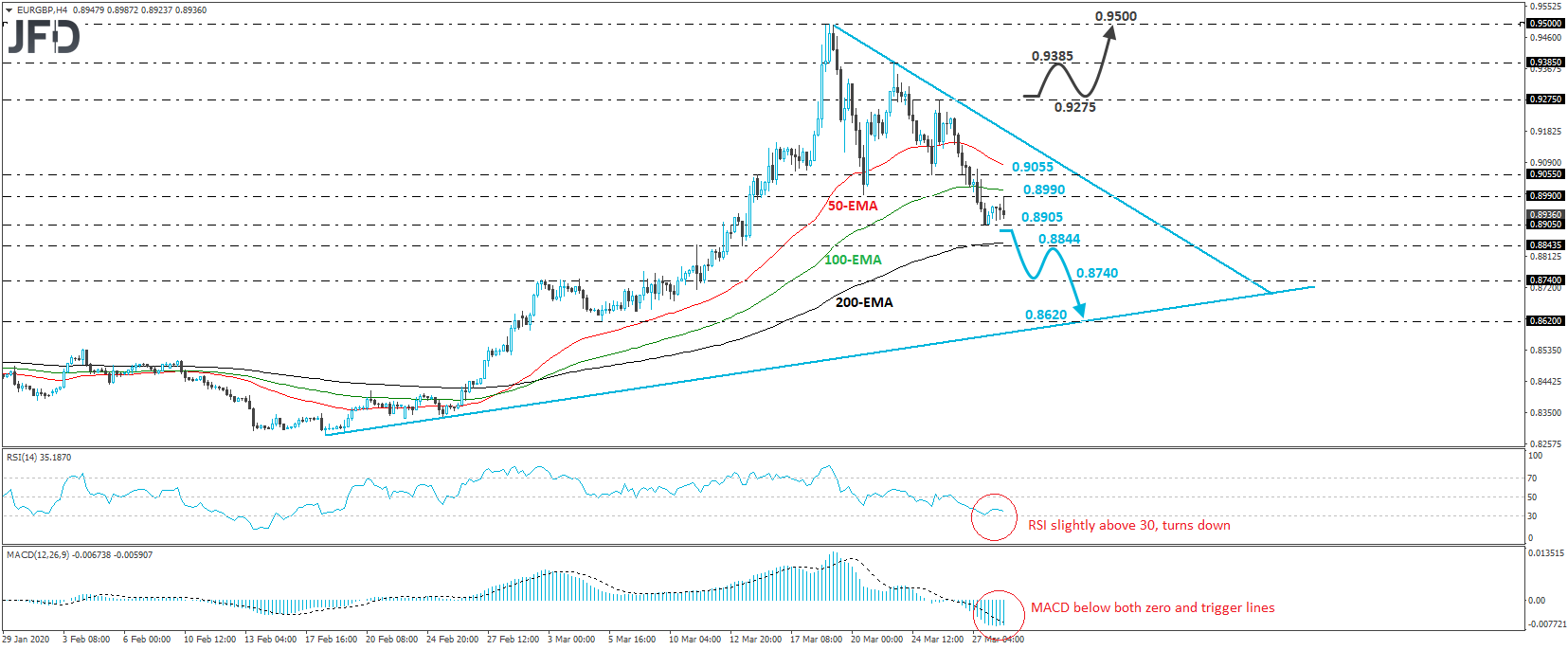

EUR/GBP has been trading in a consolidative manner since Friday, between the 0.8905 and 0.8990 levels. Overall, the pair has been in a sliding mode below a downside resistance line since March 19th, and although it stands above an upside line drawn from the low of February 18th, we believe there is ample room for more declines.

A break below Friday’s low of 0.8905 could bring the 0.8844 barrier into play, which almost coincides with the 200-EMA on the 4-hour chart. If that level is broken as well, then we could see the bears diving towards the 0.8740 area, which acted as a resistance between March 2nd and 4th. Another slide, below 0.8740, may extend the slide towards the low of March 5th, at around 0.8620, or the aforementioned upside line taken from the low of February 18th.

Looking at our short-term oscillators, we see that the RSI rebounded from near its 30 line, but turned down again, while the MACD, although flat, lies below both its zero and trigger lines. Both indicators detect downside speed and support the notion for some further declines in this exchange rate.

On the upside, we would like to see a break above 0.9275 before we start examining whether the bulls have gained the upper hand. The rate would already be above the downside line taken from the high of March 19th, while the break above 0.9275 would confirm a forthcoming higher high on the 4-hour chart. The bulls may sail north towards the high of March 23rd, at around 0.9385, the break of which may allow them to put the psychological 0.9500 hurdle on their radars. That barrier was last tested on March 19th.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will EUR/GBP Continue Sliding?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.