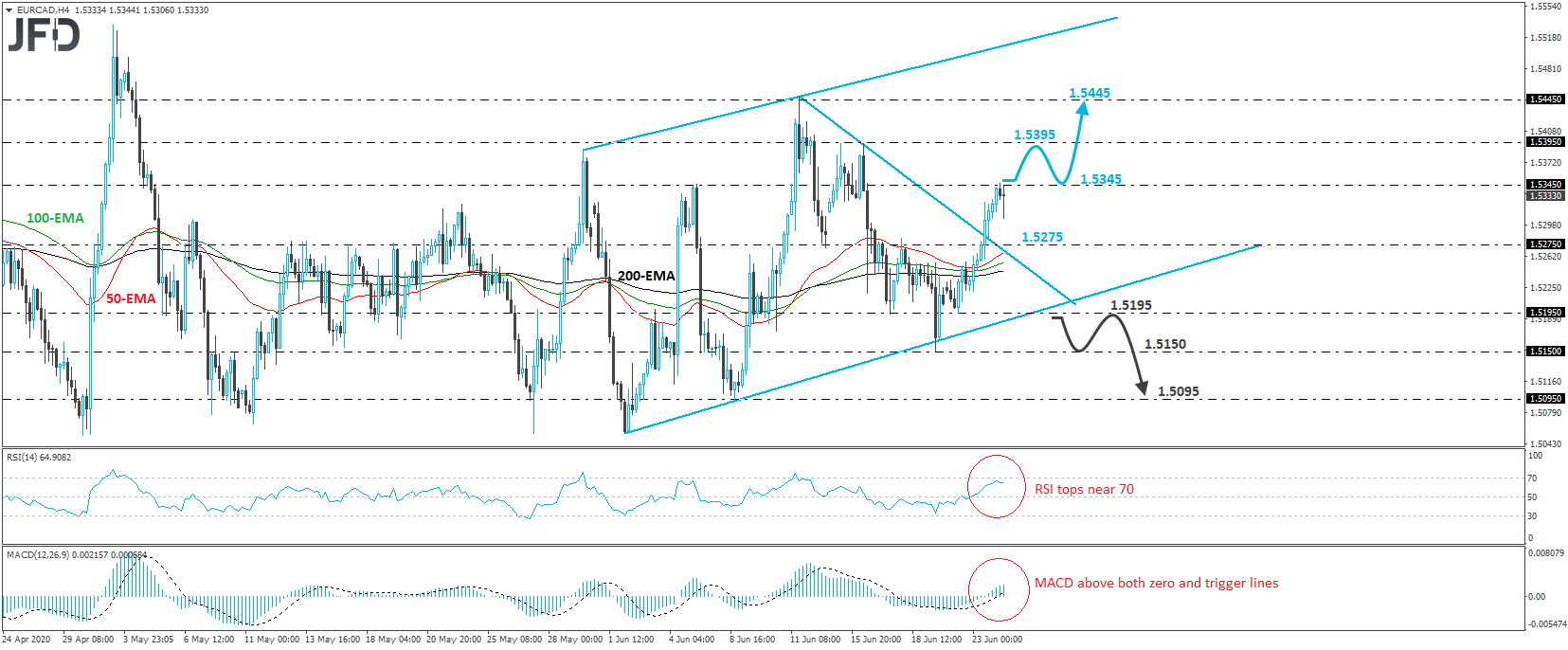

EUR/CAD has been in a recovery mode since Friday, when it hit support at 1.5150, slightly below the upside support line drawn from the low of June 2nd. Yesterday, it emerged above the tentative resistance line taken from the high of June 11th, but the rally was stopped near 1.5345. Having these technical signs in mind, we will hold a bullish stance, even if we see a small retreat initially.

If the bulls are strong enough to take charge from above the 1.5275 zone, we could see them overcoming the 1.5345 zone soon. That zone acted as a strong resistance back on June 5th. Such a break may pave the way towards the highs of June 15th and 16th, at 1.5395, the break of which may allow extensions towards the peak of June 11th, at 1.5445.

Shifting attention to our short-term oscillators, we see that the RSI topped slightly below 70, while the MACD, although above both its zero and trigger lines, shows signs that it could top as well. Both indicators detect slowing upside momentum, which makes us careful over a possible small setback before the next leg north.

That said, the move that would prompt us to start considering the bearish case is a dip below Monday’s low at 1.5195. This will take the rate back below the tentative resistance line taken from the high of June 11th, as well as below the upside one, drawn from the low of June 2nd. The bears may then get encouraged to shoot for Friday’s low of 1.5150, where a break may open the path towards the 1.5095 territory, marked as a support by the low of June 8th.