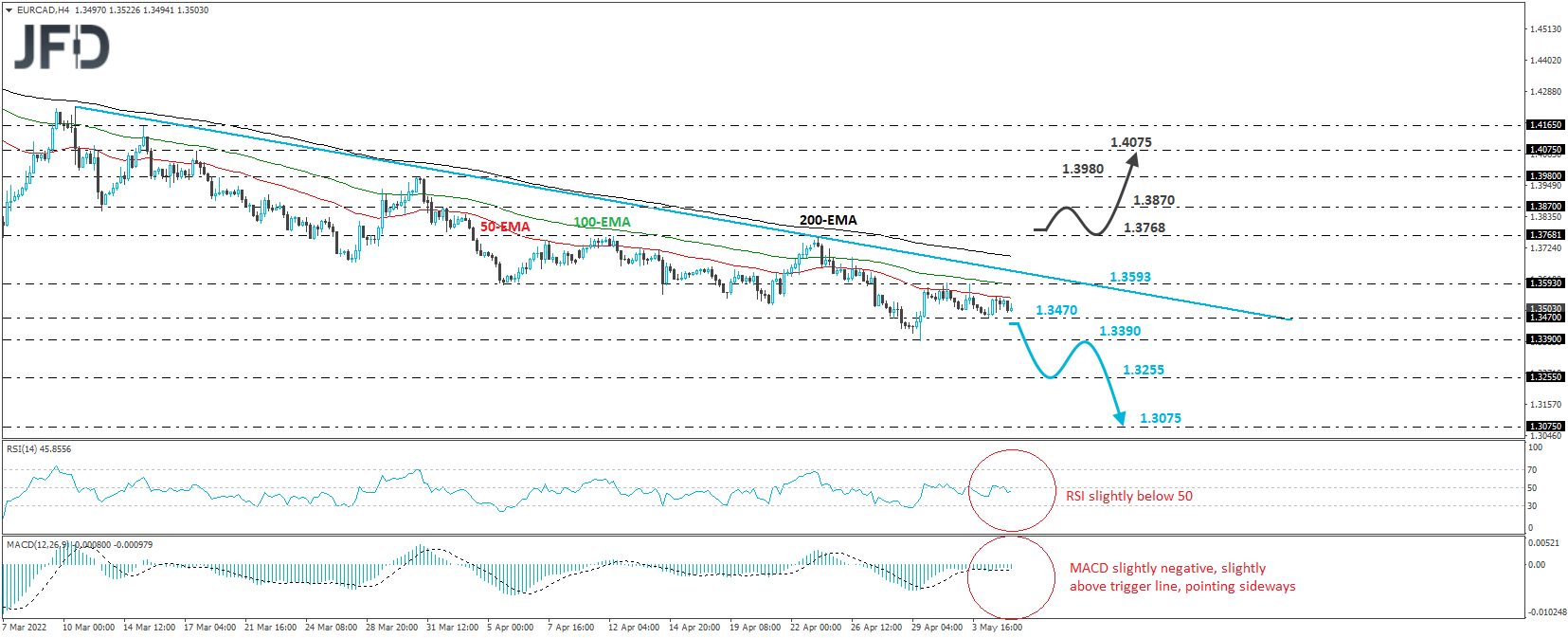

EUR/CAD traded in a consolidative manner on Wednesday and Thursday morning, staying within a very short-term range that’s been in place since Apr. 29, between 1.3470 and 1.3593. In the bigger picture, though, the stock remains below the downside resistance line drawn from the high of Mar. 10, and thus, we will maintain our bearish view.

A clear and decisive dip below 1.3470 could initially target the 2.3390 zone, marked by the low of Apr. 29, the break of which would confirm a forthcoming lower low on longer-term timeframes and perhaps encourage the bears to push the action towards the 1.3255 zone, marked by the inside swing high of Apr. 24, 2015, at 1.3255. If they are not willing to stop there either, we may experience negative extensions towards the 1.3075 zone, which provided decent support between Apr. 16 and 23.

Shifting attention to our short-term oscillators, we see that the RSI lies slightly below 50, while the MACD runs fractionally below zero, fractionally above its trigger line, and points sideways. Both indicators detect a lack of directional momentum. Thus, we would prefer to wait for a move below 1.3470 before we start examining whether the pair could extend the prevailing downtrend.

On the upside, we would like to see a clear break above 1.3768 before examining the bullish case. The rate will already be above the downside resistance line drawn from the high of Mar. 10, while the break will confirm a forthcoming higher high on the daily chart.

This may encourage advances towards the 1.3870 zone, the break of which could carry extensions towards the high of Mar. 31, at 1.3980. If the buyer does not stop there, a break higher could open the path towards the high of Mar. 17, at 1.4075.