Municipal bond supply has been low for 2012 and will continue to be low as we head into year end. Supply is projected to fall just short of 200 billion this year which is significantly lower than the 350 to 400 billion the market has seen in the past decade.

Supposedly, some market players think that the reason for lower supply is due to the 2012 Presidential Elections and the 11 state governorships open for elections according to RBC Capital Markets’ Chris Mauro.

The Head of U.S. Municipals Strategy mentioned in his latest U.S. Municipal Notes, “Only a Theory”, that this reason draws comparison to a similar sentiment back in the first half of 2011 when market players attributed the lack of supply to the election of 26 new governors in 2010. Despite no evidence backing this claim, this sentiment gained some credibility.

In an effort to determine if the uncertainty that comes with a change in leadership on either a state or national level, Mauro provided the following analysis:

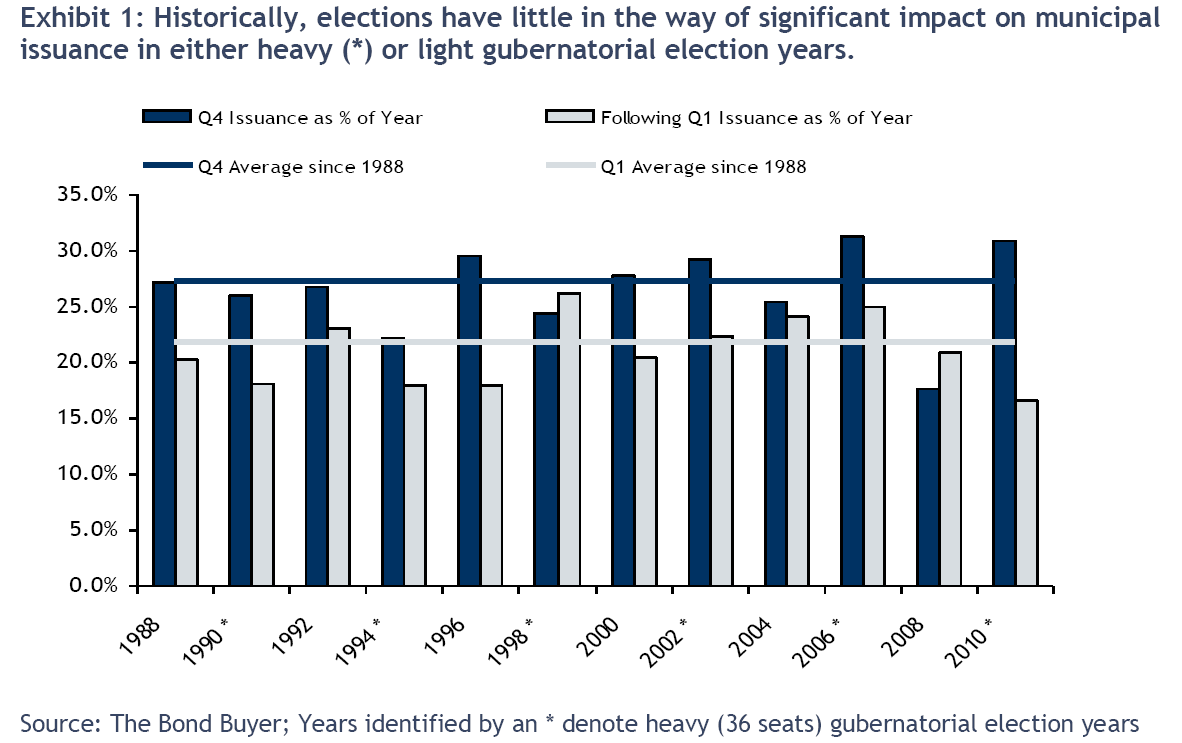

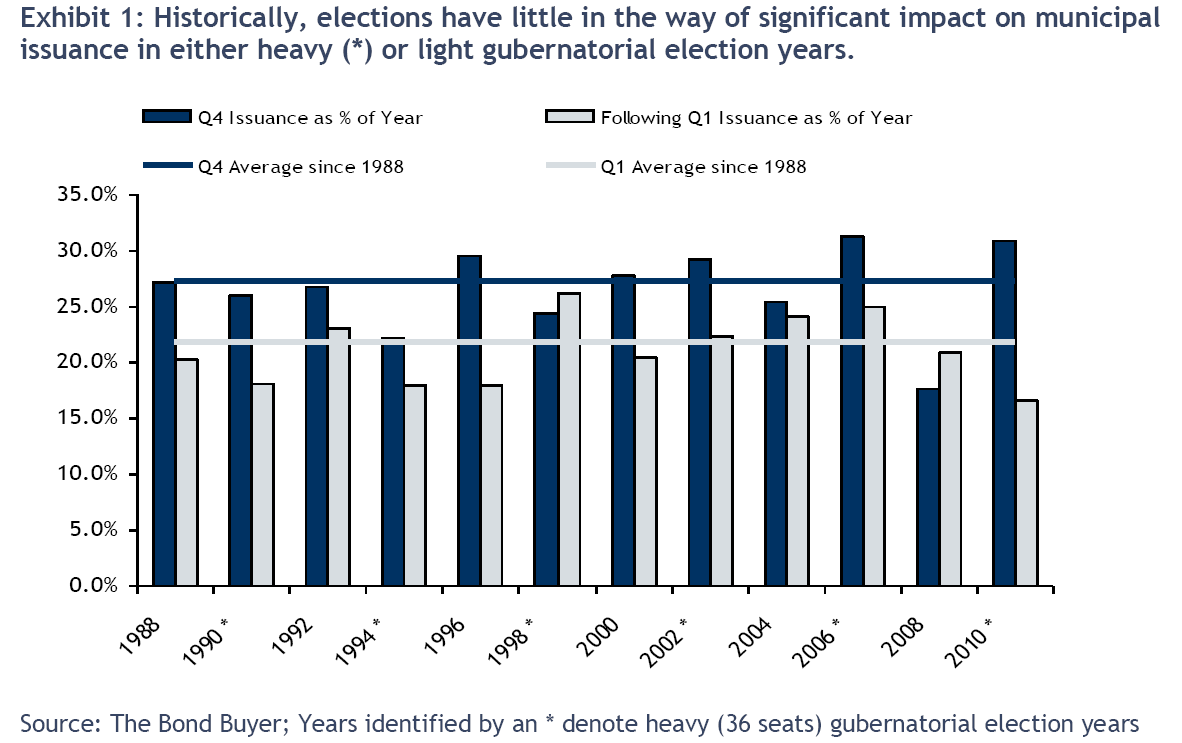

Exhibit 1 depicts municipal bond issuance in the fourth quarter of each election year and the first quarter of the following year as a percentage total annual issuance since 1988. As the exhibit illustrates, issuance in the fourth quarter and subsequent first quarter after an election year has not significantly deviated from historical averages in either heavy or light gubernatorial election years.

On average, 27% of municipal market issuance occurs in the fourth quarter of the year and about 22% appears in the first quarter. In comparison, over the last 25 years, issuance has averaged 26.5% of annual volume in the fourth quarter of biennial election years and 21.1% in the first quarter of the following year.

Hence, it seems that there is no apparent correlation between issuance and elections. While it makes sense on an intuitive level since elections can bring about uncertainty for state and local budgets, the fact is that state and local governments are just not spending. Many states are finding it difficult to obtain the approval necessary to start new projects that are not at the top of the necessity list. A reluctance to spend is leading to less of a need for state and local governments to issue bonds to raise capital. As a result, issuance going into year-end is expected to be anemic by historical standards. If this sentiment by state and local governments persists, municipal supply may be just as low extending beyond 2012.

Disclaimer : The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.

Supposedly, some market players think that the reason for lower supply is due to the 2012 Presidential Elections and the 11 state governorships open for elections according to RBC Capital Markets’ Chris Mauro.

The Head of U.S. Municipals Strategy mentioned in his latest U.S. Municipal Notes, “Only a Theory”, that this reason draws comparison to a similar sentiment back in the first half of 2011 when market players attributed the lack of supply to the election of 26 new governors in 2010. Despite no evidence backing this claim, this sentiment gained some credibility.

In an effort to determine if the uncertainty that comes with a change in leadership on either a state or national level, Mauro provided the following analysis:

Exhibit 1 depicts municipal bond issuance in the fourth quarter of each election year and the first quarter of the following year as a percentage total annual issuance since 1988. As the exhibit illustrates, issuance in the fourth quarter and subsequent first quarter after an election year has not significantly deviated from historical averages in either heavy or light gubernatorial election years.

On average, 27% of municipal market issuance occurs in the fourth quarter of the year and about 22% appears in the first quarter. In comparison, over the last 25 years, issuance has averaged 26.5% of annual volume in the fourth quarter of biennial election years and 21.1% in the first quarter of the following year.

Hence, it seems that there is no apparent correlation between issuance and elections. While it makes sense on an intuitive level since elections can bring about uncertainty for state and local budgets, the fact is that state and local governments are just not spending. Many states are finding it difficult to obtain the approval necessary to start new projects that are not at the top of the necessity list. A reluctance to spend is leading to less of a need for state and local governments to issue bonds to raise capital. As a result, issuance going into year-end is expected to be anemic by historical standards. If this sentiment by state and local governments persists, municipal supply may be just as low extending beyond 2012.

Disclaimer : The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.