Will ECB Easing And Fed Tapering Drive Euro To 1.30?

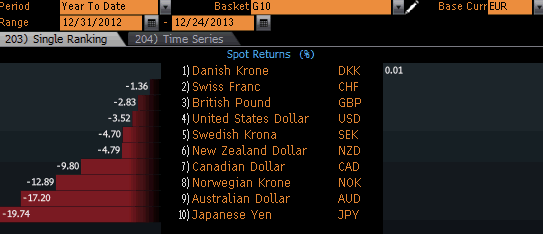

2013 has been a very interesting year for the euro. While the Eurozone is no longer facing a sovereign debt crisis thanks to ECB President Draghi's do "whatever it takes" pledge, growth has been extremely weak since the recession ended in the second quarter of 2013. In Q2 the economy expanded by only 0.3% and in Q3, this growth slowed to 0.1%. Annualized GDP growth was left at -0.4%, which is significantly weaker than the 4.1% growth reported in the U.S. for the third quarter. The Federal Reserve left monetary policy unchanged throughout year while the European Central Bank cut interest rates by 50bp. Despite weak growth and a more dovish central bank the euro has performed extremely well this year. As shown in the table below, every major currency weakened against the euro, with the Japanese Yen falling nearly 20%, the AUD 17% and the Canadian dollar dropping 10%. EUR also outperformed the U.S. dollar, but the 3.4% rally is small compared to some of the other moves.

Why the EUR Has Been So Strong?

- Record Current Account Surplus

- Stable Front End Yield Spread between EZ and US

- Diversification and Reallocation

The strength and resilience of EUR/USD in second half of 2013 surprised many investors especially in the fourth quarter when the Federal Reserve grew increasingly willing to taper asset purchases. With 10 year U.S. yields rising 100bp and 10-year German bunds rising only 40bp this year, the EUR/USD should be trading much lower. However, the currency has been supported by a record current account surplus, low front end yield spreads, diversification and reallocation. Having a current account surplus means that more money is flowing into than out of the country in trade and investment income and a persistent surplus can lead to appreciation in the currency. In the case of the Eurozone, sluggish regional growth reduced the balance between imports and exports and the gap also widened because of the weaker currency in the first half of the year. Long-term yield spreads increased significantly but the Fed's efforts to keep short term rates low have left front end spreads relatively stable. Finally, with the European sovereign debt crisis behind us, investors who previously underweight Eurozone assets increased exposure this year as risk appetite improved and financial markets recovered. Like U.S. stocks, the DAX also climbed to a record high and this move attracted demand for euros from investors who were underweight European equities. These 3 factors are expected to provide continued demand for euros in the coming year, reducing the risk of a one-way downtrend in EUR/USD. Instead we are looking for range trading in the pair but with a lower overall bias.

Eurozone Will Grow In 2014, But....

The Eurozone will grow at a faster pace in 2014 but it will still be a two-speed economy with growth trailing behind other developed nations. The ECB expects growth to accelerate to 1.1% from its currently level of -0.4%, which is extremely modest when compared to the more than 3% growth expected in the U.S next year. With the unemployment expected to drop slightly from its record high of 12.2%, few Europeans will feel the recovery. Thanks to low interest rates and higher wages, German growth will be supported by stronger consumer consumption and more exports. In contrast, France will be the sick man of Europe. With 10.9% unemployment (Germany has 6.9%), continuing fiscal consolidation, a contraction in manufacturing activity that puts the country at risk of falling back into a technical recession and higher taxes will make growth very difficult for the Eurozone's second largest economy in the coming year. In fact, Francois Hollande's approval ratings have suck to new lows and the tie between France and Germany is being strained by France's struggle to remain competitive. Italy and Spain, the third and fourth biggest economies will grow modestly next year due largely to low interest rates and external growth. However it will be a long road to recovery for both countries because competitiveness is a major problem in Italy and in Spain, the unemployment rate is a staggering 25.98%. These structural problems won't be fixed in the next year. As a result, the uneven upturn expected for the Eurozone in 2014 should make the dollar more attractive than euros, especially in the first half of the year.

How Realistic Is ECB Easing?

The most significant risk for the euro next year is ECB easing. European policymakers have said time and again that they stand ready to do more for growth including dropping interest rates to if the economy needs it. However so far their comments have amounted to nothing more than empty threats ebcause in the same breath they have always said that while they stand ready, no additional support is needed at this time. Yet the ECB could introduce another Long Term Refinancing Program especially if growth slows or inflation refuses to rise. In fact, for the ECB it will be all about inflation next year. Their fear of turning into the next Japan was the main reason for their November rate cut. The meager growth expected for the Eurozone in the coming year year will make it extremely difficult to reverse low inflation and if growth fails to accelerate, the ECB could increase stimulus for no reason other than to reverse the ugly downtrend of price pressures - a risk that we believe is realistic especially if the stimulus is in the form of another LTRO. No tightening is expected from the ECB until 2015 but if the central bank eases at a time when tapering by the Fed is driving U.S. rates higher, EUR/USD could sell-off quickly and aggressively. If the ECB stands down as the Fed moves forward with unwinding QE, the decline in EUR/USD will be more gradual.

EUR/USD To 1.33/1.30, Outlook For The Crosses

A current account surplus is expected to lend support to EUR/USD in the coming year but with Eurozone growth expected to underwhelm and U.S. rates moving higher, we are looking for a move down to 1.33 in the currency pair and possibly even 1.30 if the ECB eases. The euro will perform worst against currencies whose central banks are looking to unwind stimulus such as the USD and NZD or countries that will experience stronger growth like the U.K. and Mexico. It should perform the best against currencies whose central banks are looking to ease such as JPY and AUD.

By Kathy Lien, Managing Director of FX Strategy.