Domino's Pizza, Inc. (NYSE:DPZ) recently announced that its president and chief executive officer, Patrick Doyle will step down on Jun 30.

Richard Allison, currently president of Domino’s International, will take charge as the new CEO. Domino’s also promoted Russell Weiner, currently president of Domino's USA, to the newly-created position of chief operating officer and president of the Americas. Allison and Weiner will take on their new roles on Jul 1, 2018.

Doyle Turned Domino’s into a Leader in Digital Ordering

Doyle has been instrumental in Domino’s turnaround. He successfully helmed initiatives for taste enhancement of its key product, and investments in technology and promotions that helped the company regain market share and become a leader in digital ordering.

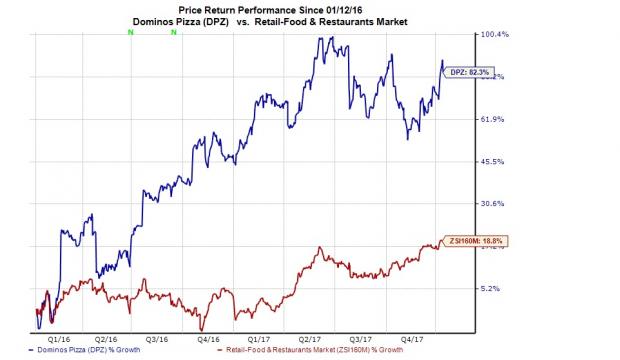

Under his leadership, Domino’s has opened more than 5,500 stores, launched the brand in several new countries, and become a well-performing stock. Domino's has returned a whopping 82.3% in the last two years, outperforming the industry’s gain of 18.8%. Shares however sank 3.2% since the day the company announced the news (Jan 9).

Doyle said that he has been successful in achieving the objectives of making Domino’s the leading pizza company, enhancing the return on investment for franchisees, and putting an efficient leadership team in place. He added that he will leave knowing that Domino’s is in great hands.

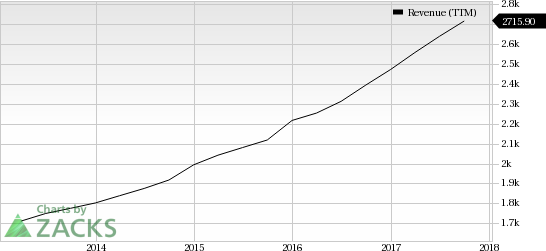

Domino's Pizza Inc Revenue (TTM)

Allison May Ramp up International Push

Allison is taking up responsibilities when Domino’s like most other U.S. restaurant chains is grappling with a challenging industry backdrop.

Since Allison has been overseeing the international business, the expansion of which is one of Domino’s counter strategies against the downsides troubling it, we expect that the company will intensify its push to expedite its presence in high-growth international markets under his leadership.

Notably, Domino’s international growth continues to be strong and diversified across markets, driven by exceptional unit level economics. The company opened 964 net new stores in international markets in the trailing four quarters and had 8,943 stores outside the United States as of the last reported quarter.

Domino’s carries a Zacks Rank #2 (Buy).

Other Picks

Some other stocks in the restaurant space worth considering include Darden Restaurants, Inc. (NYSE:DRI) , Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL) and McDonald's Corporation (NYSE:MCD) , all carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Darden, Cracker Barrel and McDonald's 2018 earnings are expected to improve 13.9%, 13.3% and 9.9%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Cracker Barrel Old Country Store, Inc. (CBRL): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Original post

Zacks Investment Research