Applied Materials, Inc. (NASDAQ:AMAT) is set to report fiscal fourth-quarter 2017 results on Nov 16. Last quarter, it delivered a positive earnings surprise of 3.61%.

The company’s surprise history has been pretty impressive. It beat estimates in each of the trailing four quarters, with an average positive earnings surprise of 2.66%.

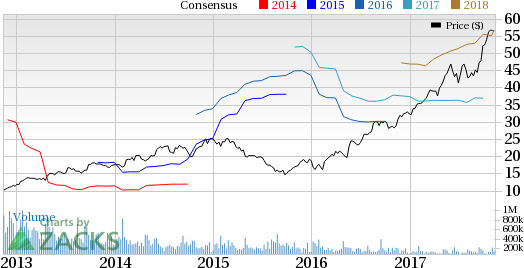

Notably, on a year-to-date basis, Applied Materials’ shares have returned 74.7%, outperforming the industry’s gain of 67.5%.

Let’s see how things are shaping up for this announcement.

Strong Demand for Applied’s Services

The company has well-differentiated products and high market share, and is efficiently delivering key enabling technology to logic and foundry customers. Service is an important part of Applied's portfolio, which grew significantly in the last quarter. The Applied Global Services (AGS) segment increased 8.6% sequentially and 19.6% year over year. The figure is further expected to increase in the upcoming quarter, driven by improved device and yield performance. The Zacks Consensus estimate for the upcoming quarter for AGS is pegged at $812 million.

Strength in Display to Drive Revenues

The company has gained considerable success in expanding beyond semiconductors, particularly in display. New display technologies such as OLED are opening new market opportunities for Applied Materials. The available market opportunity is now more than 10 times that of the traditional LCD. In the last quarter, the Display segment was up 4.9% sequentially and 31.0% from the year-ago level. The segment is further expected to perform well driven by significant opportunities coming from investments in areas such as artificial intelligence, big data, cloud infrastructure, Internet of Things (IoT), virtual reality and smart vehicles. The Zacks Consensus estimate for the upcoming quarter for Display segment is pegged at $676 million.

However, increasing competition, high fixed-cost structure and customer concentration remain major concerns, which could affect the results in the upcoming quarter.

What Our Model Suggests

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially if these have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Applied Materials has a Zacks Rank #2 but an Earnings ESP of 0.00%, a combination that does not suggest that the company is likely to beat.

Applied Materials, Inc. Price and EPS Surprise

Other Stocks to Consider

We see a likely earnings beat for each of the following companies.

NVIDIA Corp. (NASDAQ:NVDA) , with an Earnings ESP of +4.59% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Adobe Systems Incorporated (NASDAQ:ADBE) with an Earnings ESP of +0.10% and a Zacks Rank #1.

Texas Instruments Incorporated (NASDAQ:TXN) with an Earnings ESP of +0.42% and a Zacks Rank #2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research