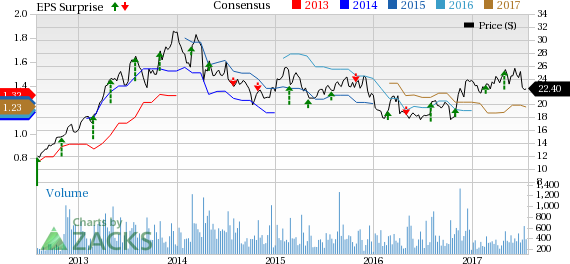

Haverty Furniture Companies, Inc. (NYSE:HVT) is set to report second-quarter 2017 results after the market closes on Jul 31. The question lingering in investors’ minds is, whether this retailer of full-service home furnishings will be able to post a positive earnings surprise in the to-be-reported quarter. It should be noted that the company has posted positive earnings surprises in eight out the last 10 quarters, with a trailing four-quarter average of 17.4%.

A look into Haverty Furniture’s stock performance, reveals that its shares have been underperforming the industry for the last six months. In the said time frame, the stock has increased 3.9%, compared with the industry’s growth of 23.4%.

Let’s see how things are shaping up prior to the announcement.

Factors at Play

On Jul 10, the company reported second-quarter sales figures, wherein it recorded improved sales of 1.1% year over year. Though growth was backed by higher average ticket and custom upholstery and accessories sales along with increased internet traffic, it was offset by the sluggish consumer traffic. However, second-quarter sales growth was also much weaker than the preceding quarter’s recorded figure of 3%.

Comparable store sales were down 0.2% for the second quarter, weaker than the comparable store sales growth of 1.6% in the first quarter. The company believes that the quarter’s sales were hurt due to a delay in Easter. Haverty Furniture stores remained closed for Easter, which was in April this year versus March last year.

Post the adjustment in Easter shift, written comparable store sales for the second quarter were down 0.7%, lower than the 4.5% growth reported last year for full second-quarter 2016. Written sales for the second quarter were up 0.6%, compared with preceding quarter’s written sales growth of 1.0%.

Despite sluggish written comparable sales, the company remains encouraged by new merchandises that are expected to flourish stores over the coming weeks through summer. The company believes that business will benefit as housing strengthens in the region and the general economy improves. We also remain encouraged by the solid fundamentals of the company and its solid store expansion plans to strengthen its presence in key markets with additional or repositioned stores. Moreover, the company is making innovations with respect to its technology developments. Also, its shareholder-friendly moves are noteworthy.

Which Way Are Estimates Trending?

Let’s look at the estimate revisions in order to get a clear picture of what analysts are thinking about the company right before the earnings release. The Zacks Consensus Estimate for the second quarter and 2017 has been declining for the last 30 days. However, the current Zacks Consensus Estimate of 19 cents per share and $1.23 for the second quarter and full-year 2017 reflect a year-over-year decline of 20.8% and 5.8%, respectively.

Further, analysts polled by Zacks expect revenues of $191.8 million for the said quarter, down 1.5% from the year-ago period. For 2017, Zacks consensus revenue is pegged at $843.2 million, reflecting a 2.6% year-over-year increase.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Haverty Furniture is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Haverty Furniture has an Earnings ESP of -5.26% as the Most Accurate estimate is 18 cents, while the Zacks Consensus Estimate is pegged at 19 cents. Moreover, the company carries a Zacks Rank #4 (Sell). Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +0.93% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nordstrom, Inc. (NYSE:JWN) has an Earnings ESP of +3.28% and a Zacks Rank #3.

Yum! Brands, Inc. (NYSE:YUM) has an Earnings ESP of +1.64% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Haverty Furniture Companies, Inc. (HVT): Free Stock Analysis Report

Original post

Zacks Investment Research