Coach, Inc. (NYSE:COH) , which is slated to release fourth-quarter fiscal 2017 results on Aug 15, has seen shares rising roughly 5% in the past three months. The stock has comfortably outperformed the broader Consumer Discretionary sector that gained 3.4%. Per the latest Earnings Preview, Consumer Discretionary sector is likely to witness earnings growth of 6.2% and revenue increase of 8.8% this reporting cycle. Let’s take a closer look as to how Coach is expected to contribute to the sector’s performance.

What to Expect from Coach?

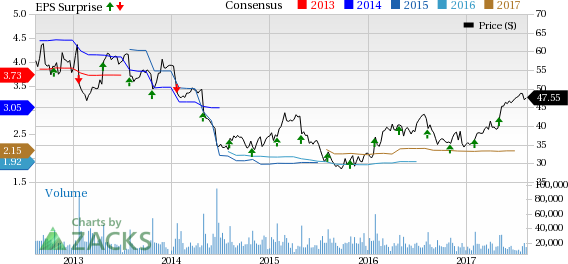

The question lingering in investors’ minds is whether this designer and marketer of fine accessories and gifts as well as house of lifestyle brands will be able to continue with its positive earnings surprise streak in the quarter to be reported. The company’s past performance reveals that it had surpassed the Zacks Consensus Estimate in the trailing 13 quarters. In the preceding four quarters, it had outperformed the Zacks Consensus Estimate by an average of 5.5%.

The current Zacks Consensus Estimate for the quarter under review is 49 cents compared with 45 cents posted in the year-ago period. We note that the Zacks Consensus Estimate has remained stable in the past 30 days. Analysts polled by Zacks expect revenues of $1,147 million marginally down from $1,155 million reported in the year-ago quarter.

Factors at Play

Coach is undergoing a brand transformation and introducing modern luxury concept stores in key markets. The acquisitions of Stuart Weitzman and Kate Spade & Company are being viewed as a significant step in efforts toward becoming a multi-brand company. Moreover, management has undertaken transformation initiatives revolving around product, stores and marketing, which are likely to have a favorable impact in the quarter to be reported. The company continues to anticipate double-digit growth in earnings per share for the fiscal year.

Due to strengthening of the U.S. dollar, management envisions low-single digit increase in fiscal 2017 revenue. Third-quarter net sales came in at $995.2 million, down about 4% on a reported basis and 3% on a constant currency basis. Sales growth were hurt by 150 basis points on account of management’s efforts to elevate the Coach brand’s positioning in the North American wholesale channel by lowering promotional events and door closures. We noted that the top line fell short of the Zacks Consensus Estimate of $1,018 million, marking the third straight quarter of revenue miss.

Coach sells products that are discretionary in nature, and in turn depends upon consumers’ disposable income. Further, its customers remain sensitive to macroeconomic factors, which if not favorable may negatively impact discretionary spending, and in turn the company’s growth and profitability.

What Does the Zacks Model Unveil?

Our proven model shows that Coach is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1(Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Most Accurate estimate is at 50 cents and the Zacks Consensus Estimate is pegged lower at 49 cents. So the ensuing +2.04% ESP and the company’s Zacks Rank #3 make us reasonably confident of an earnings beat.

Other Stocks with Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

The Gap, Inc. (NYSE:GPS) has an Earnings ESP of +3.85% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.94% and a Zacks Rank #2.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +6.00% and a Zacks Rank #2.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Coach, Inc. (COH): Free Stock Analysis Report

Original post

Zacks Investment Research