Global steel prices tend to find a floor based on the price of Chinese steel. If Chinese prices fall, domestic U.S. prices also tend to fall. However, grain-oriented electrical steel continues to beat to its own drum, often not aligned with underlying steel prices.

March is no exception.

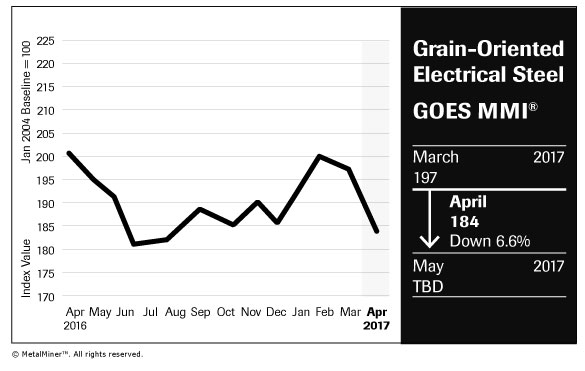

Although U.S. domestic steel prices continued to rise in March, the GOES M3 price fell and fell rather significantly dropping by nearly 7%.

Meanwhile, according to a couple of recent TEX Reports, GOES prices from Baosteel (SS:601968) increased by $38/metric ton in April after increases of $168/mt from January through March. Baosteel acts as the price leader and according to a recent report, and will likely stand pat until or unless others also increase their prices. Those “others” may have a near-term opportunity to do so as a large tender from Bharat Heavy Electricals (NS:BHEL) for 20,000 mt will bring in the global GOES producer community. As China tends to set the “market floor” for global steel prices, the TEX Report suggests that this tender will serve as the global price floor for GOES for the balance of 2017.

Supporting the rising price theory, TEX Report also suggests that prices have risen by $200-300 per mt in the Middle East and India.

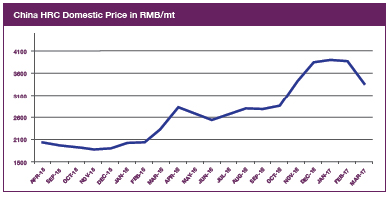

Ironically, prices for steel rebar on the Shanghai Futures Exchange have declined by 5% according to a recent MetalMiner story on the back of declining coking coal (4%) and declining coke prices (5%), as well as falling iron ore futures. Some, including MetalMiner, believe the price declines are due to speculators unwinding bullish bets.

Source: MetalMiner Forecasting

Regardless, Chinese prices for hot-rolled coil are falling and though GOES prices often diverge from underlying steel market trends, upward price movements may be elusive.