Recently, China is outperforming other major stock markets...

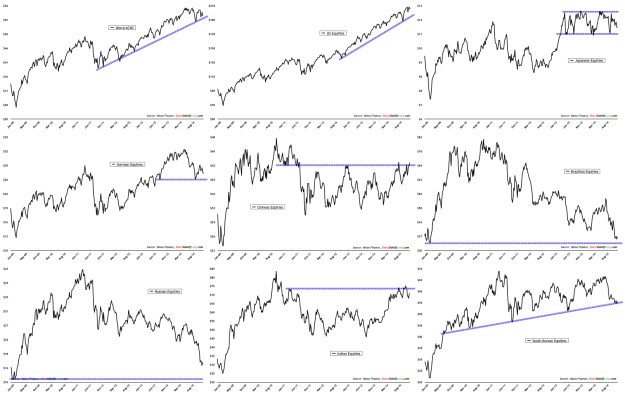

Let us have another close look at the major stock markets of the world, priced in US Dollars and without dividend yield adjustment (total return). We got a grid of nine indices in the Chart above. These include: World Index, U.S.A., Japan, Germany, China, Brazil, Russia, India and South Korea. Let us go through some of these:

- The world Index has done so well due to strong performance out of the U.S. So far there are no major clues with the price action to signal that this trend is changing. Having said that, valuations are stretched and sentiment remains very bullish. Personally I am staying away.

- Japanese equities have done well locally, however priced in U.S.dollar they have been consolidating for months on end due to major yen downtrend. Opportunity exists here, because eventually there will be a breakout out of this tight range. The longer the consolation, the more powerful the break out.

- The German stock market has been consolidating sideways in local currency, but due to the very weak euro, Germany (according to the chart above) is in a downtrend since the summer months of 2014. The index could improve if and when the euro stabilizes.

- Emerging Market Equities as a whole have been under pressure in recent months. Russia and Brazil are suffering from falling commodity prices and locally weak currencies. On the other hand, the same weakness in commodities is actually benefiting both Chinese and Indian economies. China is now attempting to break out to multiyear highs.