We expect midstream partnership Cheniere Energy Partners LP Holdings LLC (NYSE:CQH) to beat expectations when it reports third-quarter 2017 results around Thursday, Nov 2.

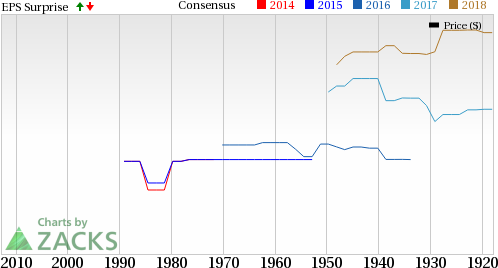

In each of the last four quarters, the partnership delivered an earnings surprise of 0.00%.

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Cheniere Energy Partners LP Holdings is likely to beat earnings in the to-be-reported quarter because it has the right combination of two key ingredients.

Zacks ESP: Earnings ESP for this company stands at +1.15%. A favorable Zacks ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Cheniere Energy Partners LP Holdings carries a Zacks Rank #3 (Hold) which, when combined with a positive ESP, makes us confident of earnings beat.

Note that stocks with Zacks Ranks #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings. On the other hand, the Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement.

What is Driving the Better-Than-Expected Earnings?

Cheniere Energy Partners LP Holdings, by virtue of its 55.9% ownership in Cheniere Energy Partners LP (NYSE:CQP) , primarily operates the Sabine Pass natural gas regasification and liquefaction facilities. Cheniere Energy Partners LP Holdings also operates Creole Trail Pipeline located in Louisiana. This solid asset base might help the partnership to earn sufficiently for its unitholders.

Being the first company to receive Federal Energy Regulatory Commission (FERC) approval to export LNG from its 2.6 billion cubic feet per day Sabine Pass terminal in Cameron Parish, Louisiana, Cheniere Energy enjoys a distinct competitive advantage over other players to ship overseas.

Moreover, the fate of the midstream player’s business is positively correlated with natural gas production. The output of the commodity in the U.S. has been booming owing to hydraulic fracturing (or fracking) and sophisticated horizontal drilling techniques. In fact, it has been an oversupplied market for the commodity over the past few quarters.

In other words, the business environment was favorable for the partnership as higher production of natural gas usually increases the need for regasification, liquefaction and transportation activities.

Other Stocks to Consider

Cheniere Energy Partners LP Holdings is not the only energy firm looking up this earnings season. Here are some companies from the space which, according to our model, also have the right combination of elements to post earnings beat this quarter:

Northern Oil and Gas Inc. (NYSE:NOG) has an Earnings ESP of +11.11% and a Zacks Rank #2. The company is expected to release earnings results on Nov 14. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Denbury Resources Inc. (NYSE:DNR) has an Earnings ESP of +11.11% and a Zacks Rank #2. The company is likely to release earnings on Nov 7.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Cheniere Energy Partners, LP (CQP): Free Stock Analysis Report

Cheniere Energy Partners LP Holdings, LLC (CQH): Free Stock Analysis Report

Denbury Resources Inc. (DNR): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

Original post

Zacks Investment Research