The Allstate Corp. (NYSE:ALL) is scheduled to report second-quarter 2017 results on Aug 1, after market close.

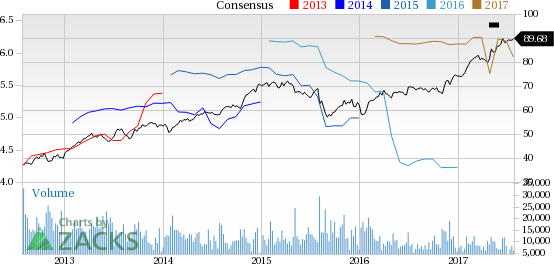

Last quarter, Allstate beat the Zacks Consensus Estimate by 57.7%. It surpassed estimates in each of the last four quarters with an average positive surprise of 27.8%.

Let’s see how things are shaping up for this announcement.

Q2 Flashback

Allstate’s earnings have always been exposed to catastrophe losses. The first quarter bore the brunt of cat losses and the same is expected in the second quarter. The company has provided preliminary estimates of cat loss of $638 million on a pre-tax basis, owing to weather-related destruction in April and May.

In the first quarter, the company closed the acquisition of SquareTrade, a protection plan provider for consumer electronics and connected devices. Allstate previously said that the deal would dilute earnings for three years. Therefore, the effect of the same will be felt in second-quarter results.

The company’s customer-focused strategy, and a wide variety of products and services sold through an extensive distribution network, will likely result in higher policies issued thus aiding top-line growth.

Allstate took profit improvement initiatives, over the last two years, in its Auto insurance business. These efforts have started bearing fruit and will aid earnings in this line of business.

Shares bought back by the company in the quarter under review will also add to the bottom line.

Earnings Whispers

Our proven model does not conclusively show that Allstate is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank of #1, 2 or 3 for this to happen. That is not the case here as you will see below.

Zacks ESP: Allstate has an Earning ESP of -2.22%. This is because the Most Accurate estimate of 88 cents per share is two cents below the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Though Allstate carries a Zacks Rank #3 (Hold), a negative ESP makes our surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Fiserv, Inc. (NASDAQ:FISV) will report second-quarter 2017 earnings results on Aug 1. The company has an Earnings ESP of +1.63% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Voya Financial, Inc. (NYSE:VOYA) has an Earnings ESP of +1.18% and a Zacks Rank #3. The company is expected to report second-quarter earnings results on Aug 1.

CME Group Inc. (NASDAQ:CME) has an Earnings ESP of +0.83% and a Zacks Rank #3. The company is expected to report second-quarter earnings results on Aug 1.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Voya Financial, Inc. (VOYA): Free Stock Analysis Report

Allstate Corporation (The) (ALL): Free Stock Analysis Report

CME Group Inc. (CME): Free Stock Analysis Report

Fiserv, Inc. (FISV): Free Stock Analysis Report

Original post