Carnival Corporation (N:CCL) Consumer Discretionary - Hotels, Restaurants and Leisure | Reports December 18, Before Market Opens

Key Takeaways

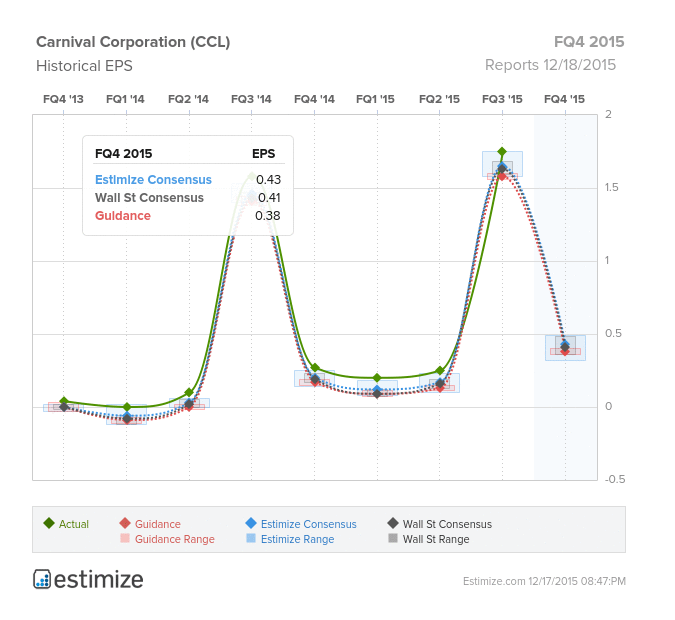

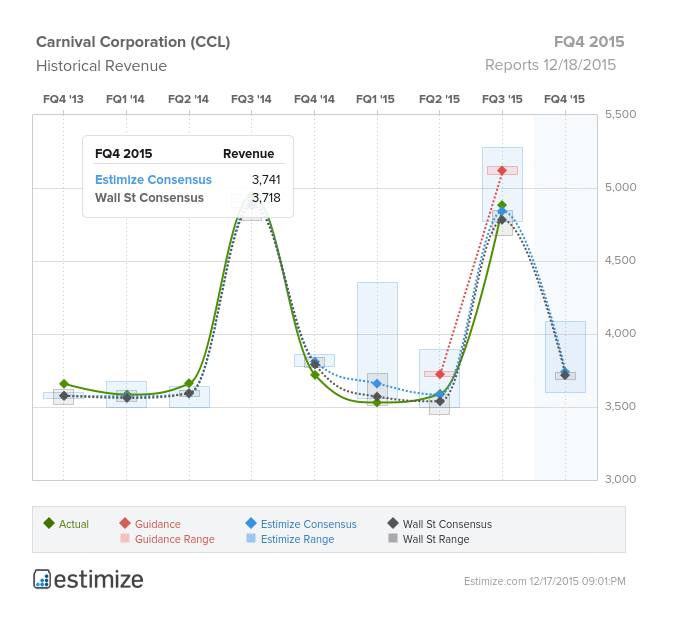

- The Q4 2015 Estimize consensus calls for $3.741 billion in revenue and $0.43 in EPS, slightly higher than Wall Street’s estimates

- Carnival (L:CCL) is riding Asian demand for cruise ships as the company expands its global operations

- The company has a track record of beating analyst estimates, and Q4 2015 is expected to be no different

Carnival Corporation is an American owned cruise line expected to release their Q4 2015 earnings on December 18th. Following a favorable summer, Carnival posted higher Q3 revenue and EPS than analysts estimated. This trend of strong earnings results over the past few quarters is expected to continue through the fourth quarter as well. The Q4 2015 Estimize consensus calls for $3.741 billion in revenue and $0.43 in EPS, slightly higher than Wall Street’s estimates. Compared to Q4 2014, this represents a 59% year over year increase in EPS . Coming into 2016, revenue is expected to continue growing due in large part to online booking platforms, higher ticket prices and global expansion.

Since the early days of the Titanic, the cruise industry has made massive strides, showing no signs of slowing down. In 2016, cruise ships are expected to carry 24 million passengers around the world, nearly 10 million more than 2006. As the premier cruise line, Carnival has the largest market share of 47% followed by Royal Caribbean and Norwegian Cruise Lines. To ensure its staying power, Carnival is focusing on expanding its footprint in Asian markets. Over the past few years, cruise ships have experienced a dramatic increase in Asian, particularly Chinese, passengers. To meet these needs, Carnival has begun manufacturing and employing ships catered to Asian markets. The company expects to maintain a high level of growth over the next three years, on the backs of this increasing demand. Combined with a promising global market, declining fuel costs have also lifted share prices and cut operating expenses. Add to this, Carnival offers investors a generous dividend yield compared to its competitors.

Despite the company’s encouraging expansion, Carnival has begun to increase spending in an effort to become more socially conscious. The company has dedicated resources to enhance sustainability and improve environmentally conscious cruise liners. These higher expenses may hurt Carnival’s earnings and shareholders as it reports in the next day. However, given the company’s track record of beating estimates for the past 7 quarters, shareholders should continue to view Carnival as a reliable investment going into its earnings report.