Property and casualty insurer Allstate Corp. (NYSE:ALL) is expected to release fourth-quarter earnings on Feb 7, after the market closes.

Let’s Take a Look at the Factors Influencing Q4 Results

Allstate expects to incur a loss of $516 million from the California wildfires. This, in turn, might dent the company’s underwriting results to some extent.

For the first nine months of 2017, this property and casualty insurer incurred $2.64 billion loss due to the catastrophe, up 16.1% year over year. Other players in the same industry, The Travelers Companies, Inc. (NYSE:TRV) incurred a loss of $499 million from the same calamity, while Chubb Ltd. (NYSE:CB) suffered a loss of $477 million.

We expect results to gain from a decline in the frequency of auto accidents and improved profitability in auto insurance, reflecting the profit improvement actions initiated in 2015.

Meanwhile, investments made for long-term growth in businesses such as Allstate Benefits, SquareTrade and its connected-car platform at Arity seem to be paying off, as evident from an increase in the company’s current policies and higher premiums. We expect the trend to continue in the to-be-reported quarter.

Also, the company is gradually gaining ground after suffering from declining income in its investment portfolio for the past many years due to market volatility and low interest rates. Net investment income rose 11% for the first nine months of 2017, reflecting higher performance-based results and stable income from market-based portfolios. We expect an increase in net investment income in the fourth quarter.

The bottom line will also get support from Allstate’s share buybacks.

Through the first nine months of 2017, the company repurchased 10 million shares or 2.7% of those outstanding at the beginning of the year. It further remains on track in executing the $2 billion share repurchase program that was approved in August 2017.

Earnings Surprise History

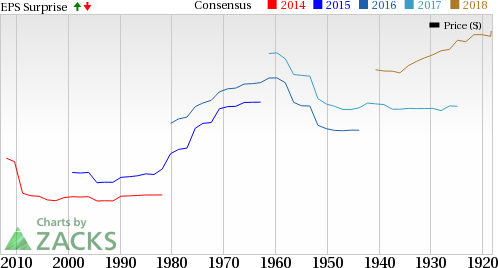

Allstate boasts an attractive earnings surprise history. It surpassed estimates in each of the trailing four quarters, with an average positive surprise of 56.9%. This is depicted in the chart below:

Allstate Corporation (The) Price and EPS Surprise

Earnings Whispers

Our proven model does not conclusively show that Allstate is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank of #1, 2 or 3 for this to happen. That is not the case here as you will see below.

Zacks ESP: Allstate has an Earnings ESP of -8.28%. This is because the Most Accurate estimate of $1.44 per share is lower than the Zacks Consensus Estimate of $1.57. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Though Allstate carries a Zacks Rank #1 (Strong Buy), which increases the predictive power of ESP, its negative ESP makes surprise prediction difficult.

We caution against Sell-rated stocks (#4 or 5) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

A Stock That Warrants a Look

Here is a stock that you may consider as our model shows that it has the right combination of elements to post an earnings beat this quarter:

CNA Financial Corp. (NYSE:CNA) will report fourth-quarter 2017 earnings results on Feb 12. The company has an Earnings ESP of +2.75% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

D/B/A Chubb Limited New (CB): Free Stock Analysis Report

Allstate Corporation (The) (ALL): Free Stock Analysis Report

CNA Financial Corporation (CNA): Free Stock Analysis Report

Original post