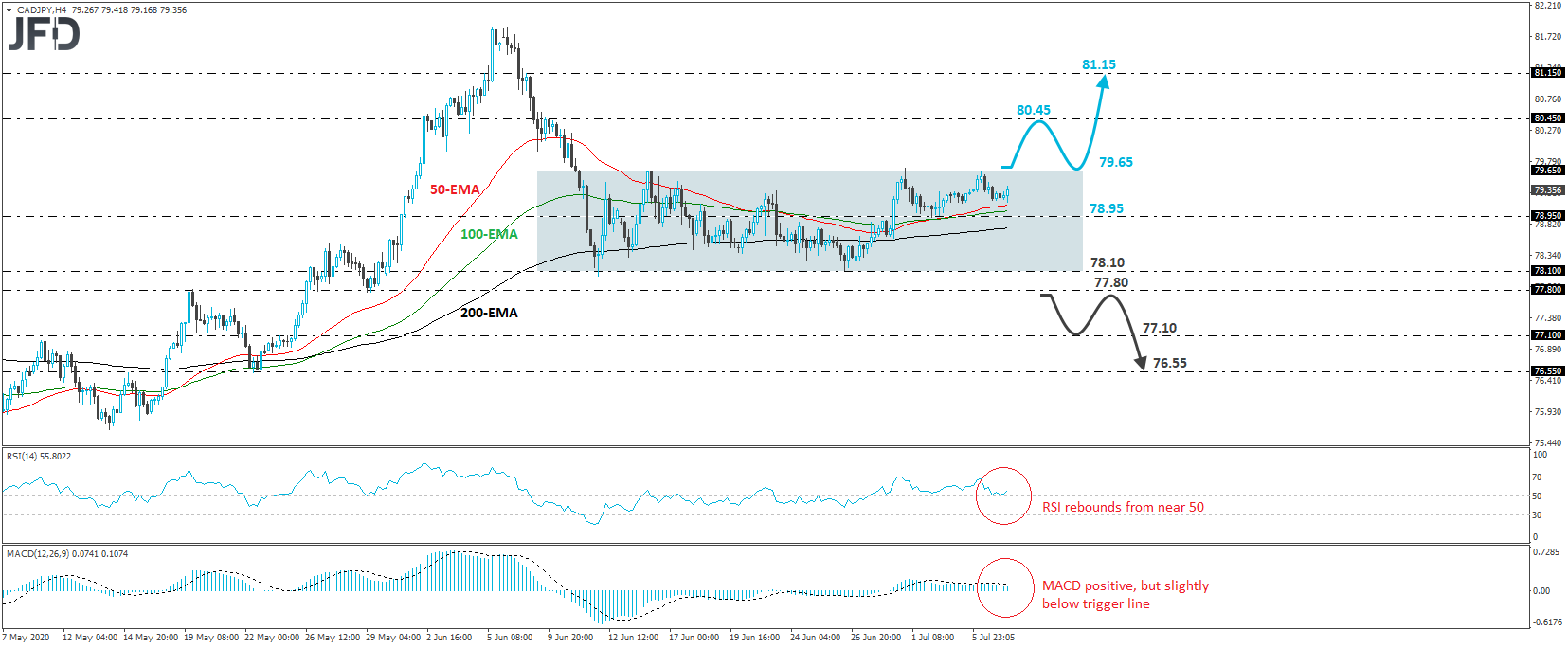

CAD/JPY traded lower yesterday, after hitting resistance at 79.65, the upper end of the sideways range it’s been trading within since June 11th. That said, the retreat was stopped above the 78.95 support, with the rate trading in a consolidative manner today. Overall, as long as CAD/JPY continues to trade within the aforementioned sideways range, we will hold a flat stance.

In order to start examining the bullish case, we would like to see a clear and decisive break above 79.65. Such a move would signal the upside exit out of the range, also confirming a forthcoming higher high. The bulls may then get encouraged to lift the rate up to the 80.45zone, marked as a resistance by the peak of June 10th, the break of which may allow extensions towards the high of the day before, at around 81.15.

Shifting attention to our short-term oscillators, we see that the RSI has just rebounded from near its 50 line, but the MACD, although positive, remains below its trigger line. Both indicators detect slightly positive momentum, but the fact that the MACD remains below its trigger, adds to our view of staying neutral for now.

We will start considering a bearish outlook only if we see the rate falling below the lower end of the range, at 78.10, or even better, below the lows of May 27th and 29th, at 77.80. This may set the stage for declines towards the 77.10 barrier, the break of which could pave the way towards the low of May 22nd, at 76.55.