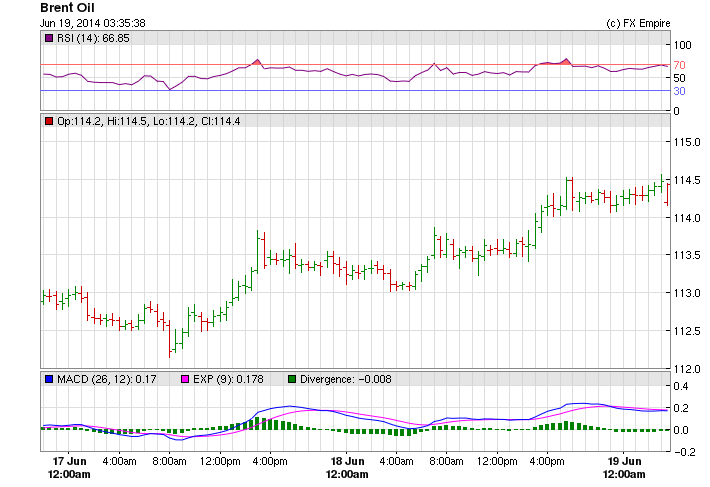

Crude Oil continued to gain on Thursday morning, trading back over 106 again and adding 42 cents while Brent Oil—which is much more sensitive to the problems in Iraq—rallied by 12 cents to trade at 114.45. Energy speculators remain nervous about fast-moving events in key crude-producer Iraq.

Militants attacked the nation’s biggest oil refinery late yesterday, as the prime minister scrambled to regain the initiative by sacking security commanders and reaching out to political rivals. Violence erupted at the Baiji refinery in Salaheddin province, north of Baghdad. ”Continued violence in Iraq is still affecting the markets, though traders are focused on the Federal Reserve’s policy meeting decision later,” said ETX Capital analyst Daniel Sugarman.

World oil prices edged higher yesterday, with Brent rising towards $114 per barrel, but held below last week’s nine-month peak of almost $115. Islamist militants battled Iraq’s military for control of the Baiji oil refinery, the country’s biggest, as President Barack Obama told top U.S. lawmakers that he won’t need additional Congressional approval for the options he’s considering in response to the crisis. Rebecca O’Keeffe, head of investment at stockbroker Interactive Investor, said the immediate impact to global oil supply from the attack on the Baiji refinery was likely to be “limited”.

“However, if the ISIL forces continue to make progress towards Baghdad and onto Iraq’s main oilfields in the south, the current oil price stabilization is likely to be short lived and we could see a significant spike in oil prices,” she added.

Crude rose for the first time in four days after a government report showed U.S. crude supplies shrank and as Iraqi forces battled insurgents north of Baghdad. Brent extended gains in London. Prices advanced as much as 0.5 percent in New York. Crude inventories fell by 579,000 barrels last week, the Energy Information Administration said yesterday. The WTI inventory in the U.S., the world’s biggest oil consumer, slid for a third week to 386.3 million barrels in the period ended June 13, according to the EIA. Supplies reached 399.4 million through April 25, the highest level since the Energy Department’s statistical arm started publishing weekly data in 1982.

Gasoline inventories expanded by 785,000 barrels to 214.3 million, compared with a decline of 550,000 barrels forecast in a Bloomberg News survey of eight analysts. The peak U.S. driving season typically starts on Memorial Day, which came on May 26 this year, and runs through Labor Day on Sept. 1. Although California has paid more than $4 per gallon for regular, unleaded gasoline for 25 consecutive days, the good news is prices have remained relatively stable despite turmoil in Iraq, according to the Automobile Club of Southern California. About 9 percent of our oil comes from Iraq. That equation changes from year-to-year. There is, of course, a big uptick in domestic production of oil. Right now there is the North Dakota shale boom, and that is increasing domestic production which continues to make the US energy independent.