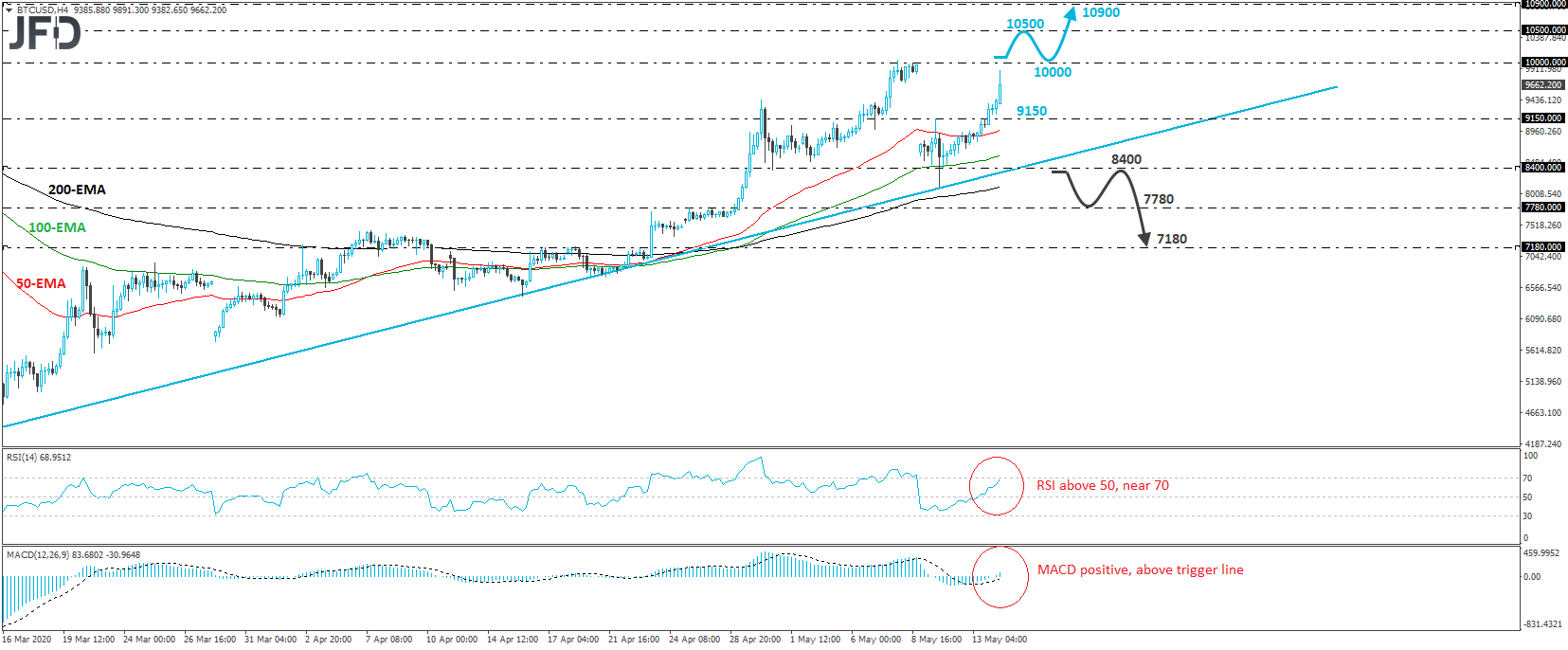

BTC/USD has been in a recovery mode since May 11th, when it hit the upside support line drawn from the low of March 16th. As long as the price continues to trade above that line, we would consider the picture to be positive, but before we get confident on larger advances, we would like to see a decisive break above the psychological zone of 10000.

If the bulls find the strength to overcome that key area, we may see them pushing towards the 10500 territory, marked as a resistance by the peak of February 13th. If they are not willing to stop there either, then a break higher may set the stage for extensions towards the high of September 6th, at around 10900.

Taking a look at our short-term oscillators, we see that the RSI lies above 50, very close to 70, and points up, while the MACD is slightly above both its zero and trigger lines, pointing north as well. Both indicators detect upside speed and corroborate the case for some further near-term advances.

On the downside, we would like to see the crypto falling below the 8400 zone before we start examining the case of a short-term reversal to the downside. The price would already be below the upside line and may initially slide towards the inside swing high of 7780. Another break, below 7780, could pave the way towards the 7180 area, defined by the inside swing highs of April 17th and 20th.