Machinery company Barnes Group Inc. (NYSE:B) is set to release second-quarter 2017 results on Jul 28, before the market opens.

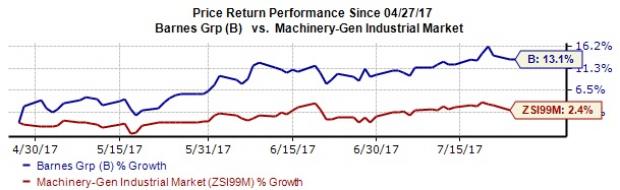

The company’s financial performance in the last four quarters was impressive, with better-than-expected results in each. Average earnings surprise was a positive 8.94%. Notably, in the last quarter, the company’s earnings of 71 cents per share topped the Zacks Consensus Estimate by 18.33%. We believe that sound financial performance and growth prospects have lifted investor sentiments for the company. In the last three months, the company’s shares have yielded 13.18% return, outperforming the gain of 2.39% recorded by the industry it belongs to.

Let us see whether Barnes Group will be able to maintain its earnings streak this quarter.

Why a Likely Positive Surprise?

Our proven model shows that Barnes Group will likely pull a surprise this quarter. This is because the company has the combination of two key ingredients for a possible earnings beat – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Barnes Group has an ESP of +1.45% for the quarter. This is because the Most Accurate estimate of 70 cents is higher than the Zacks Consensus Estimate of 69 cents.

Zacks Rank: Barnes Group’s Zacks Rank #2 increases the predictive power of ESP. Moreover, its positive ESP makes us reasonably confident of an earnings beat.

Notably, we caution against stocks with Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

What is Driving the Better-than-Expected Earnings?

We believe that operating conditions in the industry have been favorable for machinery companies in the quarter. Notably, industrial production – a measure of the level of output of manufacturing, mining and utilities sectors in a country – grew at an annual rate of 4.7% in the second quarter, driven by impressive growth in mining and utilities. New orders for U.S.-manufactured machinery increased 4.6% in the first five months of 2017. Such positives should positively impact Barnes Group’s industrial business.

Also, governmental policies supporting better trade relations, increase in infrastructural investments, job creation and high consumer-end demand will boost Barnes Group’s businesses in the quarter. Efforts of business expansion in international markets, investments for innovation and new product development, effective supply chain and logistics, and enhancement of operational excellence might be other drivers.

Barnes Group’s inorganic initiatives, especially the acquired assets of FOBOHA (Aug 2016), will be beneficial in the quarter. In the second quarter, the company acquired the privately held Gammaflux L.P. This buyout will boost the company’s Molding Solution’s businesses.

Other Stocks to Consider

Here are some companies in the industry you may want to consider, as they have the right combination of elements to post an earnings beat this quarter, according to our model.

AGCO Corporation (NYSE:AGCO) , with an Earnings ESP of +2.89% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere & Company (NYSE:DE) , with an Earnings ESP of +5.32% and a Zacks Rank #1.

Flowserve Corporation (NYSE:FLS) , with an Earnings ESP of +4.55% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Original post

Zacks Investment Research