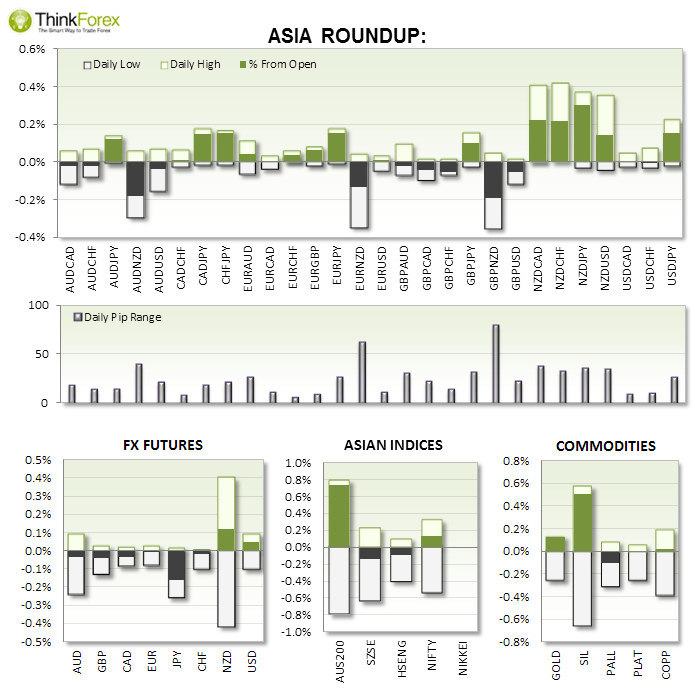

- NZD Core Retail Sales up 0.1% mm to 1.2%. Kiwi Dollar rejected recent lows to hold above key levels mentioned in yesterday's video.

- NZD Manufacturing down slightly by 0.4 points to 53.0.

- JPY Core Machinery orders to a 3-month high but short of expectations , coming in at 8.8% vs 15.5% forecast

- UK House Price Balance dips to 49% seeing Cable sink to 18-week lows

- CAD/JPY trades to 7-day high and breaches downtrend resistance line

All eyes on the Eurozone tonight as we have ECB monthly report, CPI and GDP data all at the same time. Expect some whipsaws and price gaps (either way) so if you’ve not traded one of these before you may just want to get some popcorn and watch the show. I have outlined an argument for a bullish retracement on EURUSD – whether that happens today or not is anyone’s guess.

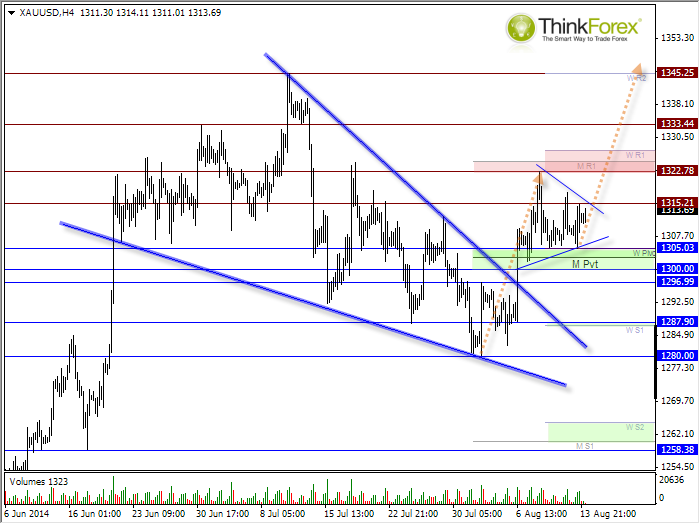

Gold: Coiling up within potential bullish wedge

The overall target to $1345 highs (projected by the bullish wedge) remains the favoured bias but we are trading within a sideways range, with the potential for an upside break to confirm a continuation triangle.

That is all very well but trying to trade this is a bit harder than finding the pattern. With so many support / resistance levels close by it is plausible to expect quick moves to key levels and rapid u-turns (which is what we have witnessed these past 2 days).

Therefor the preference is to be sensible with the reward/risk and targets and go for short-and sweet stop or limit orders, between these key levels.

Keeping it simple: Bullish above $1300 and bearish below, with the bias for price to remain above $1300 and eventually advance towards $1345.

AUD/USD

If you refer to yesterday’s analysis the bearish outlook remains.

However we have already tested the initial resistance around 0.9300 (with overshoot) and the intraday timeframe suggests we may see another leg higher. So bullish opportunities can be considered up to 0.9320 (2nd resistance zone), at which point I will be considering fading to trade towards the 0.920 target.

A break above 0.9370 swing high invalidates the count.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI