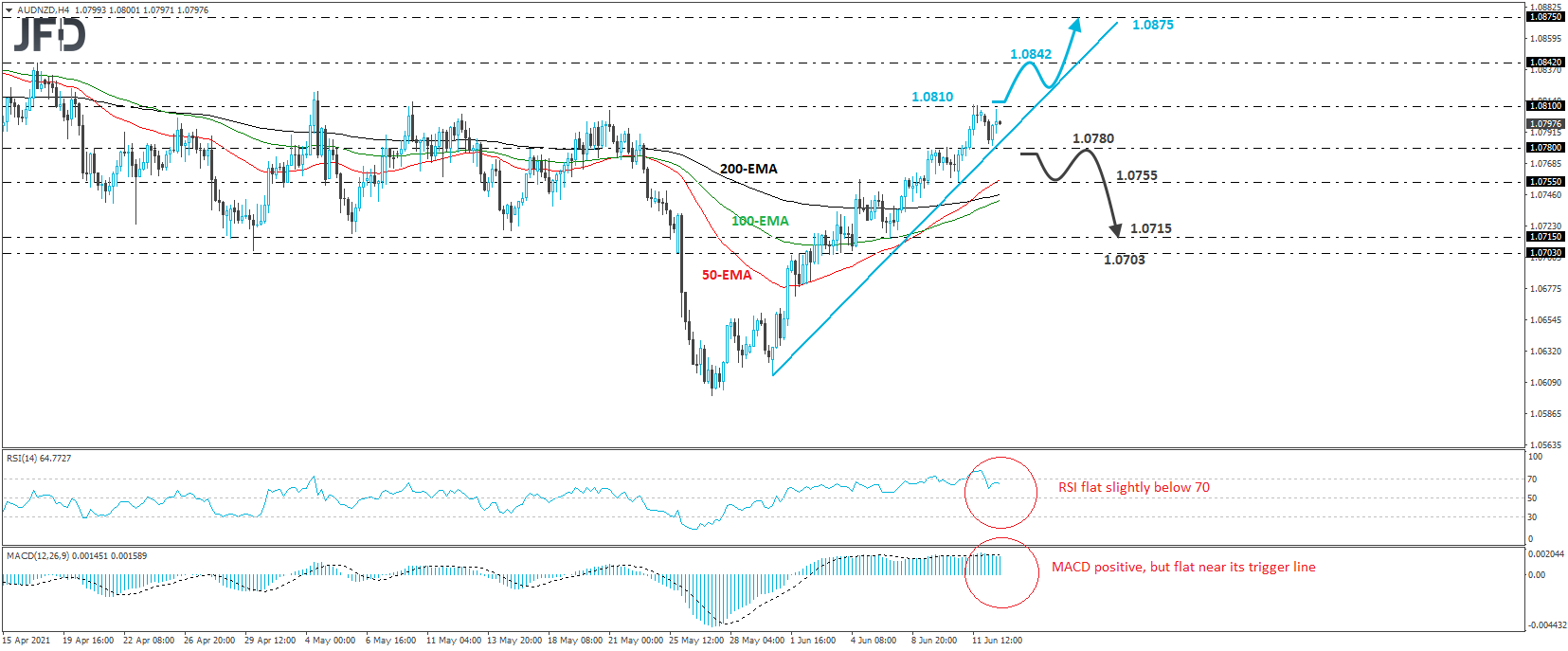

AUD/NZD traded slightly higher during the European session Monday, after it hit support near the 1.0780 support, and the upside support line drawn from the low of May 31. As long as the pair continues to trade above that line, we will hold a positive stance with regards to the short-term outlook, but in order to get confident on more advances, we would like to see a clear break above the key resistance barrier of 1.0810.

That barrier stopped the rate from moving higher on May 10 and 21, as well as on Friday, and thus, its break may encourage more bulls to enter the action and perhaps help the rate climb to the peak of April 16, at 1.0842. If they are not willing to stop there, then we may see them shooting for the 1.0875 territory, defined as a resistance by the high of April 6.

Turning our gaze to the short-term oscillators, we see that the RSI lies flat, slightly below 70, while the MACD, although well into the positive territory, is also flat, near its trigger line. Both indicators detect positive momentum, but the fact that they have recently turned flat adds credence to our view of waiting for a break above 1.0810 before trusting a trend continuation.

On the downside, a dip below 1.0780 would also take the pair below the aforementioned upside line, something that may cancel the bullish case. The bears may then get encouraged to push towards Thursday’s low of 1.0755, the break of which could extend the fall towards the 1.0715 hurdle, marked by the low of June 7.