Wall Street is buzzing. The largest IPO in history will hit the market next year.

Saudi Arabia’s state-owned oil giant, Saudi Aramco, will go public in 2018. The company could be worth $2 trillion... or more.

But not much of it is being sold. The Aramco IPO will offer just 5% of shares to the public.

So why is it even bothering? The reason is simple... Saudi Arabia needs the cash to fund its economic diversification plan. The goal is to make its economy less dependent on oil prices.

The Chinese government is expected to be a big buyer of the Aramco IPO. Buying shares is one more way China can feed its oil addiction.

And while it may be tempting to buy shares of the world’s largest oil company, you should think twice before you pull out your wallet. History repeats itself, and state-owned oil companies don’t have a very profitable history...

A History of Underperformance

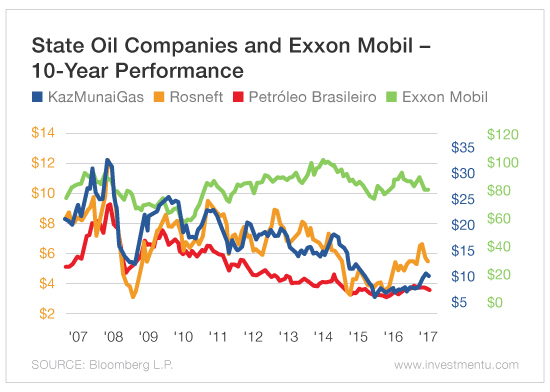

This week’s chart shows that government-backed IPOs haven’t gone well in the past.

Over the last 11 years, countries such as Brazil, Russia and Kazakhstan have all listed shares of state-run oil and gas companies. But as you can see, after an initial spike in interest, their share prices and market valuations have lagged private-sector firms like Exxon Mobil (NYSE: NYSE:XOM).

Petroleo Brasileiro Petrobras (NYSE:PBR) stock price has fallen on hard times recently. Since the 2010 IPO, Petrobras’ management has been accused of corruption (more on that in a moment). Buyers have avoided the stock.

Rosneft (LON:ROSNq), the Russian state-owned oil company, went public on the London Stock Exchange in 2006. But U.S. economic sanctions against Russia have hurt operations and investor sentiment.

KazMunaiGas Exploration Production (LSE: KMG) also was listed in London in 2006. Today, the company’s minority shareholders are battling the Kazakhstan government for control of the company. So far, they have failed, and many outsiders have dumped the stock out of frustration.

Serving Two Masters

Why do these state-run companies always run into problems? Partially because they often don’t know how to be public companies. They have a hard time making the transition.

A public company with government ownership doesn’t have to please just its shareholders. It’s also beholden to its government. Aramco will likely end up in the same conundrum.

State-run companies aren’t generally as profitable. They often have higher costs, employ more people and pay more taxes. And shareholder value isn’t necessarily the company’s first priority. Its government may have other goals in mind.

We saw this problem rear its head in Brazil recently. Now-impeached President Dilma Rousseff stuffed the Petrobras board with her own political allies. This was the beginning of a massive scandal, which ultimately led to the removal of Rousseff’s entire government.

The Petrobras scandal is one example of how state-run oil companies can easily become political pawns. Many investors feel that these politically entangled investments are just too risky.

Saudi Arabia is certain to be a big winner of the Aramco IPO. But for buyers, the outcome is less clear. It’s too early to tell whether the Aramco IPO will be a good deal for shareholders.

Remember, bigger doesn’t always mean better when it comes to investing. And state-run companies rarely put shareholders first.

For now, buying shares of the oil majors like Exxon is the safer play.