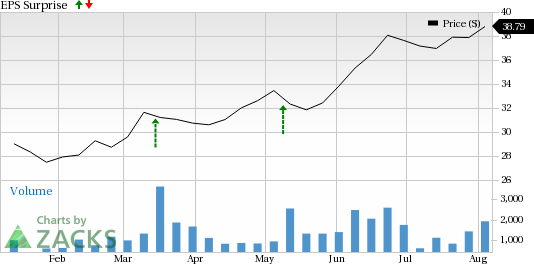

Alarm.Com Holdings, Inc. (NASDAQ:ALRM) will report second-quarter 2017 results on Aug 8. Last quarter, the company delivered a positive earnings surprise of 50%.

The surprise history has been good in Alarm.Com’s case. The company surpassed estimates in each of the trailing four quarters, with an average four-quarter positive surprise of 46.54%.

The company's shares have gained 39.4% year to date, outperforming the industry’s gain of 2.9%.

Let's see how things are shaping up for this announcement.

Factors to Consider

Alarm.Com offers cloud-based security and home-automation products. By relying on cloud technology, the company significantly reduces operating costs and allows users to manage their home from anywhere. For example, users can remotely control almost anything in their home, including security systems, thermostats, light switches and even garage doors through a mobile application. The company also offers wellness and activity tracking software.

The company’s first-quarter earnings beat the Zacks Consensus Estimate by 6 cents. Also, total revenues of $74.2 million increased 26% year over year. Moreover, SaaS and license revenues grew 26% year over year to $50.2 million.

The company has a differentiated product portfolio and broad dealer network. It is working toward building new service-provider relationships, breaking new ground in product innovation and achieving international reach. Naturally, this will help the company in penetrating the home automation and security market, and gain share. This will also help in expanding its customer base, thereby driving results.

Alarm.Com is already poised to be a vantage player in the expanding home-automation industry. For the second quarter, the company expects SaaS and license revenues in the range of $57.8–$58.0 million.

However, intensifying competition and an uncertain macro environment could impact results in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively show that Alarm.Com will beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 13 cents. Hence, the Earnings ESP is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Alarm.Com’s Zacks Rank #3 increases the predictive power of ESP. However, its 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

You could consider the following stocks with a positive Earnings ESP and a favorable Zacks Rank:

CACI International (NYSE:CACI) with an Earnings ESP of +1.83% and a Zacks Rank #2.You can see the complete list of today’s Zacks #1 Rank stocks here.

Broadcom Limited (NASDAQ:AVGO) with an Earnings ESP of +2.57% and a Zacks Rank #2.

MTS Systems Corporation (NASDAQ:MTSC) with an Earnings ESP of +4.35% and a Zacks Rank #3.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure

See these buy recommendations now >>

CACI International, Inc. (CACI): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

MTS Systems Corporation (MTSC): Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM): Free Stock Analysis Report

Original post

Zacks Investment Research