Abercrombie & Fitch Co. (NYSE:ANF) is scheduled to report fourth-quarter fiscal 2018 numbers on Mar 6, before the opening bell.

In the last reported quarter, the company delivered a positive earnings surprise of 83.3%. Also, the company boasts an impressive earnings surprise history, marking six straight quarters of a beat. The average four-quarter positive surprise is 88.6%. Let’s see what’s in store for the company this time around.

How are Estimates Faring?

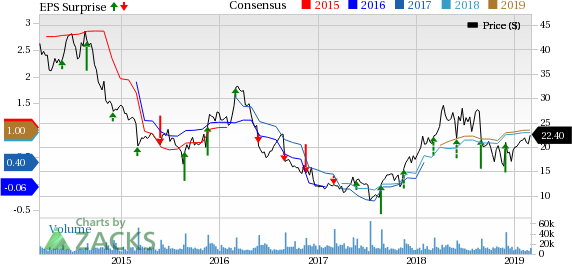

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.12, reflecting an 18.8% decline from $1.38 per share registered in the year-ago quarter. Notably, the consensus mark has remained stable over the past 30 days. For revenues, the consensus mark stands at $1,136 million, mirroring a 4.8% decrease from the year-ago quarter’s tally.

Abercrombie & Fitch Company Price, Consensus and EPS Surprise

Factors Likely to Drive Results

Abercrombie is gaining momentum on the back of its multiple strategic endeavors that include planned capital investments and cost-saving efforts as well as loyalty and marketing programs. Further, it is benefiting from strength in Hollister as well as direct-to-consumer (DTC) business. The company’s investments in mobile, omni-channel and fulfillment have significantly aided the DTC business’ growth. Notably, digital engagement with consumers has been its core strength.

Backed by robust digital momentum across both brands and geographies, the DTC business performed well in the fiscal third quarter. Moreover, the company plans to continue investing in DTC capabilities alongside bringing innovations in this channel using customer insights and data analytics.

Additionally, the expansion of Hollister stores in newer markets presents a long-term growth opportunity for Abercrombie, given the brand’s ongoing strength. With this expansion, the company garners the advantages of small-sized operations, which are cheaper and require little capital investments. Impressively, Hollister is gaining from the positive customer response toward product innovations and emerging categories.

However, the company expects foreign currency headwinds and calendar shift to hurt the top line in fourth-quarter and fiscal 2018. Sales for the fiscal fourth quarter is expected to include adverse impact of nearly $60 million from the additional week in fiscal 2017 and about $15 million from negative currency translations.

For the fiscal fourth quarter, the company continues to anticipate net sales decline in mid-single digits. Gross margin is likely to be flat or up slightly from fourth-quarter fiscal 2017 level of 58.4%. Meanwhile, operating expenses (excluding other operating income) are still estimated to decline 1-2% from adjusted operating expenses of $561 million in the prior-year quarter.

What Does the Zacks Model Say?

Our proven model shows that Abercrombie is likely to beat estimates in fourth-quarter fiscal 2018. This is because a stock needs to have both — a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Abercrombie has a Zacks Rank #2 and an Earnings ESP of +2.28%, making us reasonably confident about an earnings beat.

Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post earnings beat.

Zumiez Inc. (NASDAQ:ZUMZ) has an Earnings ESP of +0.45% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) has an Earnings ESP of +1.43% and a Zacks Rank #2.

Chico's FAS, Inc. (NYSE:CHS) has an Earnings ESP of +2.17% and a Zacks Rank #2.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

Ollie's Bargain Outlet Holdings, Inc. (OLLI): Free Stock Analysis Report

Chico's FAS, Inc. (CHS): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Original post

Zacks Investment Research