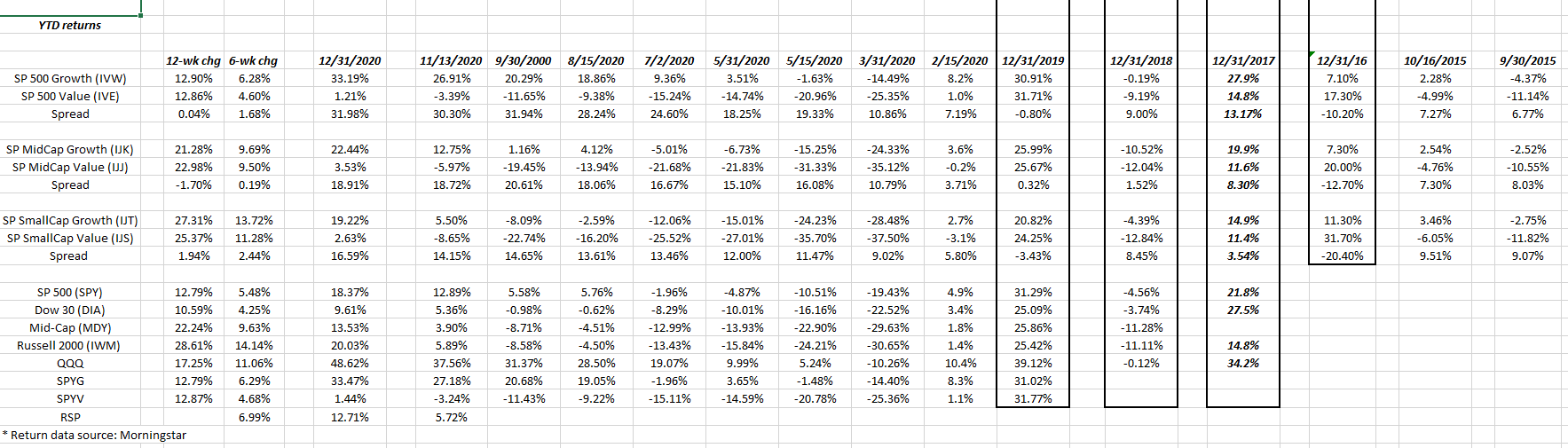

The catch-up in mid-cap and small-cap was dramatic in Q4 ’20 per the above numbers, but despite “value” doing better, it hasn’t yet really narrowed the gap between it and growth yet. Large cap growth and mid-cap growth saw the return differentials narrow between it and “value” the last 12 weeks, but the longer-term return differential has been substantial favoring growth since 2017.

The 12-week total return in mid-cap in Q4 ’20 was 22% and in small-cap it was 28.6%. Those numbers are eye-popping.

The TLT (not shown) actually saw a slight decline in Q4 ’20. Clients are being told to wait for the 10-year Treasury yield to trade above 1% yield.

Top 10 Holdings:

- Microsoft (NASDAQ:MSFT): +42% 2020 return

- Blackrock Strategic Income Opportunities Portfolio Investor A Shares: +6.92%

- Amazon (NASDAQ:AMZN): +76%

- VWO (NYSE:VWO): +15.5%

- Schwab (NYSE:SCHW): +13%

- JPMorgan (NYSE:JPM): -6.25% return in 2020

- Tesla (NASDAQ:TSLA): +743%

- JP Morgan: +3% (bond fund)

- Loomis Sayles: +1.89% (bond fund)

- QQQ: +48.6%

Top 10 individual stock holdings:

- Microsoft: +42%

- VWO: +15.5%

- Schwab: +13%

- JP Morgan: -6.26%

- Tesla: +743%

- QQQ: +48.6%

- XBI: +48%

- RSP: +12.7%

- Oakix: +4.9%

- The percentages listed are the 2020 full-year returns per Morningstar.

- The bond funds will likely be reallocated and shifted in early 2021.

The biggest change in the second half of 2020 is that Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO) and Oakmark International Fund Investor Class are now top 10 equity holdings as client portfolio gravitate to more EM and non-US given the return disparities between US and non-US.

Interesting fact: Oakmark International was down 22% YTD as of Halloween weekend and ended the year up 4.9%. David Herro swings from #1 in his peer group of 780 international funds to all the way down to the 99th percentile. This fund is not for the faint of heart. It will be discussed further in another email.

Summary

Let’s see if the November ’20 elections have consequences for monetary and fiscal policy and capital market returns. Reasonable investors would have to conclude that value will start to outperform growth at some point given that growth has trounced value since – well – 2017. The last year where “value” outperformed across all market caps was 2016.

Take everything you read with substantial skepticism, both here and elsewhere. There is no one manager, one firm, one style, one methodology, one geography or any one asset class that will do well in every market. “Creative destruction” and “reversion to the mean” are catch-phrases for capital being reallocated from one investment to another. Any security or fund mentioned above can be sold without updating readers.