- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Will 2016 Become The Year We Lament World Debt Levels?

As a student of economics, one of the first lessons you learn is that there is no free lunch and that in economies, as in life, there is always a trade-off to be made. Unfortunately, it appears that many within financial circles have either forgotten or disregarded that sage advice as they forge ahead with policies of Quantitative Easing and Zero Interest Rate Policies (ZIRP). Subsequently, as global instability mounts so too does speculation that 2016 could be the year that ends the Keynesian farce.

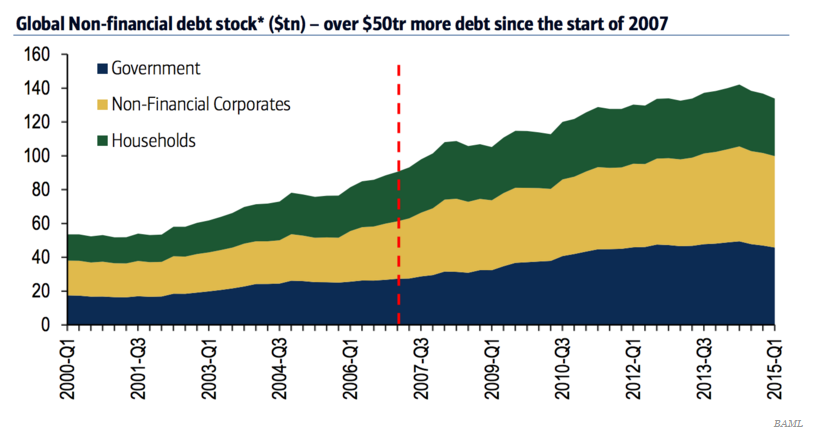

In fact, recent comments from the Ex-Chief Economist of the Bank of International Settlements have fuelled the debate given that he correctly predicted the 2008 crash. William White has subsequently expressed his sharp concern over the state of global debt loadings that shows no deleveraging since the GFC. Unfortunately his comments point to increasing levels of instability in world financial markets that could cause an avalanche of bankruptcies.

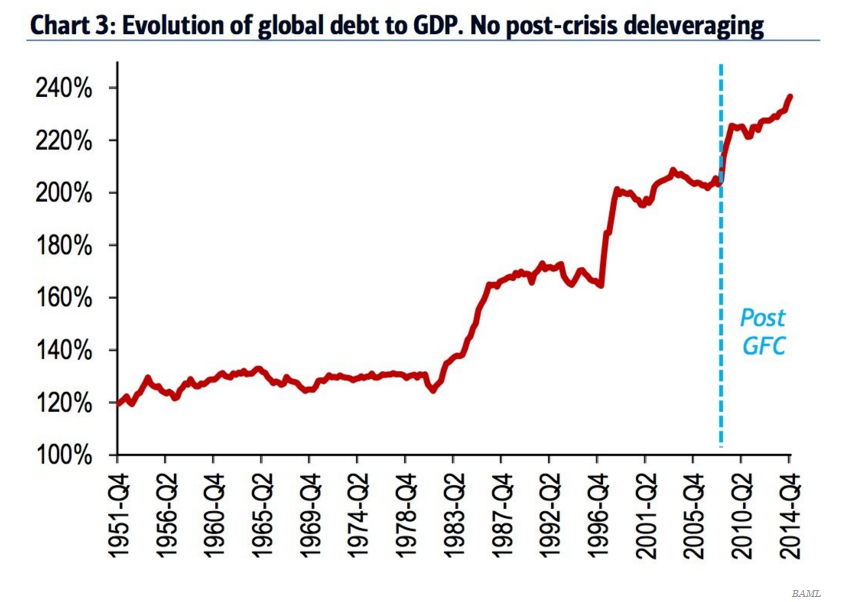

The concern over global debt to GDP limits isn’t new or particularly surprising but the issue has become increasingly more urgent as the levels now exceed 240%. Debt levels have continued to grow post GFC and now threaten the broader stability of the system. In particular, a sharp recession could cause the debt bubble to pop and many of these obligations to remain unserviceable as debt markets slam close on the fingers of participants.

Unsurprisingly, as bond repayments continue to grow, so too does the additional issuance of tranches that are taking significantly longer to fill. There is certainly something rotten in global debt markets, and what were once easy deals, are now becoming more problematic to place. Subsequently, the smell of something rotten continues to emanate and only the strongest of constitutions can accept the odour.

Subsequently, the failure of efficient debt markets can be largely placed at the feet of Keynesians economists who have advocated for massive increases to the money supply. Unfortunately, those injections have sought to spend our collective futures on almost an inter-temporal basis. However, one must now ask the question as to how far ahead we really are prepared to spend.

The question now needs to be asked as to which economies, banks, and corporations will remain solvent and able to service their debts without continual access to the debt markets. The unfortunate reality is that much of the assets currently held on balance sheets might have a very different book value in the event of a rolling round of defaults. The smart money knows this hence the recent swing in sentiment towards liquid assets.

Unfortunately, central banks have largely been to blame for the current debt bubble as they attempted to stoke the fires of inflation rather than allowing some deflation and a rebalancing in the global economy to occur. In fact, the successive rounds of QE and ZIRP may have inflated the largest debt bubble in history that represents a clear and present danger to stability.

Subsequently, as the world macro-economy now enters a period of slowing growth, central banks have little left in the tank to fight an inevitable change in the business cycle. In addition, we also now possess the largest global debt loading relative to GDP ever recorded. Clearly, something has to break and it’s likely to be the sound of the debt market jar slamming shut on the fingers of the many central bankers.

The economic and market conditions are now ripe for such an event to occur as the sentiment largely starts to swing towards the emotions of fear and concern. It is unclear how far reaching any such event could be but given the scale it’s likely to exceed anything seen during the GFC. In fact, a 1930’s style “Fisher” debt-deflation scenario could occur and would be disastrous. Therefore, 2016 is firming as a year of risk and one where you should seriously start looking at the “real” valuation of assets upon your balance sheet.

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

For every trader, choosing a reliable broker is a cornerstone of success. Achieving consistent gains in trading is not a walk in the park as it is, and you don't want any extra...

Tariff talk and weak US data fueled a risk-off reaction Nvidia earnings may test market’s risk appetite More Fed rate cuts priced in; a “Fed put” reaction expected? Both dollar...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.