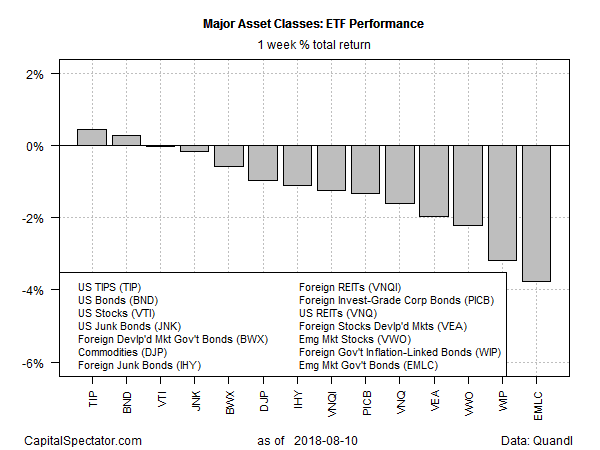

US investment-grade bonds were spared losses last week. Otherwise, red ink spilled across the major asset classes, based on a set of exchange-traded products.

The biggest setback was in emerging-markets bonds. VanEck Vectors JP Morgan EM Local Currency Bd (NYSE:EMLC) tumbled 3.8% for the five trading days through August 10. The hefty decline left the ETF at its lowest price since January.

Concern over Turkey’s currency crisis took a toll on assets in emerging markets generally last week.

“This is another headwind facing emerging markets that has arisen in the past few months,” advised William Jackson, chief emerging-market economist for Capital Economics in London, in a research note, according to Bloomberg. “China’s economy is now slowing, emerging markets are now tightening monetary policy and the trade war is escalating. This could worsen investor sentiment towards emerging markets and also strengthens our view that emerging-market growth will weaken.”

The risk-off sentiment buoyed safe-haven assets last week. Inflation-protected Treasuries (TIP) and investment-graded US bonds (AGG) ticked higher, adding 0.5% and 0.3%, respectively, for the five trading days through Friday.

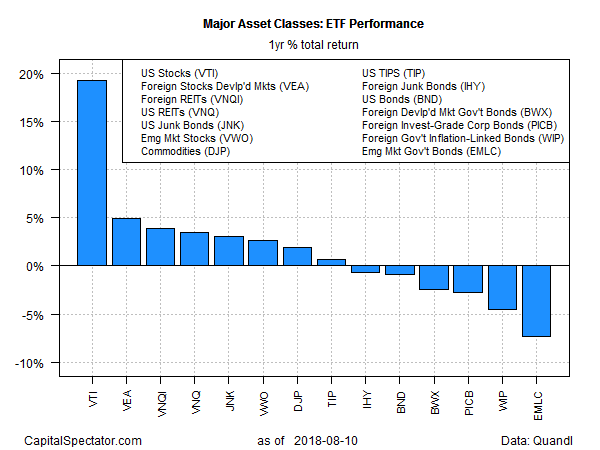

For the one-year trend, US stocks remain far and away the strongest performer among the major asset classes. After a fractional loss last week, Vanguard Total Stock Market (NYSE:VTI) posted a 19.3% total return for the year through August 10 – dramatically above the one-year performances for the rest of the field.

The steepest one-year decline at the moment can be found in emerging-markets bonds. Echoing the one-week profile above, EMLC is the worst performer for the trailing one-year window via a 9.7% decline.

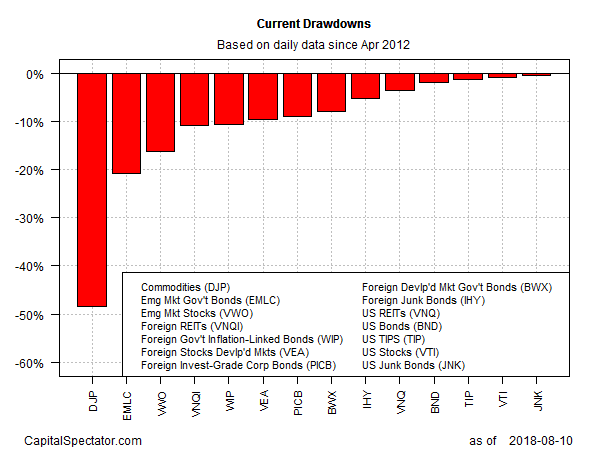

Ranking the major asset classes by current drawdown continues to show that broadly defined commodities suffer the biggest peak-to-trough decline. The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) is nearly 50% below its previous peak.

After last week’s rout, emerging-markets bonds are currently posting the second-biggest drawdown for the major asset classes via a slide of slightly more than 20% from the previous peak.

Meanwhile, high-yield bonds in the US are still posting the smallest drawdown. SPDR Barclays High Yield Bond (NYSE:JNK) closed last week at only a fraction below the ETF’s previous peak, based on adjusted prices that include distributions.