Even though the stock market is closed this Friday, the bond market is open. The Bureau of Labor Statistics is scheduled to release the March Employment Report at 830 ET.

I am seeing consensus headline NFP estimates in the 245K range, but I will largely be discounting that number. Not only is it extremely noisy, the Fed has signaled that it is focused elsewhere. In last Friday's speech, Janet Yellen made herself quite clear [emphasis added]:

I have argued that a pickup in neither wage nor price inflation is indispensable for me to achieve reasonable confidence that inflation will move back to 2 percent over time. That said, I would be uncomfortable raising the federal funds rate if readings on wage growth, core consumer prices, and other indicators of underlying inflation pressures were to weaken, if market-based measures of inflation compensation were to fall appreciably further, or if survey-based measures were to begin to decline noticeably.

In other words, rising inflation and inflationary expectations isn't a prerequisite to raise interest rates, but falling inflation would cause them to reconsider their liftoff timetable.

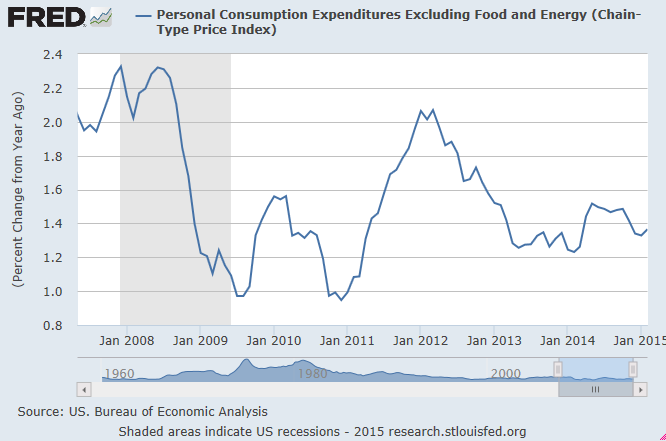

Already, the YoY Core PCE growth rate surprised the market by ticking up to 1.4% on Monday, vs. market expectations of 1.3%. That release could be an indication of accelerating inflation.

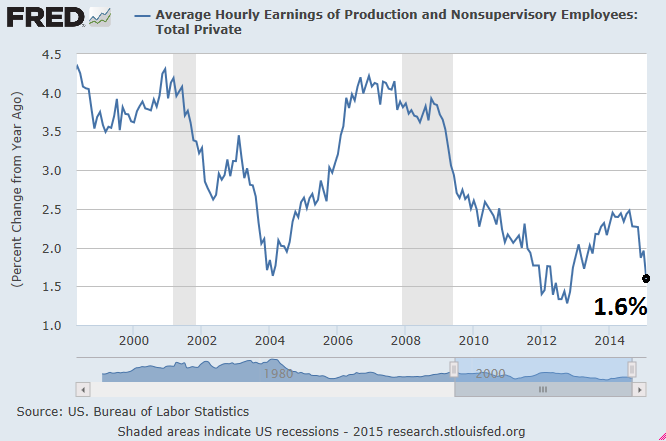

With respect to the Employment Report on Friday, Average Hourly Earnings would give a greater clue to the direction of Fed policy than the headline NFP number. As the chart below shows, Average Hourly Earnings has been falling on a YoY basis, will it continue to fall or will it start to turn up again?

Stay tuned Friday morning!