WisdomTree Investments, Inc. (NASDAQ:WETF) is scheduled to report second-quarter 2017 results on Jul 28, before the market opens. Its revenues and earnings are expected to grow year over year.

Last quarter, this New York-based exchange traded fund and exchange-traded product sponsor reported adjusted earnings per share of 5 cents, beating the Zacks Consensus Estimate by a penny. The company witnessed significant increase in other income. However, the positives were partially offset by lower assets under management (AUM) and higher expenses.

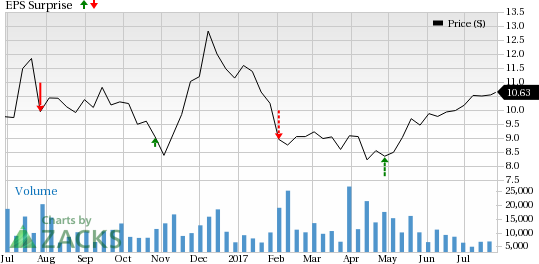

WisdomTree has a disappointing earnings surprise history. It lagged earnings estimates in two of the trailing four quarters with an average negative earnings surprise of 21.9%.

WisdomTree Investments, Inc. Price and EPS Surprise

Earnings Whispers

According to our quantitative model, we cannot conclusively predict an earnings beat for WisdomTree in the upcoming results. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #3 (Hold) or better for this to happen, which is not the case here as elaborated below:

(You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.)

Zacks ESP: The Earnings ESP for WisdomTree is 0.00%. This is because the Most Accurate estimate matches the Zacks Consensus Estimate of 7 cents.

Zacks Rank: WisdomTree’s Zacks Rank #3 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident of an earnings beat.

Factors at Play

In 2016 and first-quarter 2017 WisdomTree was hit by significant outflows. The outflows were mostly due to internationally hedged products, particularly the company’s major currency-hedged funds – HEDJ and DXJ – which constitute a major part of the company’s AUM.

In the second quarter, there was no measurable progress that can help the company reduce outflows.

WisdomTree remains focused on executing strategic growth initiatives, including expansion of distribution capabilities, investment in technology, launch of innovative products and addition of personnel. We expect such initiatives to increase marketing and sales expenses in the second quarter.

A key area to watch is the compensation expense level during the quarter. Management expects compensation expenses to be 28–31% of revenues for the year.

WisdomTree’s activities during the to-be-reported quarter were inadequate to win analysts’ confidence. As a result, the Zacks Consensus Estimate for the quarter remained stable over the last seven days.

Stocks that Warrant a Look

Franklin Resources, Inc. (NYSE:BEN) is scheduled to release second-quarter results on Jul 28. Its Earnings ESP is +1.37% and it carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Banco Santander (MC:SAN) Chile (NYSE:BSAC) has an Earnings ESP of +6.98% and a Zacks Rank #2 (Buy). It is scheduled to report second-quarter results on Jul 28.

The Earnings ESP for Hilltop Holdings Inc. (NYSE:HTH) is +2.33% and it carries a Zacks Rank #2. The company is scheduled to release results on Jul 27.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See

See Zacks' 3 Best Stocks to Play This Trend >>

Banco Santander Chile (BSAC): Free Stock Analysis Report

WisdomTree Investments, Inc. (WETF): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

Hilltop Holdings Inc. (HTH): Free Stock Analysis Report

Original post

Zacks Investment Research