Wells Fargo & Company (NYSE:WFC) | Financials – Diversified Financial Services | July 13

Wells Fargo & Company (NYSE:WFC) has found itself in a myriad of scandals and scandals in the last several years, making it increasingly difficult to successfully rebound. While Wells Fargo’s main competitors, namely JP Morgan Chase (NYSE:JPM), Citibank and Bank of America (NYSE:BAC) have averaged nearly 20% gains in stock price, Wells Fargo has flatlined for the past several quarters. Wells Fargo’s latest misconduct includes a discovery by the Securities and Exchange Commission that the bank took advantage of average working class americans by pressuring them to invest in high-fee debt products.

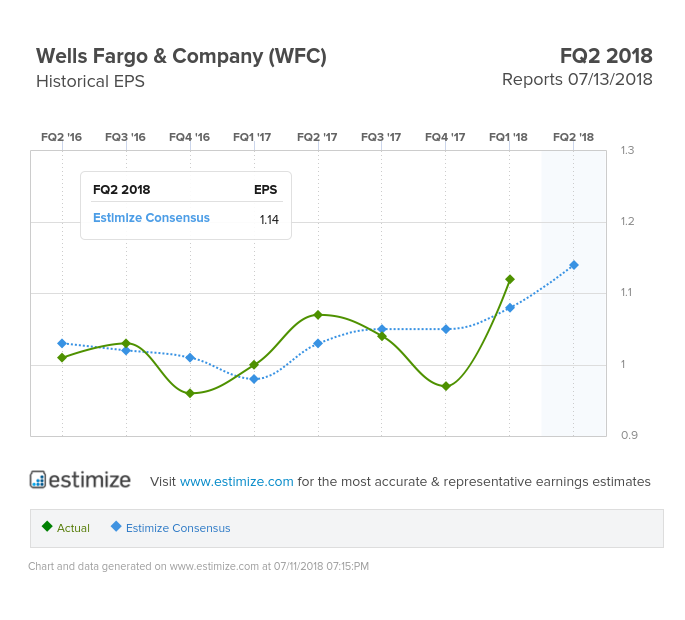

These new revelations come right on the heels of Wells Fargo’s account fraud scheme, where the bank created fraudulent checking and savings accounts on behalf of clients as a means of increasing revenue. Since becoming entangled in a string of scandals, Wells Fargo’s revenue has flatlined as well, with the Estimize Consensus predicting a 3% fall in revenue this coming report. Perhaps an optimistic sign for investors, the bank’s EPS climbed 12% last quarter (YoY), and is predicted to rise another 6% next quarter, according to the Estimize community. Nonetheless, investors will be cautious as Wells Fargo’s revenue continues to remain stagnant.