Here’s the straight skinny: In the forty or so years we’ve been trading options, we’ve yet to come across anyone who has made money consistently by buying options on a bullish or bearish hunch. Because options are so knowledgeably priced, that’s akin to betting against the house. And any bettor who thinks he’s smarter than his bookie is bound to come out a loser.

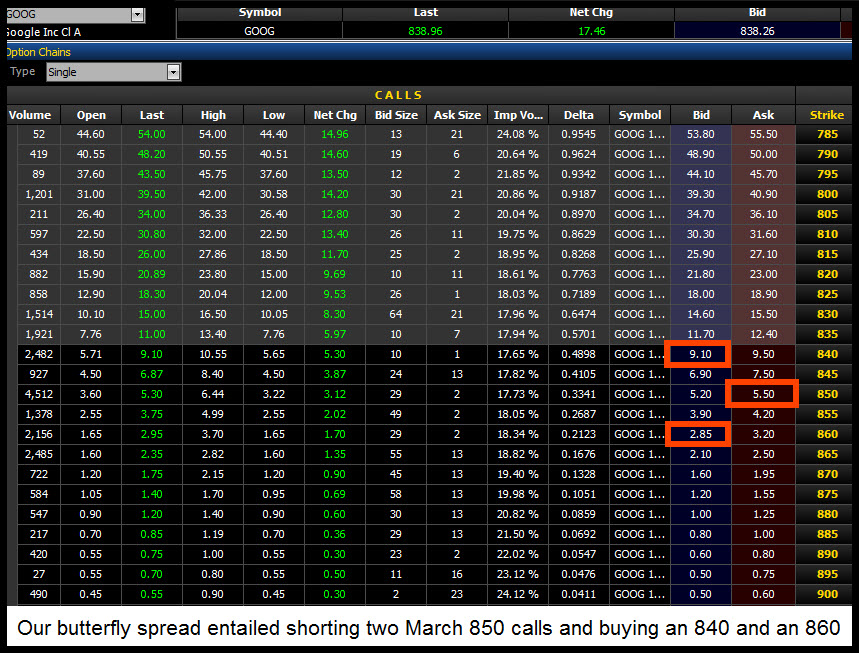

The way around it is to always sell puts or calls against options you have bought. That is what we did about five weeks ago in Google (GOOG) when the stock was trading for around $750. Specifically, we told subscribers to buy the March 840-850-860 butterfly spread four times for 0.20 ($20).

This implied shorting two 850 calls while simultaneously buying an 840 and an 860. Our total risk, including commissions, was about $100. Although we are perennially bearish on the stock market, that doesn’t mean we always bet against it. Most of the time, we prefer to take long and short positions at the same time. In this case our bullish play in Google was balanced by a put calendar spread in the Diamonds that gives us cheap leverage if the market falls between now and June. Certainly not impossible. Our counterplay in Google was essentially a bet that if the stock market were to explode to new highs early in 2013, Google would lead the charge.

A Quintupler

And so it has. At yesterday’s peak, GOOG was up more than $90, or about 12%, since we put on the position. The stock’s steep rise has caused our butterfly spread to more than quintuple in value. It could have been sold yesterday for as much as $230, producing a theoretical gain of $840 on the four-spread position. At its theoretical maximum, with Google trading for $850 when the March options expire next Friday, the butterfly would sell for 10.00 (i.e., $1000) — a 50-fold gain over the 0.20 we paid for it.

In practice, however, we’ll be shooting for a comfy 3.00-4.00 ($300-$400) per spread, since the theoretical 10.00 is impossible to achieve. At that point we’ll have no skin in the came, since, at the suggestion of a subscriber yesterday in the chat room, we advised selling 25% of the position for 1.30 or better. Several traders reported having done so, more than covering their entire position risk. They now hold “free” calls on Google.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why We Hate The Market But Love Google

Published 03/06/2013, 12:22 AM

Updated 07/09/2023, 06:31 AM

Why We Hate The Market But Love Google

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.