Given that the Nasdaq 100 Index (NDX) has been drifting lower for the past six days (including the flat closing price on October 12), the index may be becoming a bit “oversold” in the near-term. We hesitate to use the term “oversold” because it’s a relative term; stocks and ETFs can frequently become even much more “oversold” before eventually bouncing. Therefore, we use the term loosely. Nevertheless, odds now technically favor at least a short-term bounce off the lows in the coming week, which could create a new opportunity to short sell QQQ (or buy an inversely correlated “short ETF”) for swing traders who missed the initial sell-off and breakdown in the Nasdaq.

Because of the anticipated near-term bounce, we have tightened the protective stop on our current ETF position in the inversely correlated ProShares Short QQQ (PSQ), which is presently showing an unrealized gain since our October 9 entry (we bought PSQ, rather than selling short QQQ, so that subscribers with non-marginable cash accounts could still participate).

Going into today, our new stop for PSQ has been moved to just below last Friday’s (October 12) intraday low ($25.09). This new stop price enables us to capture even more gains if the Nasdaq 100 fails to bounce today and continues extending its losing streak. However, with this new, tightened stop price, we will still quickly lock in a gain on our ETF trade, even if the Nasdaq suddenly bounces sharply higher or a “short squeeze” sets in.

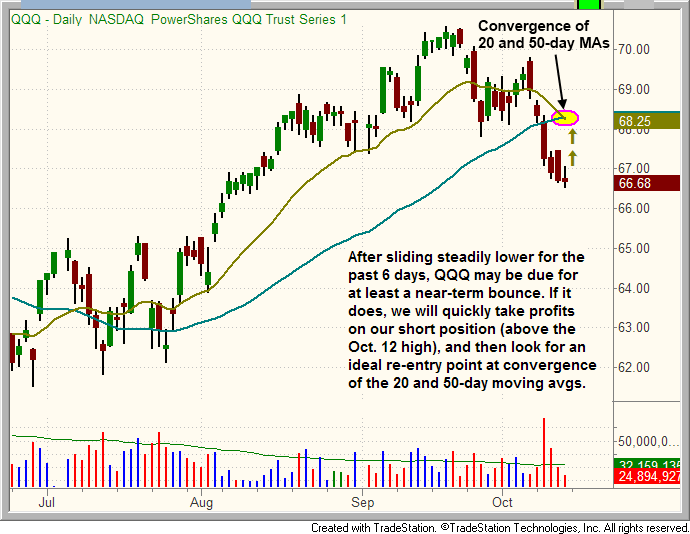

Over the next week or two, we would ideally like to see a substantial bounce in the Nasdaq 100 Index up to new technical resistance of its 50-day moving average (remember that a prior level of support becomes the new level of resistance after the support is broken). Further, the 20-day exponential moving average (beige line on the chart below) is now converging with and is poised to cross below the 50-day moving average (teal line), thereby creating additional resistance.

If the Nasdaq 100 bounces into convergence of the 20 and 50-day moving average and stalls, we would then have a low-risk re-entry point for selling short the Nasdaq 100 Index, along with a much more positive reward-risk ratio, in anticipation of the index making another leg down. The ideal bounce for the Nasdaq 100 is annotated below on the daily chart of PowerShares QQQ trust (QQQ), a very popular ETF proxy for the Nasdaq 100 Index:

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why We Are Waiting For The Nasdaq 100 To Bounce Into Resistance (QQQ)

Published 10/15/2012, 04:04 AM

Updated 07/09/2023, 06:31 AM

Why We Are Waiting For The Nasdaq 100 To Bounce Into Resistance (QQQ)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.