This stock hurts to short. The bears are gluttons for punishment.

Thirty-six percent (36%!) of outstanding shares are sold short. This dividend is just waiting to be squeezed higher.

Meanwhile, the pessimists are paying the stock’s 12.8% dividend out of pocket. That’s how shorting works—you must borrow shares to put on your bearish bet. As such, you’re on the hook for the dividend.

Wouldn’t be my bet. I’m talking, of course, about our controversial out-of-favor favorite Arbor Realty Trust (NYSE:ABR). ABR is a mortgage real estate investment trust (mREIT)—a REIT subset that typically doesn’t deal in physical properties, but instead owns “paper” real estate. Mortgages, that is.

Arbor founder Ivan Kaufman started ABR as a lender for single-family mortgages, and early on, it even sent every new homeowner a tree at their loan closing.

But Ivan isn’t one to sit still. He has pivoted the company and added (or killed off) different business lines throughout Arbor’s history.

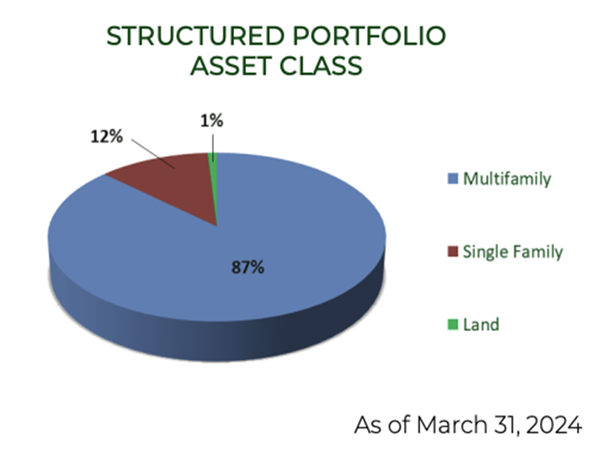

One of those expansions–multifamily lending–is now Arbor’s leading asset:

Source: Arbor Realty Trust first-quarter fact sheet

As you can see, Ivan has smartly diversified Arbor away from commercial real estate. Yet, in terms of stock jock coverage, Arbor is often lumped with commercial lenders and landlords.

This is unfair given that, depending on the quarter, these loans make up between 1% to none of the portfolio. But this mistaken classification is our contrarian advantage. We know that:

- Arbor has grown its book value during a time when other mREITs shrank.

- The company pays a high dividend that has even grown lately.

- ABR is a heavily shorted stock, which provides fuel for potential price gains.

That last point has been an exploding point of interest for nearly two years now, with doubters starting at a trickle but eventually growing to make ABR one of the most shorted stocks on the market.

We’ve discussed ABR’s bout with the shorts in December 2023, and again just a couple months ago. So far, the shorts are taking it in the shorts. ABR has delivered a 20%+ total return since the start of 2023 despite a persistent rise in short interest.

The shorts bet on something that even Arbor admitted. As long as the Fed kept rates elevated, ABR would feel the pressure:

“We are in a period of peak stress and expect the next two quarters to be challenging, if not more challenging than the fourth quarter,” Kaufman said during the Q4 2023 conference call in February. “As a result of this environment, we are experiencing elevated delinquencies.”

The Fed hasn’t flinched so far in 2024, and that was reflected in Arbor’s most recent earnings report. But the Fed is darn close to cutting and, in the interim, we see signs that Kaufman & Co. are navigating the challenging conditions.

Second-quarter distributable EPS of 45 cents per share beat estimates by 3 cents per share, and was a couple cents clear of its 43-cent dividend. Book value declined, but by merely 1%, to $12.47 per share, also beating expectations for $12.42 per share.

Agency originations of $1.15 billion were shy of forecasts but still up 35% quarter-over-quarter.

Total delinquencies did indeed rise, to $1.04 billion in Q2 from $954 million in Q1:

- Non-performing loans (NPLs) grew to $676 million from $465 million, predominantly because $264 million of loans progressed from less-than-60-days delinquent to greater-than-60-days delinquent.

- Less-than-60-days delinquent loans dropped to $368 million from $489 million previously, in part from progression into greater-than-60-days delinquent status, but also, $138 million worth of loans was either modified or paid off. (This line was also affected by $281 million in new loans that didn’t accrue interest.)

Importantly, though, Arbor is aggressively modifying loans to squeeze payoffs out of past-due loans. ABR modified more than $730 million of loans in Q2.

Kaufman says “$23 million of fresh capital [was] injected into these deals from the sponsors.”

In the meantime, they’re working on the $1 billion in delinquent loans, through modification, REO (real estate-owned; basically, foreclosure) or bringing in new sponsorship.

Arbor also added about $29 million to its current expected credit losses (CECL) reserves to further build its defense, bringing its total to $239 million. But importantly, it’s doing so without hemorrhaging book value like some of its peers.

How about the biggest reason for optimism? Kaufman says Arbor was able to generate $630 million worth of payoffs, $490 million of which were refinanced into fixed-rate agency deals–a feat he chalked up to recent declines in interest rates.

Arbor has been beating the same drum for several quarters now: It wants to convert its multifamily bridge loans into agency products.

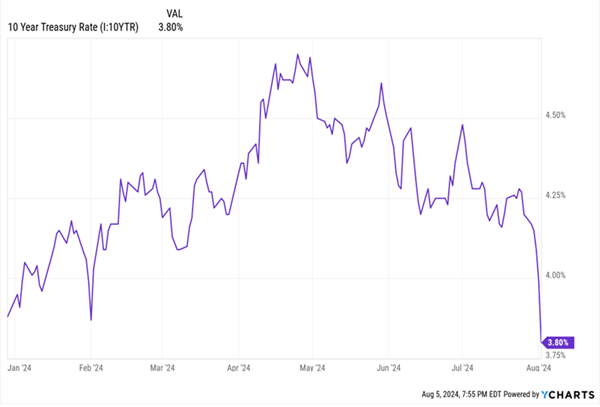

It can do so at high rates, but a drop in the 10-year Treasury to 4% would be a meaningful development, with Kaufman adding that every quarter-point drop from that level should really speed things up.

This Chart Looks Great From Arbor’s Point of View

Prolonged weakness in the 10-year Treasury would be a boon for ABR shares, and could in turn force some bears to call it quits–triggering the virtuous cycle of a short squeeze.

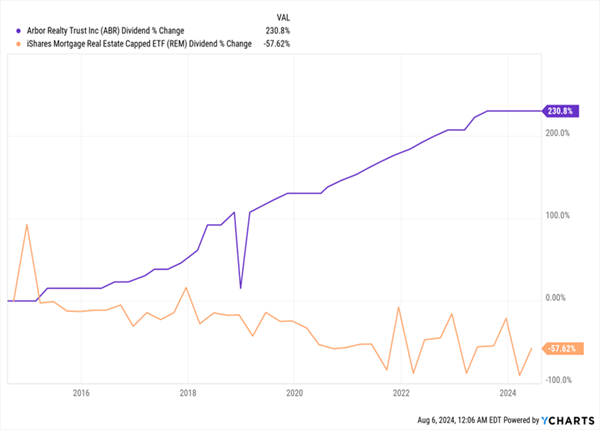

Further pressuring the bears is Arbor’s massive 13% dividend, whose growth over the past decade stands in stark contrast to the mREIT space.

ABR’s Dividend Grows by 3X+ While the mREIT Industry’s Payout Is Cut in Half

Think You Can’t Retire on Just $500K? Think Again.

The world of uber-high-yield stocks is a minefield–but it’s one we need to navigate if we want to retire on dividends alone.

A retirement plan that can generate at least 9% annually in reliable dividends will let you sleep easy at night, even if you have a smaller nest egg of, say, $500,000 to work with.

The math is easy: If you put $500,000 to work in a portfolio yielding 9%, you’ll earn a $45,000 “salary” of dividends from your retirement account.

Combine that with Social Security, and you’ll have plenty to work with once you’ve moved on from your career.

And if you have an even bigger pile of cash to plug into our 9% “No Withdrawal” Retirement Portfolio, you’re looking at a downright cozy retirement–one where you’ll never have to touch your original nest egg!

The hated stocks above don’t quite fit the bill. But I have plenty of stealth payout plays that do yield the 9% or more that we need to coast forever on dividends alone.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."