By David Messler

- OPEC+ will be very happy with where oil prices currently are and is unlikely to change its course anytime soon

- The U.S. does have the ability to increase production, but U.S. shale does not have support from either the government or shareholders to boost production significantly

- The two bearish variables that could drag prices down in the near term are a strong dollar and the continuation of inventory builds

For years, the Kingdom of Saudi Arabia’s economy has suffered from low oil prices. Since 2014 when it increased supplies to try and break American shale producers, Saudi Arabia has had to struggle with a flooded market. Its cash reserves have been drawn down by hundreds of billions and it had to sell a small percentage of its prize asset, Saudi Aramco (SE:2222).

At the same time, Saudi Arabia’s Vision 2030 plan fell behind in its lofty goals of diversifying its economy. I discussed this at some length in a prior Oil price article. Now with the price of Brent - the benchmark against which Saudi Arabia prices its production - finally back above the $80 mark, the Kingdom is beginning to refill its coffers. So it was no great surprise when the Saudis and the Russians, the two principal members of the OPEC+ cartel, roundly rejected a demand from President Biden to increase production to ease the world’s energy crisis.

Up to this point, there had been some lingering concern on the part of OPEC+ that too high a price would reinvigorate the shale industry that had finally come to heel in early 2020. Restraint on the part of shale drillers since then has encouraged them that a new “war” for market share won’t be the result. As the Reuters article notes, while some American shale drillers are bumping up their budgets, many are standing pat. Kaes Van't Hof, the CFO of Diamondback Energy (NYSE:NASDAQ:FANG) was quoted as saying:

"The industry has tried a market share war with OPEC before and it didn't work out."

In this article, we will discuss what we see as being the major variables to the oil supply equation and where oil prices might go in the next few months. We think the world is in a new era of higher-priced commodities including oil, and several factors will sustain this condition for a number of years.

The new energy Triumvirate

There are three countries with the significant excess capacity to substantially increase oil supplies in a short period of time, KSA, Russia, and the USA. The IEA projects that KSA has about 12.25 mm BOPD of capacity or about 2.25 mm BOPD above present levels. S&P Global Platts estimates that Russia, currently producing 9.7 mm BOPD under the OPEC+ agreement, has an upper capacity of about 11.5 mm BOPD. Between the two they could quickly add 4-mm BOPD and knock prices down considerably if it was remotely in their best interests. KSA and Russia depend upon oil sales to fund their economies as they produce little else of value for the global market.

The USA on the other hand is a giant of international commerce but still depends on its internal production to fund its approximate 21.3 mm BOPD habit. Russia and KSA have the clear objective of wanting to derive the maximum benefit from their production by optimizing the supply/price ratio. The U.S. has for years sent mixed messages to its domestic producers, a trend that’s only increased with the new administration. With its climate goals front and center the U.S. has tied the hands, figuratively speaking, of its domestic energy producers. Whether it’s the canceling of lease sales, denying permits on federal lands, opposing midstream takeaway, or implementing carbon taxes the American government has sent U.S. producers a very clear message.

What should we expect from OPEC+?

Consistency has not been a hallmark associated with the OPEC cartel in terms of sticking to output cuts, but since allowing the Russians to first participate in their meetings in 2016 has shown a much more deliberate approach to setting output goals. This new resilience came with some false starts, but finally, in 2018 the cartel (with the Russians) began withholding crude from the market and apportioning the cuts among its members. By 2021 they were able to declare victory.

Oil in the $80s means that each country can fund their internal and external demands as they look to maintain their economic growth and expand their geopolitical ambitions. We shouldn’t expect them to alter a course that took so long to craft and finally deploy successfully.

What should we expect from American shale producers?

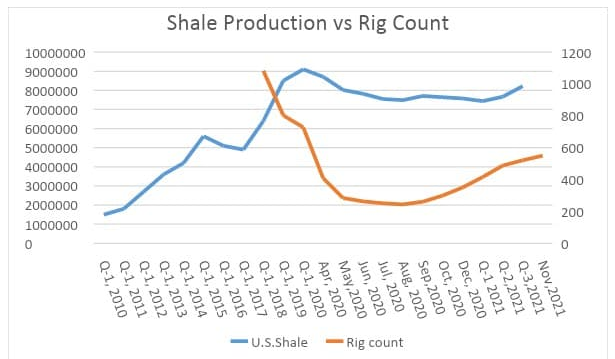

Bank debt-laden and near bankruptcy, the pandemic of 2020 found many shale drillers already in the early stages of changing their corporate strategies. In the years that followed the oil crash of 2014 they had pursued a bank-fueled growth at any cost approach to development. This drove shale production ever higher year over year to the point, where even as the rig count had begun to decline from persistently low prices, it peaked in the first quarter of 2020 at 9.3 mm BOEPD.

Baker Hughes/EIA Chart by author

Post the depths of the pandemic, as the global economy began to recover, shale drillers moved from a posture of bank-financing their drilling programs to one of self-funding their activity with cash flow. This posture was driven not only by financial necessity but by government fiat as the new administration began to issue edicts intended to hamper growth in the industry as it pushed its “climate-friendly” agenda.

Two principle things have actually occurred in the face of this governmental opposition. The first is the consolidation trend that began in 2020 with several mid-sized companies being bought out by larger companies, has continued into 2021. Prime examples from 2020 would be, ConocoPhillips, (NYSE:COP), taking out Concho Resources (NYSE:CXO), Devon Energy, (NYSE:DVN), taking out WPX Energy (NYSE:WPX), and then Pioneer Natural Resources, (NYSE:PXD) taking out Parsley Energy (NYSE:PE). Most of these deals were pure stock swap transactions that created no new debt for the surviving company. These mergers have had the goal of “bolting-on” to existing prime acreage positions to enhance well planning, logistics, and to lower unit costs.

The second thing that’s occurred as shale drillers have seen the stunning run-up in oil prices this year triple and quadruple operating cash flows is the use of this cash flow to fund capex in amounts sized to keep production essentially flat through 2022, repair their balance sheets by paying down debt, and reward shareholders with increased dividends and stock buybacks. Rick Muncrief, CEO of Devon Energy made the following comment in their Q-3 conference call-

“As we have stated many times in the past, we have no intention of adding incremental barrels into the market until demand side fundamentals sustainably recover and it becomes evident that OPEC+ spare oil capacity is effectively absorbed by the world market. With this disciplined approach and to sustain our production profile in 2022, we are directionally planning on an upstream capital program in the range of $1.9 to $2.2 billion.”

DVN

Flat or slightly increasing production is a refrain we have heard from many companies like DVN whose share prices collapsed to single digits at the bottom of the pandemic. In the case of DVN a share price of $8.10 on Oct. 28 2020, has rebounded to $44.52 in Monday, Nov. 8 trading.

The expectation is that shale drillers will maintain their posture of capital restraint and shareholder reward despite recent pleas from the administration to increase drilling to ease perceived or anticipated shortages in supply for the coming year.

Things driving the direction for oil prices going into 2022

Every day it becomes clearer that the global economy is on the rebound. Just today the government reopened the skies between the U.S. and 35 foreign countries. Airline stocks are soaring as a result. Demand for jet fuel will quickly return to and surpass 2019 levels. The question then becomes: what is the supply situation? Two key indicators are shown in the charts below.

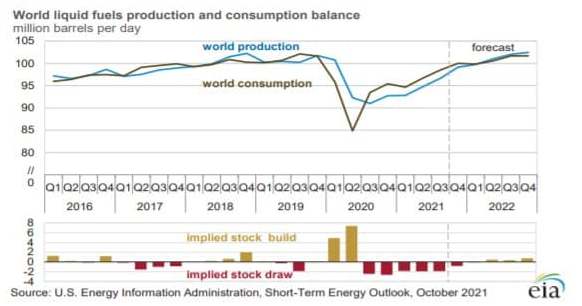

The Energy Information Agency-EIA, Short Term Energy Outlook report is instructive here. Updated monthly, the report shows a very tight balance between output and demand as we go into 2022.

STEO

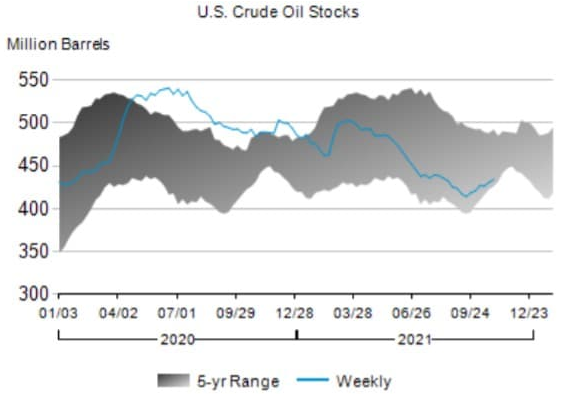

The second indicator for crude is shown in the EIA report below. Crude stocks, despite 6-weeks of steady builds, are still on the very low end of 5-year averages for this time of year.

EIA-WPSR

These factors are primarily bullish for oil (WTI and Brent) maintaining current levels and then perhaps exceeding them as natural gas prices cause electricity generators to substitute oil for increasingly expensive gas. This puts another unanticipated demand on already tight supplies of crude.

Forecasts of $100 Brent are becoming increasingly common as we head into the winter of 21/22.

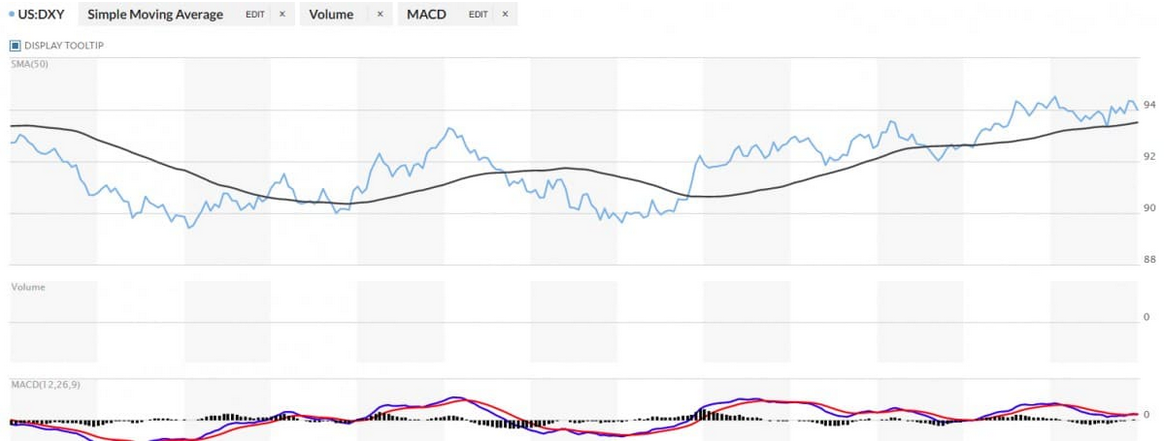

There are some factors that may tend to blunt the effects of this tightness in the market. Chief among them is likely the dollar strength compared to the market basket of other currencies. The USD is trading at a one-year high as the Fed announces a tapering of asset purchases beginning as early as November. Crude, which is priced in dollars, may see some softness as a result.

Inventory builds are also increasingly problematic for market sentiment and had been the primary drag on oil prices over the last six weeks of builds until OPEC+ announced their intention to maintain its course with increased supplies. If this continues, that $100 forecast will look increasingly dated.

Your takeaway

Inflation has reared its head in the global marketplace after nearly a three-decade absence of any significance. Prices for everything are surging as the demand side of the equation empties shelves of goods. The term “Commodity Super-Cycle” is increasing in news reports for the first time in a number of years. I discussed this possibility in an Oil price article early this year.

Inflation and surging growth in commodities prices may put a drag on the prices of stocks in some sectors of the economy. Stocks that participate in the energy economy still trade at a significant discount to the major indexes and may provide a haven for investors looking to shield their portfolios from the full effects of higher energy and commodities prices.

It is likely in my view that the current oil price rally still has legs, all things considered, and the stocks of companies that participate in this rally will continue to do well in the coming year.