As we know, gold and the US dollar have an inverse relationship. Gold is priced in US dollars and the drivers of each are similar (from an inverse point of view). Over long-term periods both trend in the same direction but the magnitude of the moves can vary and be quite different.

The standard inverse relationship has not been a perfect one in recent months or years.

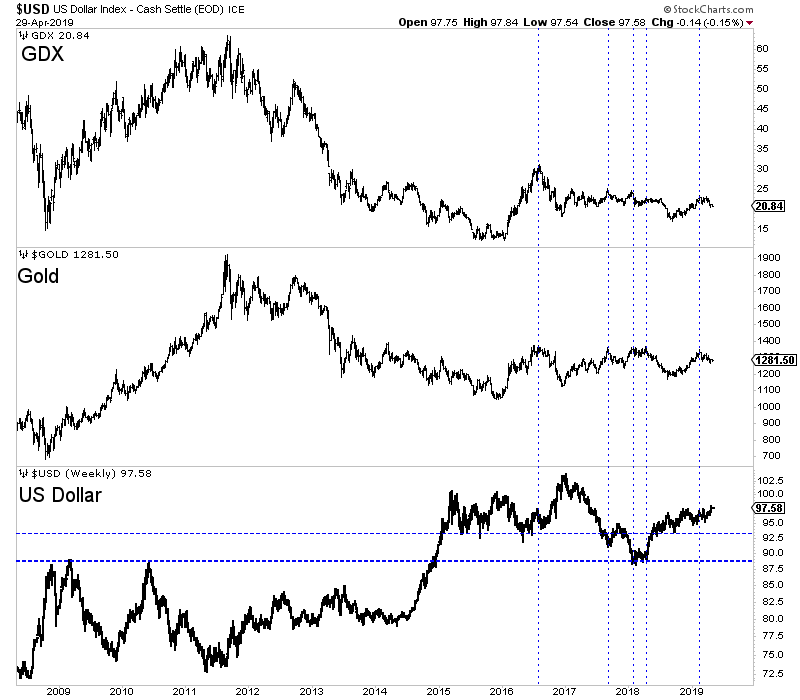

In the chart below we plot gold, gold stocks and the US dollar.

We highlight (with vertical lines) the points at which gold tested the wall of resistance. As you can see, the relationship with the dollar hasn’t been uniform.

GDX

GDX, Gold And US Dollar

In particular, note what transpired in 2017. The dollar declined sharply and penetrated its 2016 low to the downside yet Gold didn’t make a new high and gold stocks didn’t even come close to their 2016 high.

Recently, the reverse has transpired. The US dollar has or is breaking out to a new high yet gold is much closer to its 52-week high rather than its 52-week low.

Gold bulls hope the breakout will reverse course and lead to a big decline. Surely, a big decline would push gold to a massive breakout. Or would it?

Recall 2017. Gold did not breakout and gold stocks performed even worse. Gold’s fundamentals were not bullish because real interest rates increased throughout 2017. Dollar weakness simply prevented gold and gold stocks from faring worse.

If the dollar declines again and for similar reasons as in 2017 (global recovery and global risks averted) then we should not expect Gold to breakout. If strength in US stocks and global stocks continues then gold is not going to breakout regardless of what happens to the US dollar.

If the US dollar were to continue rising throughout 2019 then it would eventually cause a myriad of problems that would lead to softer policy and Fed rate cuts. Gold may not breakout initially but eventually it would.

The best scenario for gold would be a dollar decline coupled with a decrease in real interest rates, which would be driven by Fed rate cuts or a consistent rise in inflation as the Fed stands pat.

Keep an eye on the US dollar over the weeks ahead as its fate could give us a sense of where things are going for the balance of 2019 and then we could assess how gold may react.