While most people – including mainstream economists – seem to believe that our bubble problems ended when the U.S. housing bubble burst in 2008, the reality is that there are even more bubbles forming today than before the Great Recession. I listed the bubbles that I am warning about in a detailed piece that I wrote last week called “Why You Should Not Underestimate The Severity Of The Coming Recession.” I believe that the bursting of these numerous bubbles is likely to cause another recession that may be even more severe than the Great Recession was. In the current piece, I will discuss the bubble that is currently forming in U.S. commercial real estate and how it is likely to burst.

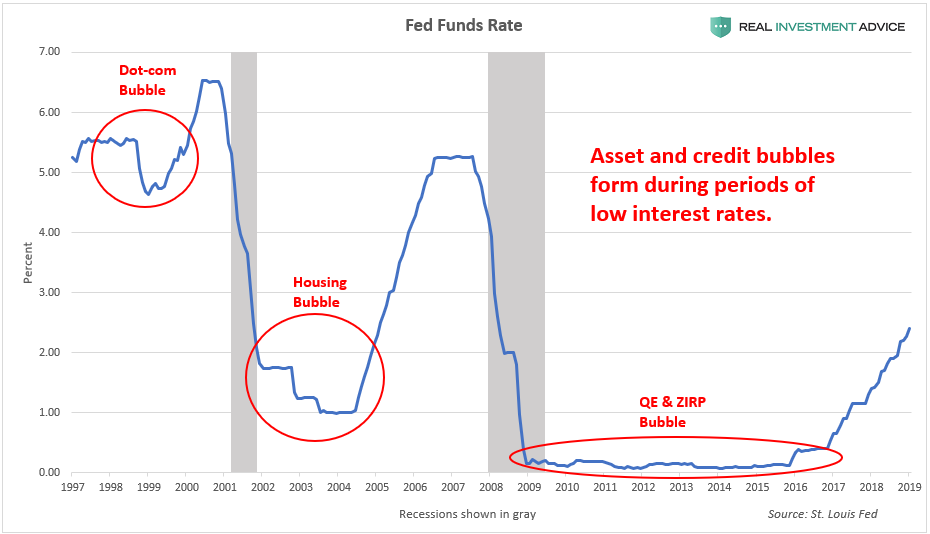

In order to understand the bubble that is currently forming in U.S. commercial real estate, it is important to first understand the extremely unusual monetary environment that the U.S. has been in since the Great Recession. After the U.S. housing and credit bubble burst in 2008, the Federal Reserve was desperate to stimulate the economy by slashing borrowing costs. The Fed cut and held interest rates at virtually zero percent (i.e., zero interest rate policy or “ZIRP”) for seven years and has been gradually increasing those rates since late-2015. Unfortunately, dangerous economic bubbles form during low-interest rate periods and burst when rates rise once again. The dot-com and housing bubbles formed in this manner and so are numerous other bubbles in the current cycle, including commercial real estate. Commercial real estate is particularly sensitive to interest rates, and benefits when rates are low and suffers when rates are high.

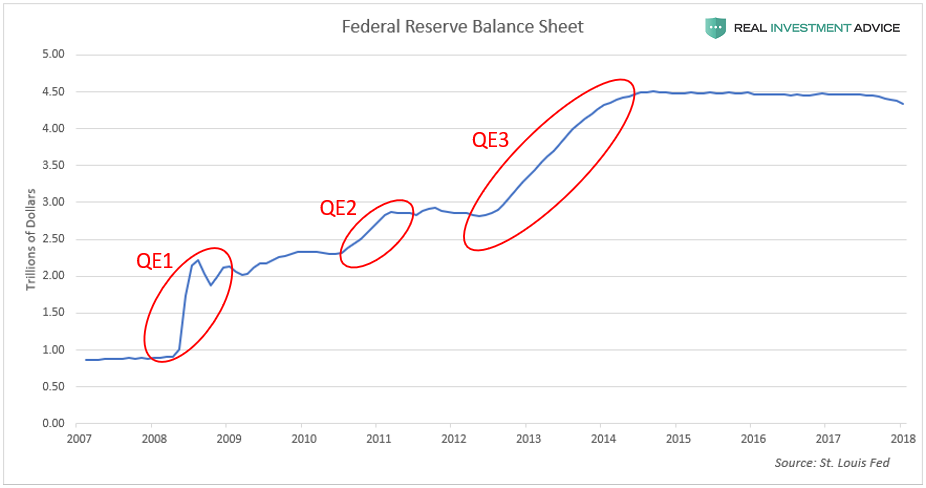

In addition to ZIRP, the Fed utilized an unconventional monetary policy known as quantitative easing or QE, which pumped $3.5 trillion dollars worth of liquidity into the U.S. financial system from 2008 to 2014. When conducting QE, the Fed creates new money digitally for the purpose of buying bonds and other assets, which helps to suppress interest rates and boost asset prices. The chart below shows the growth of the Fed’s balance sheet since QE started in 2008:

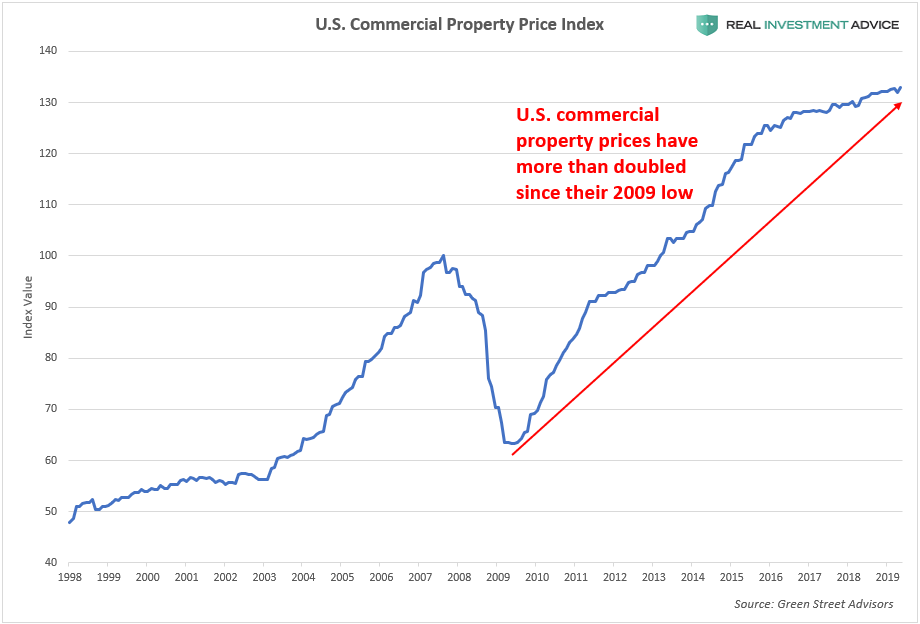

As a result of the Fed’s ZIRP and QE programs in the past decade, virtually all types of assets soared in value: stocks, bonds, art, classic cars, farmland, residential real estate, and commercial real estate. On average, U.S. commercial real estate prices have surged by 111%, or more than double, since their 2009 low. Interestingly, most people don’t realize that U.S. commercial real estate also experienced a bubble from 2004 to 2008 at the same time as the U.S. housing bubble. This early bubble inflated for many of the same reasons as the housing bubble, which were ultra-low borrowing costs and loose lending standards. From 2004 to 2008, commercial real estate prices rose 66%, but crashed by nearly 40% during the 2008 financial crisis. Commercial real estate prices have increased even more in the current bubble (111% vs. 66%), which means that the coming commercial real estate bust is likely to be even worse than the 2008 bust.

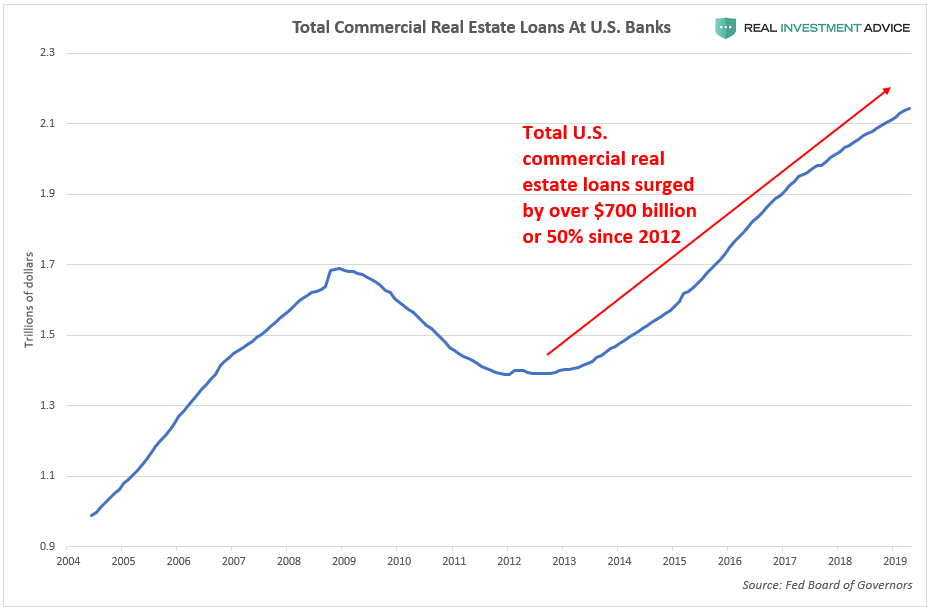

As discussed earlier, low interest rate environments often cause dangerous bubbles to develop by encouraging borrowing booms. Like the U.S. commercial real estate bubble of 2004 to 2008, commercial real estate lending has flourished during the current bubble. Since 2012, total commercial real estate loans at U.S. banks have increased by an alarming $700 billion or 50%.

Similar to the last U.S. commercial real estate bubble, the MSCI U.S. REIT Index has quadrupled in value during the current bubble. REITs or real estate investment trusts are publicly-traded companies that own income-producing real estate and are, therefore, one way of tracking the performance of the commercial real estate industry. The MSCI U.S. REIT Index lost approximately three-quarters of its value during the 2008 crisis; a repeat performance may be in the cards when the current commercial real estate bubble bursts.

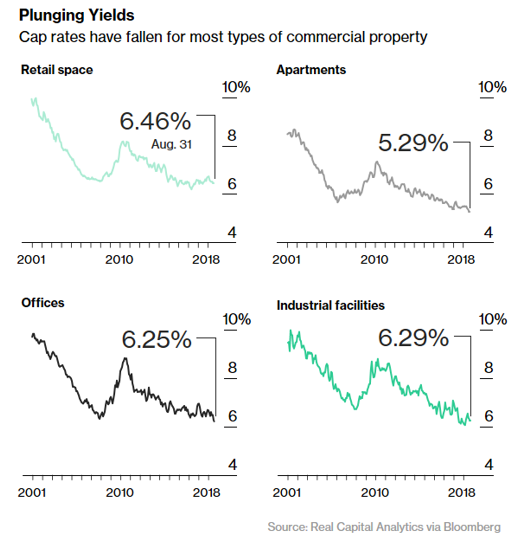

Over the past two decades, U.S. commercial real estate prices have risen at a much faster rate than rents, which has caused capitalization rates (or “cap rates”) to plummet to record lows. The capitalization rate is the rate of return that is expected to be generated on real estate investments. It is calculated by dividing the property’s net operating income (NOI) by the current market value. Unusually low cap rates are an indication that commercial real estate prices are excessively inflated and at risk of a correction. Cap rates in the current commercial real estate bubble are even lower than they were at the peak of the commercial real estate bubble in 2007.

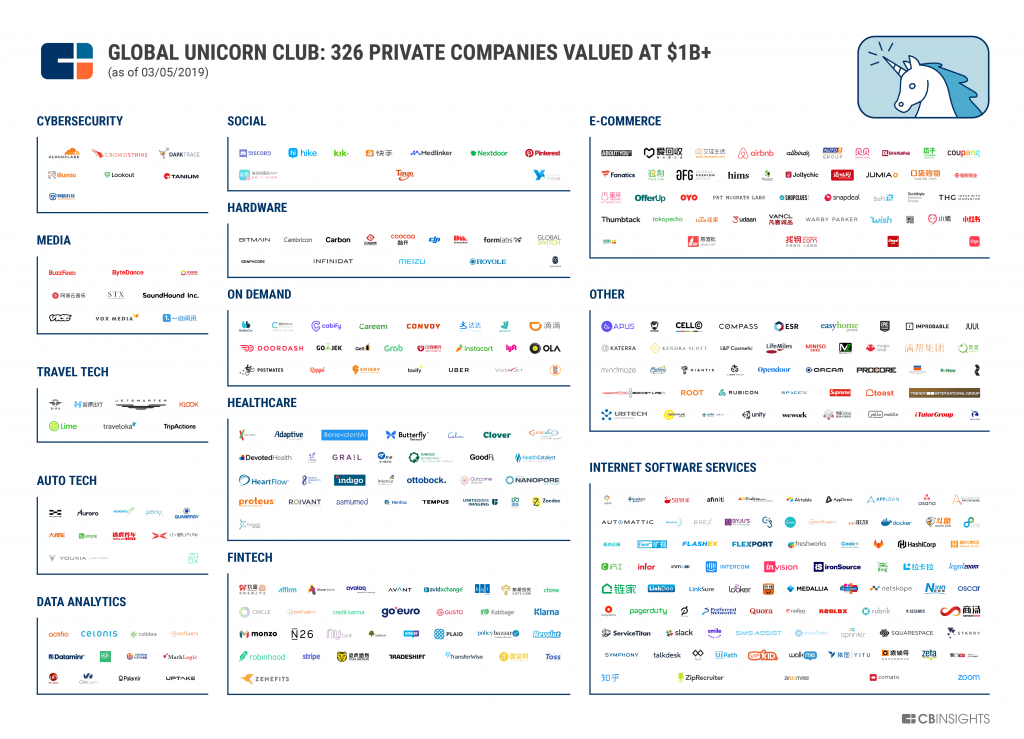

One of the major risks that will help to pop the commercial real estate bubble is the coming tech startup bust. As I have been warning, there has been an explosion of interest and activity in the tech startup arena since the Great Recession. Tens of thousands of tech startups have been founded in recent years and there are now over three hundred new “unicorn” startups that have valuations of $1 billion or more. The creation of tens of thousands of tech startups has generated a tremendous amount of demand for office space, which has benefited the commercial real estate industry.

The venture capital boom of the past several years can be seen in the chart of the monthly count of global VC deals that raised $100 million or more:

Today’s tech startup mania is the byproduct of ultra-low interest rates and QE, just like the commercial real estate bubble. Sadly, the majority of today startups – including today’s hottest unicorns – are burning copious amounts of cash. Startups in today’s bubble are playing the same role that dot-com companies were playing in the late-1990s. I strongly believe that a devastating bust is ahead that is going to wipe out thousands, if not tens of thousands, of non-economically viable tech startups as investors lose their appetite for such pie in the sky investments. As tech startups fold by the thousands (along with other businesses in the coming recession), office space vacancies are going to soar.

The ongoing “retail apocalypse” is another trend that will help cause the U.S. commercial real estate bubble to burst. According to UBS, retailers have closed more than 15,000 stores since 2017, and will close an incredible 75,000 more stores by 2026. In addition, there has been a massive restaurant boom in the past decade, which is likely to experience a bust of its own in the coming recession as unprofitable restaurants get culled. It’s just a matter of time before investors wake up and realize that the prospects for commercial real estate are terrible going forward and that today’s high prices are a fantasy. When that happens, expect to see a commercial real estate crash like 2008 or even worse.